Way back in 2010, and then over and over again in subsequent years, I have showed that it is very simple to balance the budget.

All that is necessary is some reasonable spending restraint, sort of like what happened during the Tea Party era in the early part of last decade.

Today, let’s see if that’s still true. The Congressional Budget Office just released its Economic and Budget Outlook, which includes a 10-year forecast of what will happen if spending and revenue are left on autopilot.

As I almost always do when that happens, I calculate what amount of spending restraint would be necessary to balance the budget over 10 years.

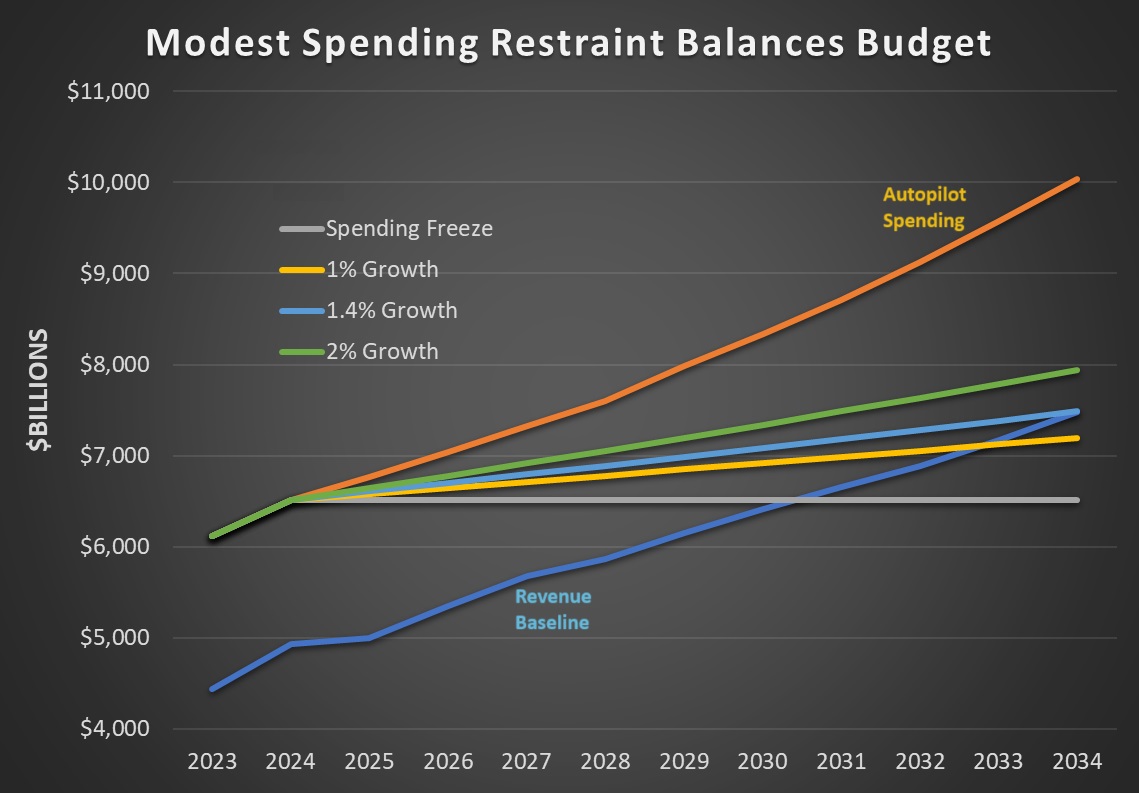

As you can see in the chart, limited spending so it grows by 1.4 percent yearly is all that is needed to balance the budget.

The budget can be balanced much quicker with a spending freeze. And the deficit can be largely eliminated if spending grows by 2 percent annually.

By the way, CBO projects that inflation will average close to 2 percent over the next decade.

So the main takeaway is that we can basically eliminate red ink if the federal budget grows slightly less than the rate of inflation.

There are two points worth mentioning.

- There is no need for any tax increases. Revenues already are projected to grow by 4.2 percent yearly, nearly twice the estimated rate of inflation. Plus, tax increases would surely give politicians an excuse to increase spending.

- Spending restraint is a simple concept, but it would not be politically easy. Interest groups want to leave spending on autopilot, or have it grow even faster. Plus, some entitlement reform almost surely would be necessary.

One further point is that the CBO baseline assumes that the Trump tax cuts expire at the end of 2025. Extending those tax cuts would lower the revenue baseline, thus requiring additional spending restraint to achieve a balanced budget over the 10-year window.

P.S. Balancing the budget is a good idea, but spending restraint should be the main goal of fiscal policy. Fortunately, the evidence shows that spending restraint is the only effective way of achieving fiscal balance (whereas tax increases have a track record of failure).

P.P.S. The ideal long-run policy is a spending cap.