There are three important things to understand about Western Europe.

- The burden of government is larger than it is in the United States.

- Lower-income and middle-class taxpayers finance that extra spending.

- Europe’s greater fiscal burden is associated with less prosperity.

Today, let’s further look at what we can learn from Europe.

Adam Michel of the Cato Institute authored a new study that compares Europe and the United States.

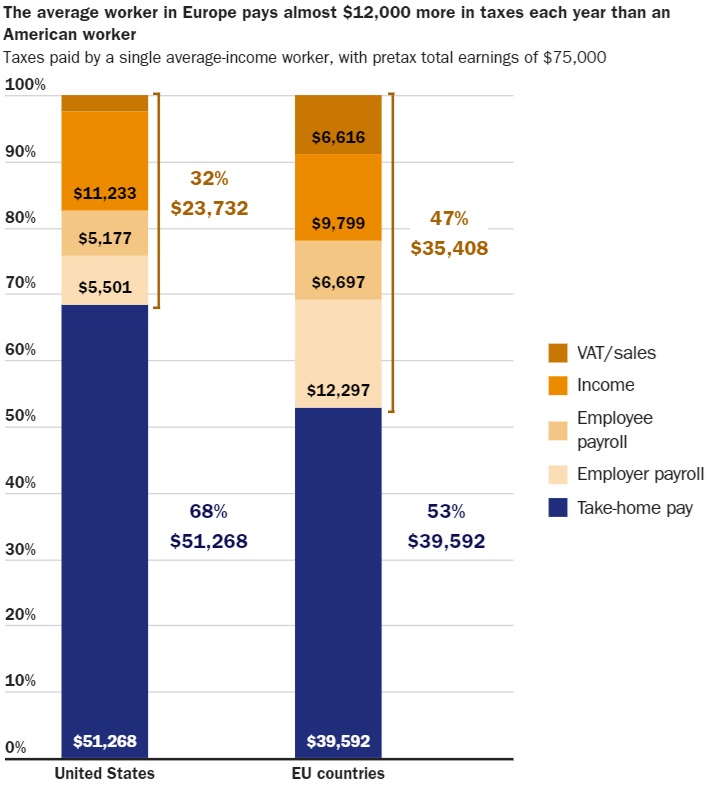

As part of his report, he calculated that the a middle-class European pays nearly $12,000 more in taxes than an American at the same income level.

The huge gap is due mostly to Europe’s value-added taxes and employer payroll taxes (which companies pay on behalf of workers).

Needless to say, this is not good news for European households.

But that’s just part of the bad news. You also have to consider that Europeans are much less likely to earn as much money as their American counterparts.

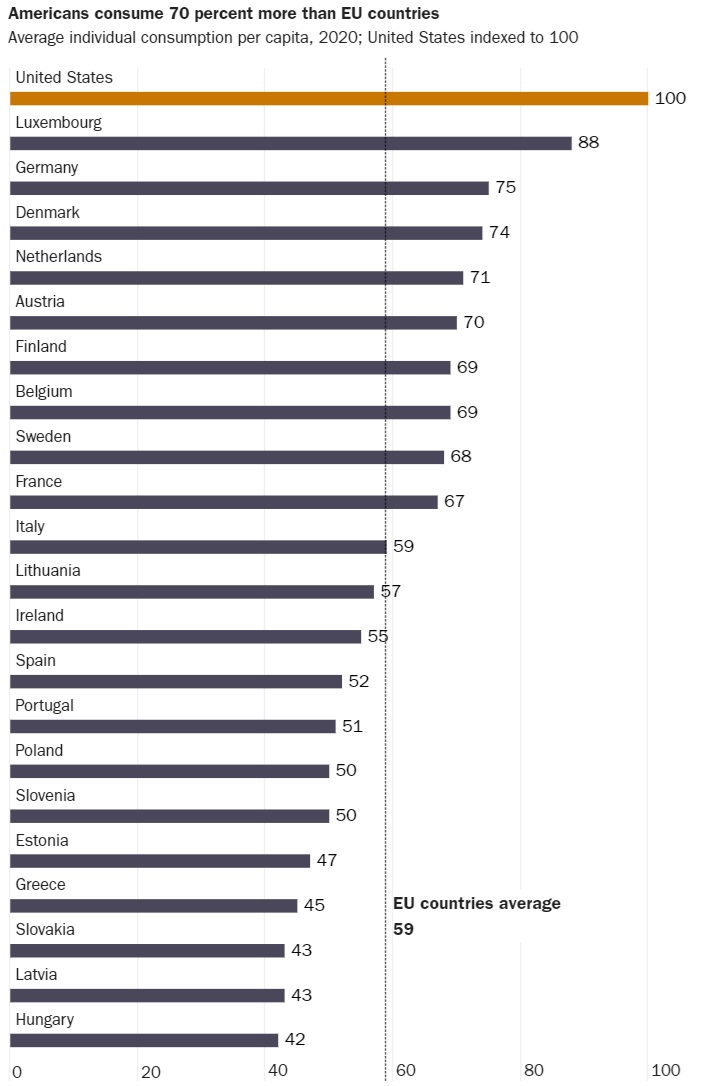

There’s an enormous gap between the U.S. and E.U. when looking at per-capita GDP. But GDP doesn’t directly translate into living standards, so let’s look at another chart from Adam’s paper.

Here’s a comparison of per-capita consumption (using the same AIC data I’ve shared in 2012, 2014, 2017, 2019, and 2022). Only the tiny tax haven of Luxembourg is close to the United States.

By the way, I don’t blame Eastern European nations for being way behind the United States. They still have to catch up after suffering from communist enslavement (though some of them are doing a much better job than others).

But I’m digressing. The main lesson to be learned from today’s column is that America should not become more like Europe. That’s a recipe for earning less income and paying higher taxes. I hope Trump and Harris are paying attention.

———

Image credit: Sébastien Bertrand | CC BY 2.0.