The main argument for smaller government – from an economic perspective – is that more resources are left in the productive sector of the economy and this leads to faster growth and higher living standards.

This is a reason why the United States, with a medium-sized welfare state, out-performs Europe, which is saddled with large-sized welfare states.*

And it is why lower-income households in the United States have living standards akin to middle-class households in Europe.

Lower-income and middle-class household in America also benefit because they enjoy lower tax burdens.

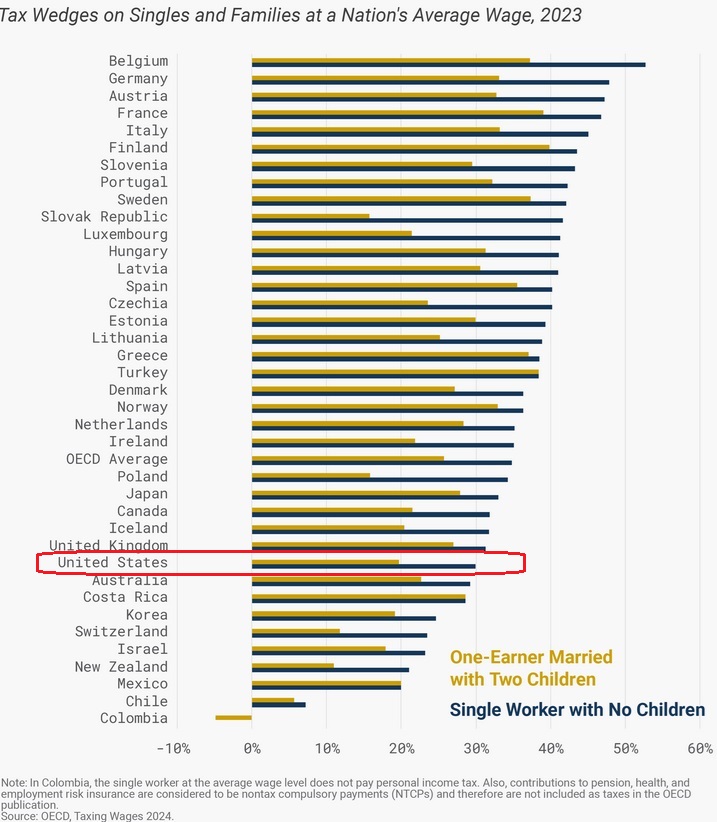

Here’s a chart from the Tax Foundation showing the tax wedge (the difference between pre-tax income and post-tax consumption) in various OECD member nations. As you can see, the tax burden on average households is lower in the United States (highlighted in red) than in any European nation other than Switzerland.

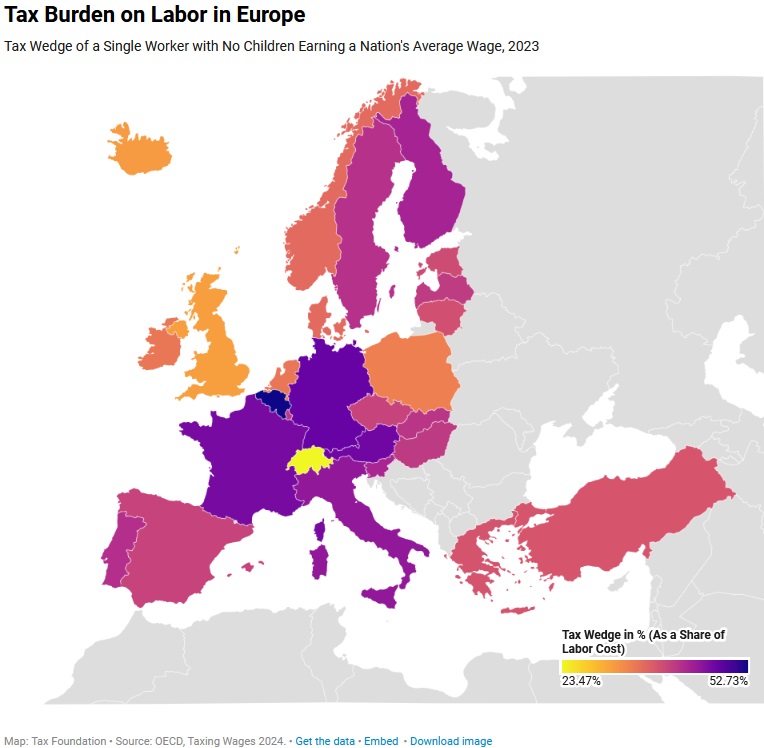

Since I mentioned that Switzerland is the only European nation with a smaller tax wedge than the United States, I’ll also share a map comparing taxes in Europe.

As you can see Switzerland (in yellow) stands out in a very positive way. Some nations (Belgium, Austria, Germany, and France) have tax burdens on middle-class households that are 100 percent higher than in Switzerland.

The bottom line is that spending restraint and modest-sized government is paying big dividends for Switzerland.

Lower-income and middle-class households are benefiting directly (lower tax burdens) and indirectly (faster growth and higher living standards).

P.S. This column has focused on tax burdens for average households. You can peruse the original OECD data to see that this analysis is equally true for lower-income households.

*This is also the reason places with small-sized welfare states, such as Singapore, out-perform the United States.