Earlier this month, I explained that Ronald Reagan deserves praise for shrinking the burden of government spending.

Today, starting with this video, let’s add Bill Clinton to the mix and look at how America wound up with budget surpluses in the late 1990s.

The core point of the above video is that there was spending restraint under both Reagan and Clinton.

And this, not Clinton’s 1993 tax increase, led to budget surpluses in the late 1990s.

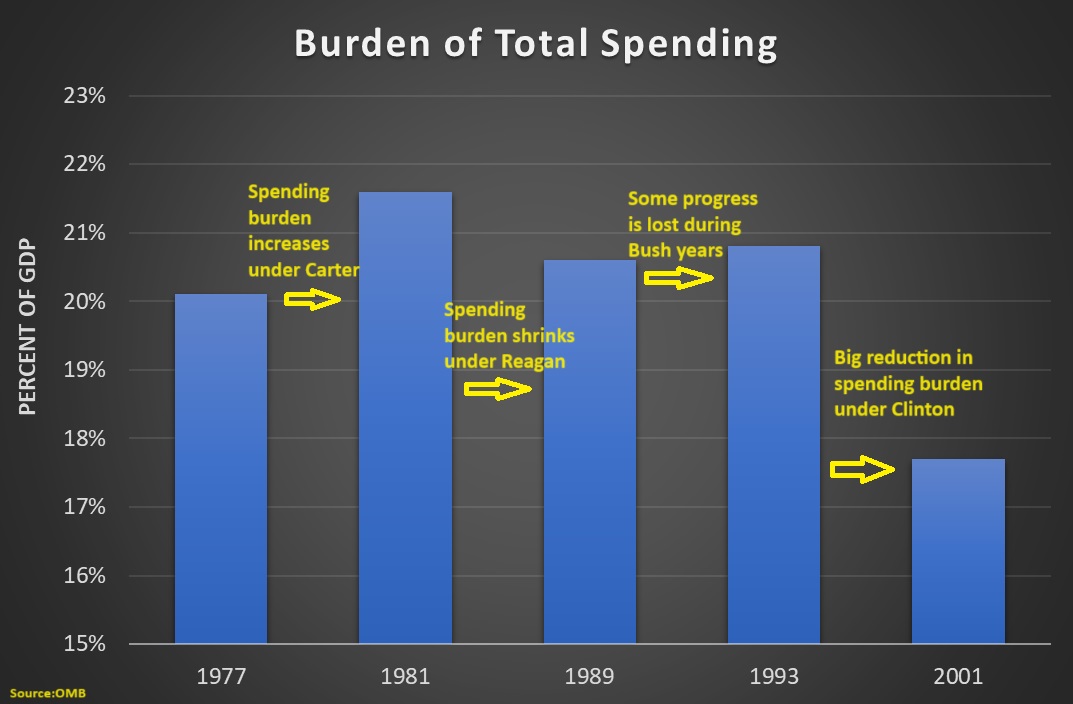

Here’s a chart, based on Table 8.4 of OMB’s Historical Tables. You can see how the burden of government spending (as a share of economic output) changed under Carter, Reagan, Bush I, and Clinton.

Based on this chart, it would appear that Bill Clinton was more fiscally conservative than Reagan.

Perhaps, but keep in mind that the above chart includes the “peace dividend.”

To be more specific, Reagan’s policies helped bring about the collapse of the Soviet Union. As a result, a defense budget that totaled 5.5 percent of GDP when Reagan left office dropped to just 2.9 percent of GDP by the time Clinton left office.

Perhaps I’m being biased, but Reagan deserves the lion’s share of the credit for that.

It’s also worth noting that interest rates were lower in the 1990s than the 1980s, in part because Reagan brought inflation under control, so maybe he should also get some credit for lower interest payments on the national debt.

Those are judgement calls and I know some people will have a different perspective.

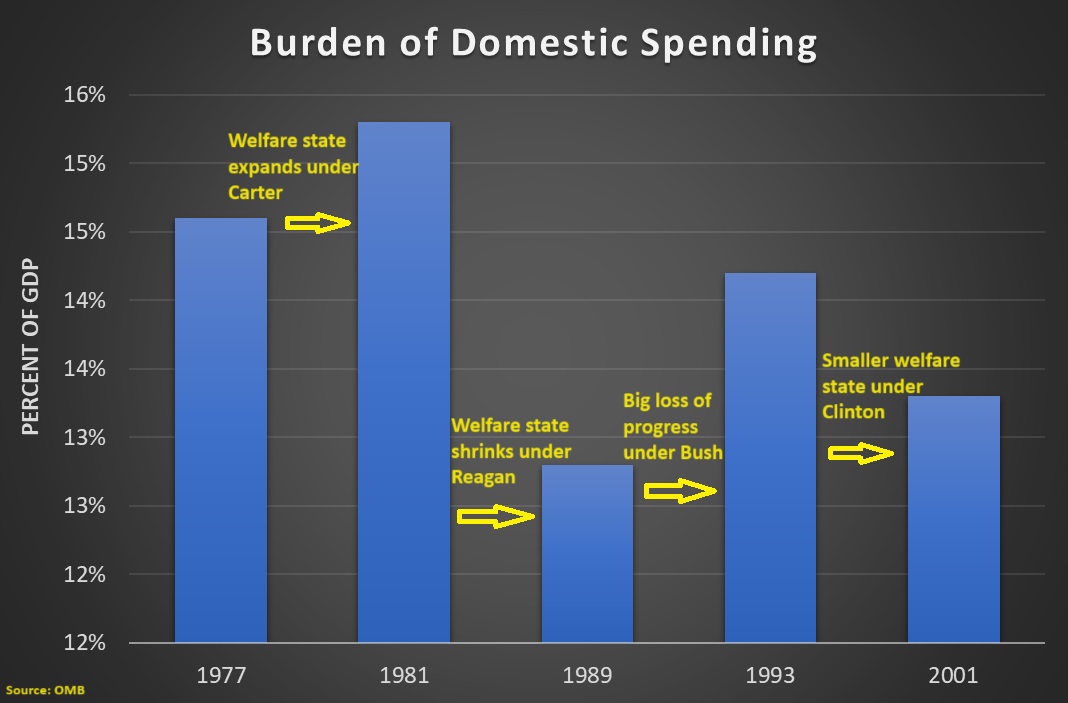

But there’s no ambiguity about our next chart. Reagan was easily the biggest champion when looking at the burden of domestic spending.

Reagan made a lot of progress. Some of that progress was undone by Bush I, but then we moved in the right direction again under Clinton. Click here if you want details (including information on the S&L bailout, which makes Bush look worse than he was and makes Clinton look better than he was).

The net result was that there was enough spending restraint that the country eventually got a budget surplus.

P.S. My friends on the left doubtlessly will point out that revenues also rose during the 1990s. That’s true, but there’s a big difference between revenues climbing because of economic growth and revenue climbing because of higher tax rates. In any event, the most relevant point is that we would have a budget surplus today if the overall spending burden (as a share of GDP) was the same as it was when Clinton left office.

P.P.S. Speaking of tax policy in the 1990s, smart leftists are fond of arguing that high tax rates don’t matter because we had decent growth during the Clinton years when the top tax rate was 39.6 percent. So wouldn’t it be a good idea, they ask, to return to those halcyon days? As I’ve explained before, that might be a worthwhile trade if we also got the lower spending levels and lower levels of regulation that existed at the time.

———

Image credit: The U.S. National Archives | Public Domain.