I just finished a speech at a conference in Miami that looked at changing demographics and the implications for tax competition.

To elaborate, I explained how an ever-growing burden of government spending will lead to more class-warfare tax policy, which will give politicians even more incentive to attack low-tax jurisdictions.

For today’s column, I want to focus on the portion of my presentation dealing with demographics.

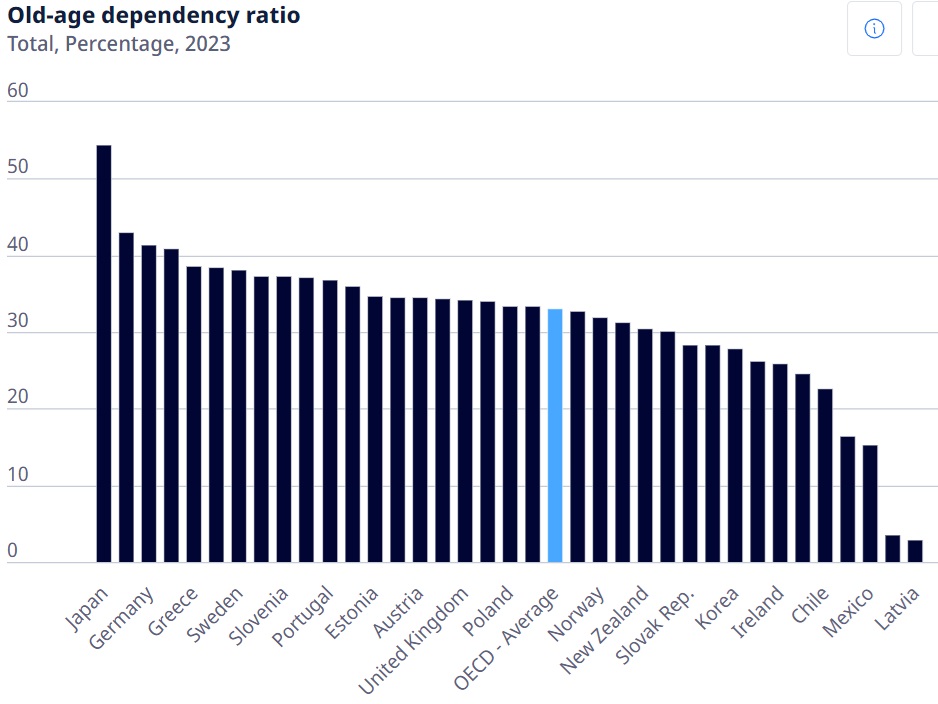

I started with this chart from the OECD showing the old-age dependency ratio in member nations. As you can see, Japan currently has the most old people relative to the rest of the population.

These 2023 numbers show why there is some pessimism about Japan’s fiscal outlook.

Simply stated, the number of old people receiving benefits (government pensions and health care) is very large compared to the number of working-age people paying taxes.

Which is why taxes already have increased in Japan and that worrisome trend will continue.

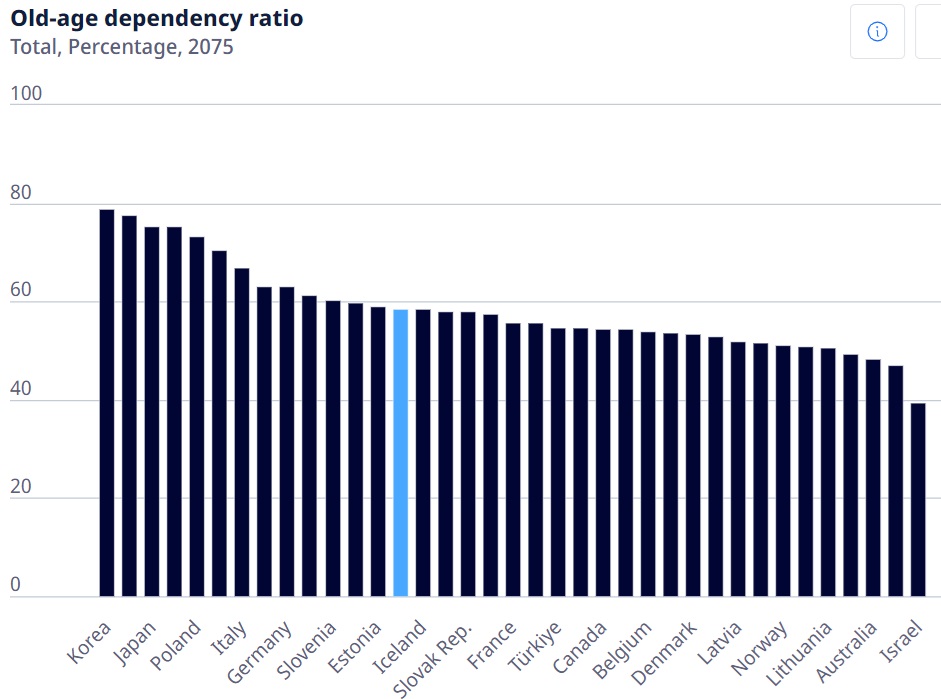

And that brings me to my second chart, which shows the estimated 2075 old-age dependency ratio.

At first glance, these two charts may not look that different, but notice that the vertical axis on the top chart only goes up to 60 while the bottom chart goes up to 100.

So the critical takeaway is that almost every developed country 50 years from now will have a demographic profile that is worse than today’s Japan.

If governments don’t reform their entitlement programs, it is no exaggeration to say that these numbers have grim implications.

And when they pursue those policies, uncompetitive governments will have even greater incentives to undermine low-tax jurisdictions in hopes of reducing the freedom of people to escape bad policy.

———

Image credit: Pedro Ribeiro Simões | CC BY 2.0.