I’ve already written two columns (here and here) about why a “bipartisan” budget deal would be a recipe for higher taxes and bigger government.

To start our third installment in this series, here’s a clip from my recent appearance on Vance Ginn’s Let People Prosper.

Simply stated, America’s long-run fiscal problems are entirely the result of government being too big and growing too fast.

So there is no need to make our bad tax system even worse with tax increases. Especially since (as I explained in the above video clip) politicians almost surely would spend any extra revenue.

By the way, my opposition to “putting taxes on the table” is practical rather than ideological. Back in 2012, I wrote that I would accept a big tax increase, but only if the other side would accept various changes to control the burden of government spending.

Needless to say, none of those options are acceptable to the big spenders in Washington. Not in 2012 and not today.

Since I’m focusing on practicality, I’ll share two additional pieces of evidence against having a pro-tax increase fiscal commission.

- In 2011, a reporter from the New York Times inadvertently showed that the only budget deal that actually led to a balanced budget was the 1997 agreement that cut taxes. All the other budget deals raised taxes and the net result was more spending and continued red ink.

- Tax burdens in Europe have dramatically increased over the past 50-plus years, usually because politicians claimed people needed to surrender more money in order to reduce red ink. But over that same time period, government debt more than doubled because politicians spent all the new revenue.

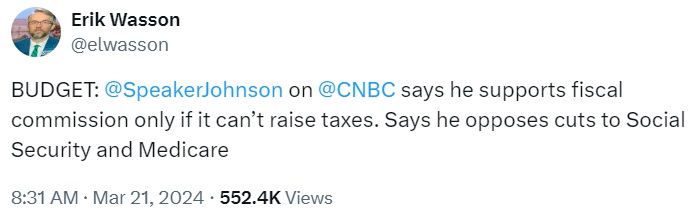

Given all this data, you might think I’m happy about this tweet from a Bloomberg reporter.

But I’m only half-happy. I’m glad the Speaker of the House is ruling out tax increases.

However, his anti-tax position is not credible when he also says that entitlement programs can’t be touched.

That’s the Biden–Trump view and it’s a recipe for fiscal chaos and – sooner or later – huge tax increases on lower-income and middle-class Americans.

The bottom line is that there’s an unavoidable choice to be made in the United States. We either reform the entitlement programs or we agree to let politicians take more of our money.

———

Image credit: 401(K) 2012 | CC BY-SA 2.0.