Marginal tax rates (how much you are taxed for earning additional money) have a big impact on incentives to engage in productive activity such as work, saving, investment, and entrepreneurship.

This is why governments should keep tax rates at modest levels.

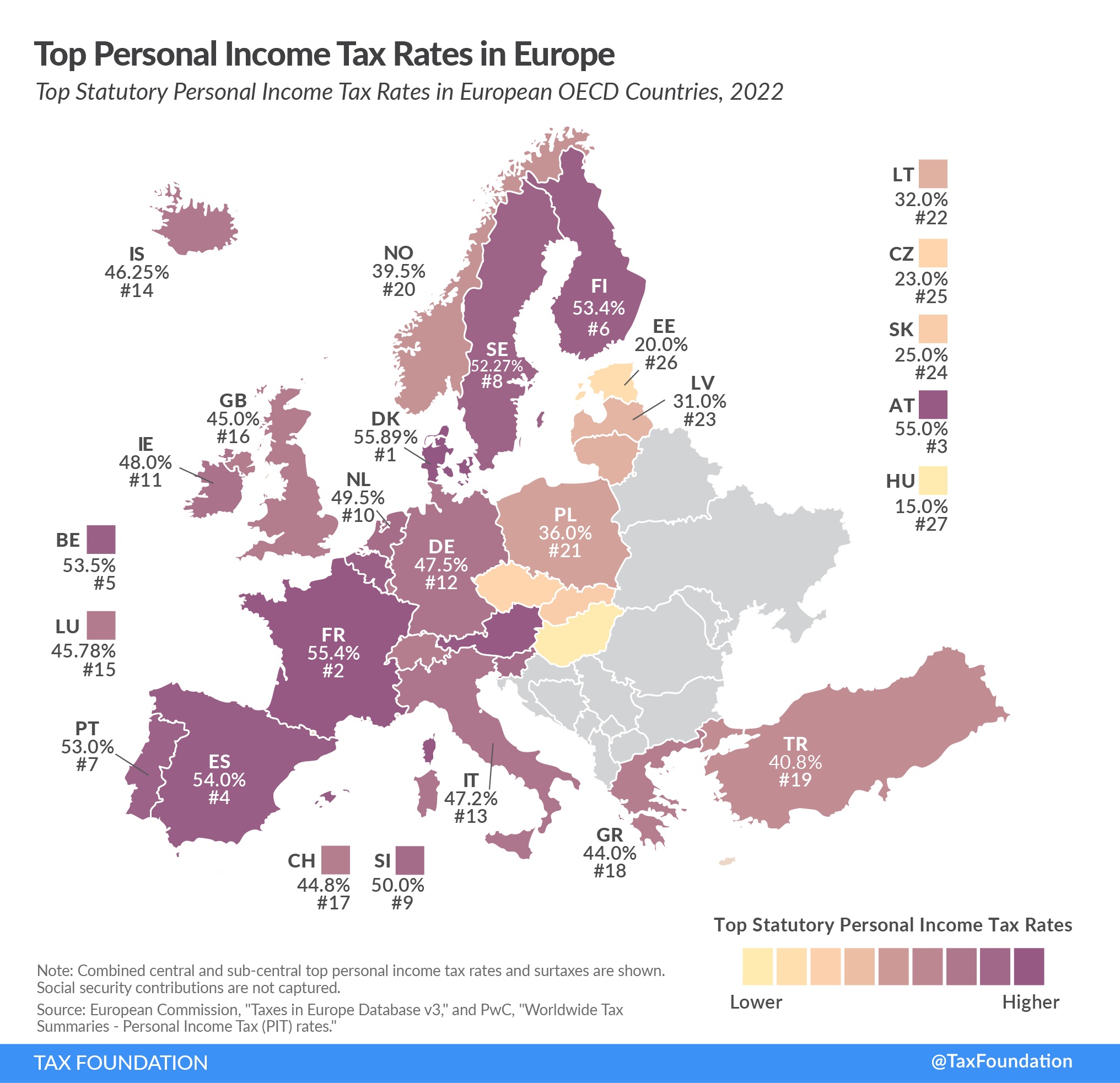

But as you can see from this map from the Tax Foundation, European governments generally cannot resist the temptation to impose onerous top tax rates on investors, entrepreneurs, business owners, and other successful taxpayers.

Congratulations to Hungary for having the lowest rate, followed by Estonia, the Czech Republic, and Slovakia.

And “congratulations” to Denmark for having the highest top tax rate, followed by France, Austria, and Spain.

At this point, a few caveats are necessary. A nation’s top income tax rate is important, but it’s not the only thing that matters for tax policy.

- It’s also important to look at social insurance (payroll) taxes, particularly if they apply to all income.

- It’s also important to look at the level of “double taxation” on income that is saved and invested.

- It’s also important to look at VATs, which increase the wedge between pre-tax income and post-tax consumption.

Needless to say, other economic policies also matter. A nation might have a good tax system but very dirigiste policies in other areas. Or vice-versa.

For instance, even though Hungary has the lowest top tax rate on personal income and Denmark has the highest, there’s actually more overall economic liberty in Denmark.

Some readers may be wondering how the United States compares to the European nations shown in the above map.

The good news (relatively speaking) is that the top tax rate in the United States is 42.9 percent, so that’s lower than the average in Europe.

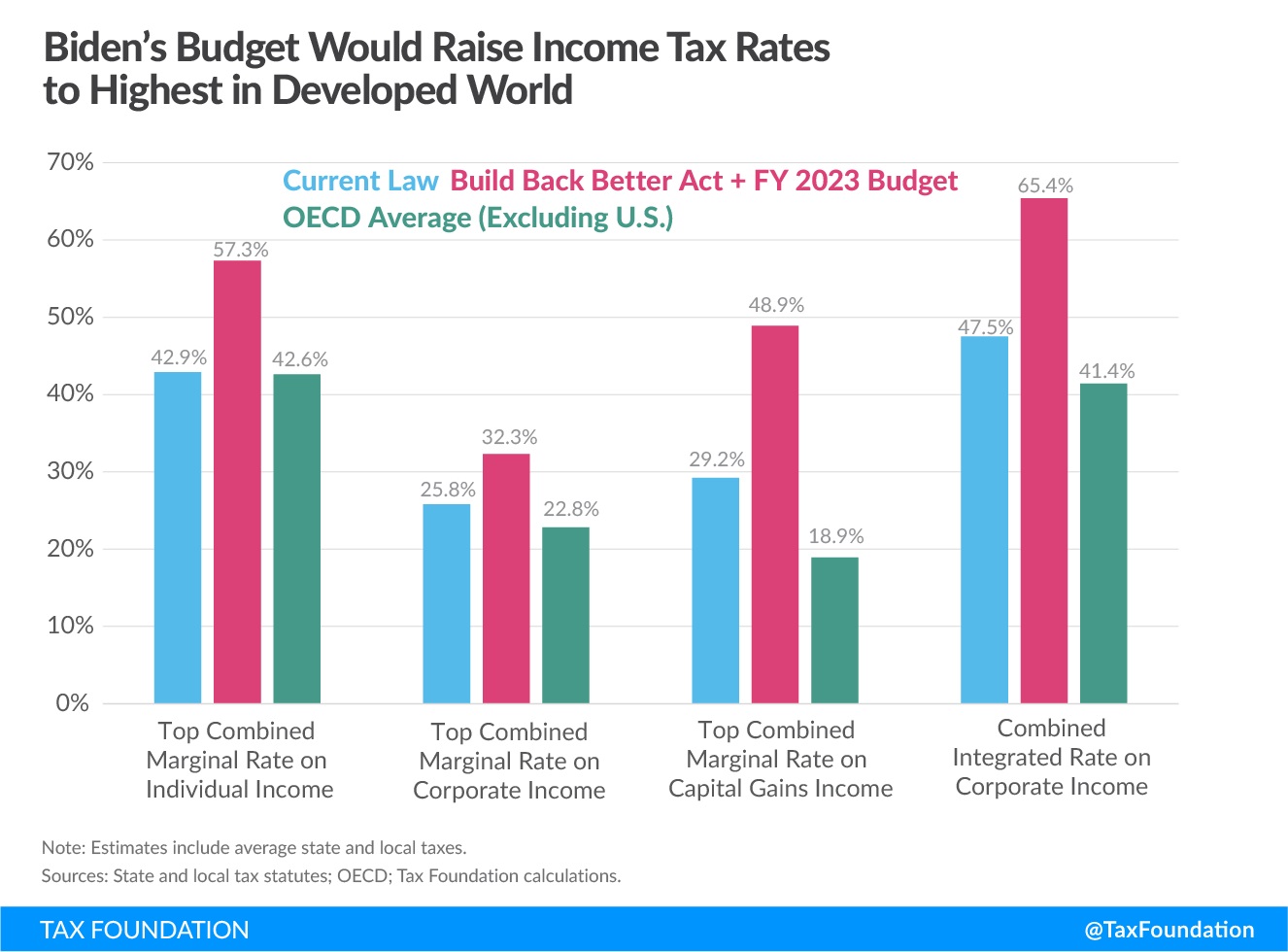

The bad news is that the US would have the highest tax rate if Biden’s budget was approved.

However, the top income tax rate in the United States can vary substantially depending on state.

A resident of New York or California, for instance, will face a much higher top tax rate than a resident of a zero-income-tax state such as Texas or Florida.

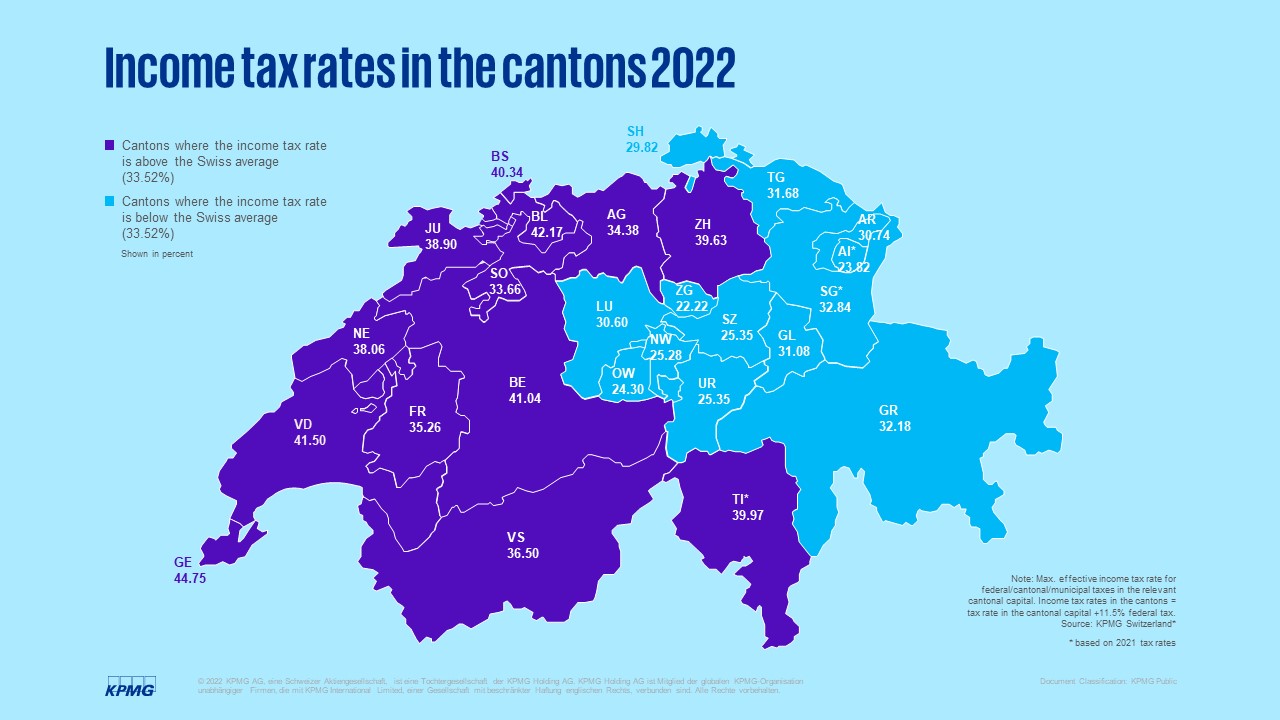

The same thing is even more true in Switzerland, where top tax rates vary substantially.

A successful taxpayer in Zug pays a top tax rate of 22.22 percent, less than half as much as a similar taxpayer in Geneva.

I’ll close by noting that this map is another example of the advantages of genuine federalism.

When the central government is small and most government takes place at the state and local level (or, in the case of Switzerland, at the cantonal and municipal level), there is more diversity, choice, and jurisdictional competition.

That type of federalism still exists in Switzerland, but unfortunately is eroding in the United States.

———

Image credit: Pixy.org | CC0 Public Domain.