Over the past week, we’ve looked at both the Tax Hell Index and the International Tax Competitiveness Index, giving us a good idea of which nations have terrible and not-so-terrible tax policy.

Today, let’s look at which states rank high and low on tax policy.

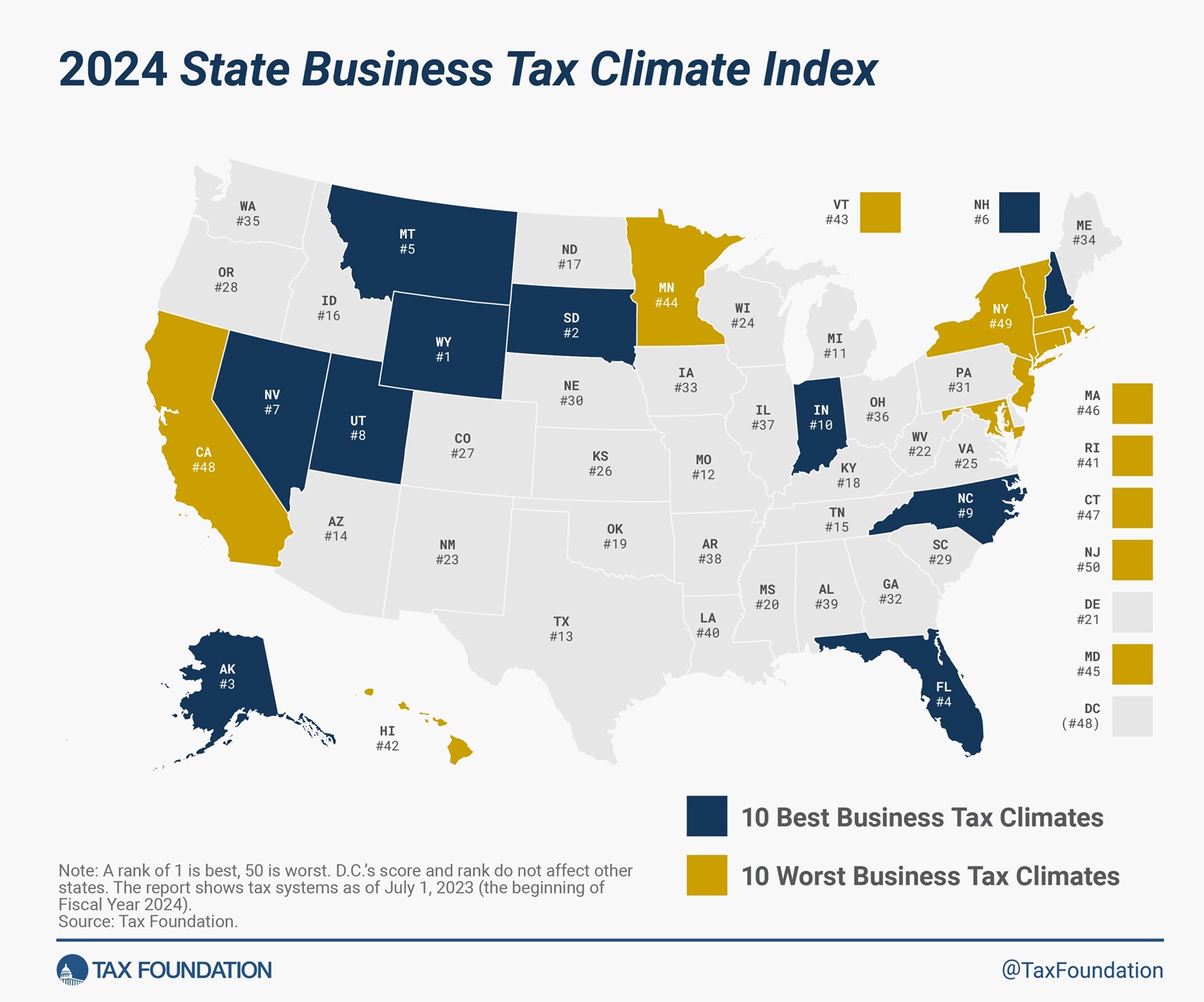

Here’s a map from the Tax Foundation’s new State Business Tax Climate Index. The top-3 states are Wyoming, South Dakota, and Alaska and the bottom-3 states are New Jersey, New York, and California.

Of the top-10 states, six have no state income tax and three have flat taxes.

Conversely, all of the bottom-10 states have so-called progressive taxes that discriminate against entrepreneurs, investors, small-business owners, and other high-income taxpayers.

A lot has been happening at the state level, so here are some of the highlights (and one lowlight).

Arizona transitioned from a two-bracket, graduated-rate individual income tax system with a top rate of 2.98 percent to a flat tax rate of 2.5 percent… This major development helped the state improve seven places on the individual income tax component and five places overall, from 19th to 14th.

Iowa witnessed significant changes in its tax landscape this year. Notably, the state reduced its top marginal individual income tax rate from 8.53 to 6.0 percent… As a result, Iowa’s overall ranking improved from 38th to 33rd.

Massachusetts fell further than any other state in the overall rankings this year, sliding 12 places since last year. This decline in tax competitiveness is due to the adoption of Question 1 in November 2022, which amended the state’s constitution to move from a single-rate to a graduated-rate income tax by imposing a 4 percent surtax on income over $1 million, raising the top marginal individual income tax rate from 5 to 9 percent.

Mississippi’s ranking improved from 27th to 20th overall. The state improved from 13th to 8th on the corporate tax component… The implementation of a flat individual income tax drove a seven-place improvement on the individual income tax component, from 26th to 19th.

Kudos to Mississippi for moving up seven spots, as well as Arizona and Iowa for jumping five spots.

And Massachusetts has really hurt itself, dropping by 12 spots.

P.S. As I’ve noted before, I think Wyoming and Alaska are overrated since they collect so much revenue from energy taxes.