When I want to know the nations with the best and worst policies, I peruse Economic Freedom of the World or the Index of Economic Freedom.

But what if you want to know the countries with the best and worst consequences? In that case, the best option might be Professor Steve Hanke’s annual Misery Index.

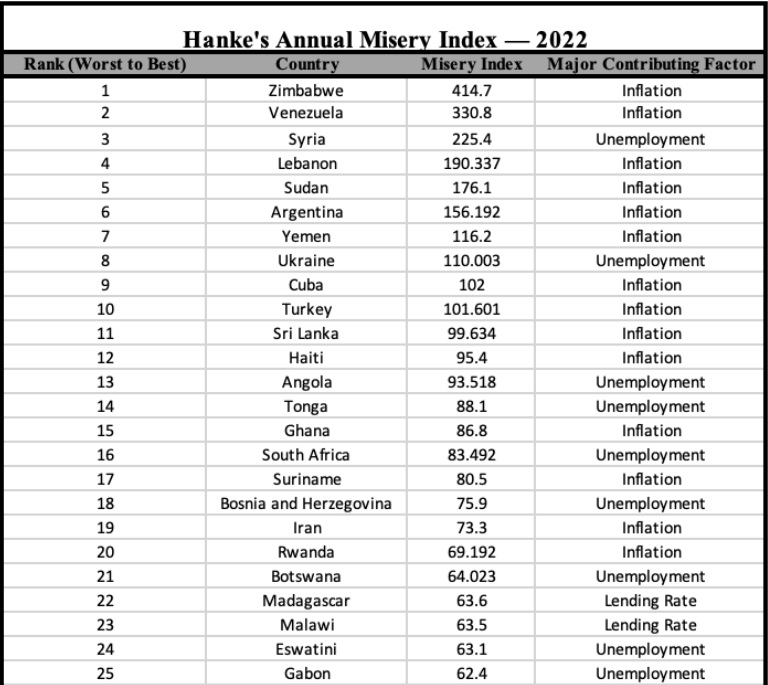

On that basis, the worst-governed country in 2022 was Zimbabwe, followed by Venezuela and Syria.

What’s the methodology for Professor Hanke’s Index?

Here’s some of his explanation for National Review.

In the economic sphere, misery tends to flow from high inflation, steep borrowing costs, and unemployment. …Comparing countries’ metrics can tell us a lot about where in the world people are sad or happy. Hanke’s Annual Misery Index (HAMI) gives us the answers. My version of the misery index is the sum of the year-end unemployment (multiplied by two), inflation, and bank-lending rates, minus the annual percentage change in real GDP per capita. Higher readings on the first three elements are “bad” and make people more miserable. These “bads” are offset by a “good” (real GDP per capita growth).

What are the countries with the best outcomes?

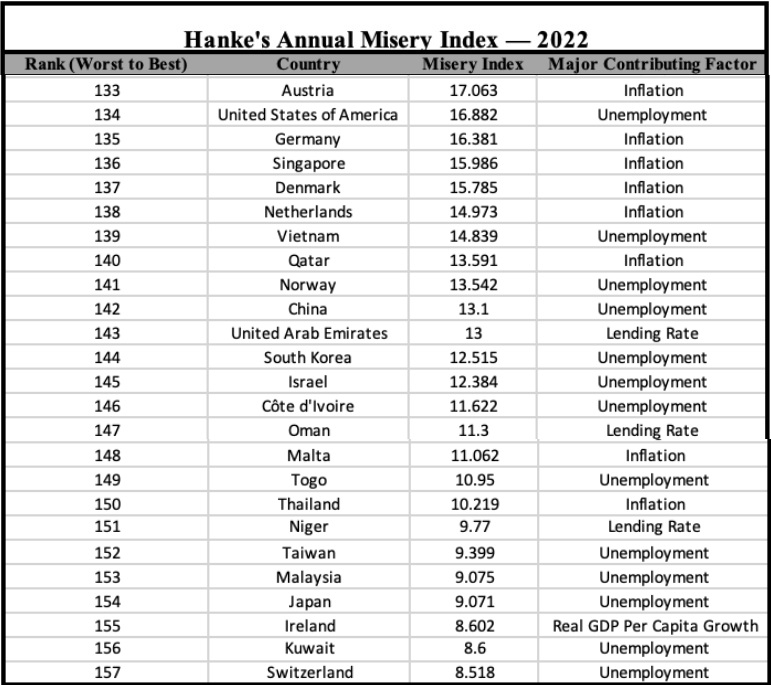

The nation with the least misery is Switzerland, which also happens to be the world’s most libertarian nation (needless to say, I don’t think that’s a coincidence).

I’ll share one final excerpt from Hanke’s article. He points out that Switzerland’s spending cap is a big reason for the nation’s success.

Switzerland has the lowest HAMI score in the world. One reason for that is the Swiss debt brake. The debt brake has worked like a charm. Unlike most countries, Switzerland’s debt-to-GDP ratio has been on a downward trend in the last two decades, since it enshrined its debt brake into its constitution in a 2002 national referendum. In 2002, central-government debt stood at 29.7 percent of GDP, and by 2018 had been reduced to 18.7 percent.

I agree with him, but the real benefit of the debt brake is that it restrains spending.

The falling debt numbers should be viewed as a fringe benefit of the spending restraint.

P.S. Needless to say, other nations should adopt a Swiss-style spending cap.