I wrote in both 2021 and 2022 about states enacting lower tax rates.

And that includes several states (Iowa, Idaho, Arizona) adopting flat taxes.

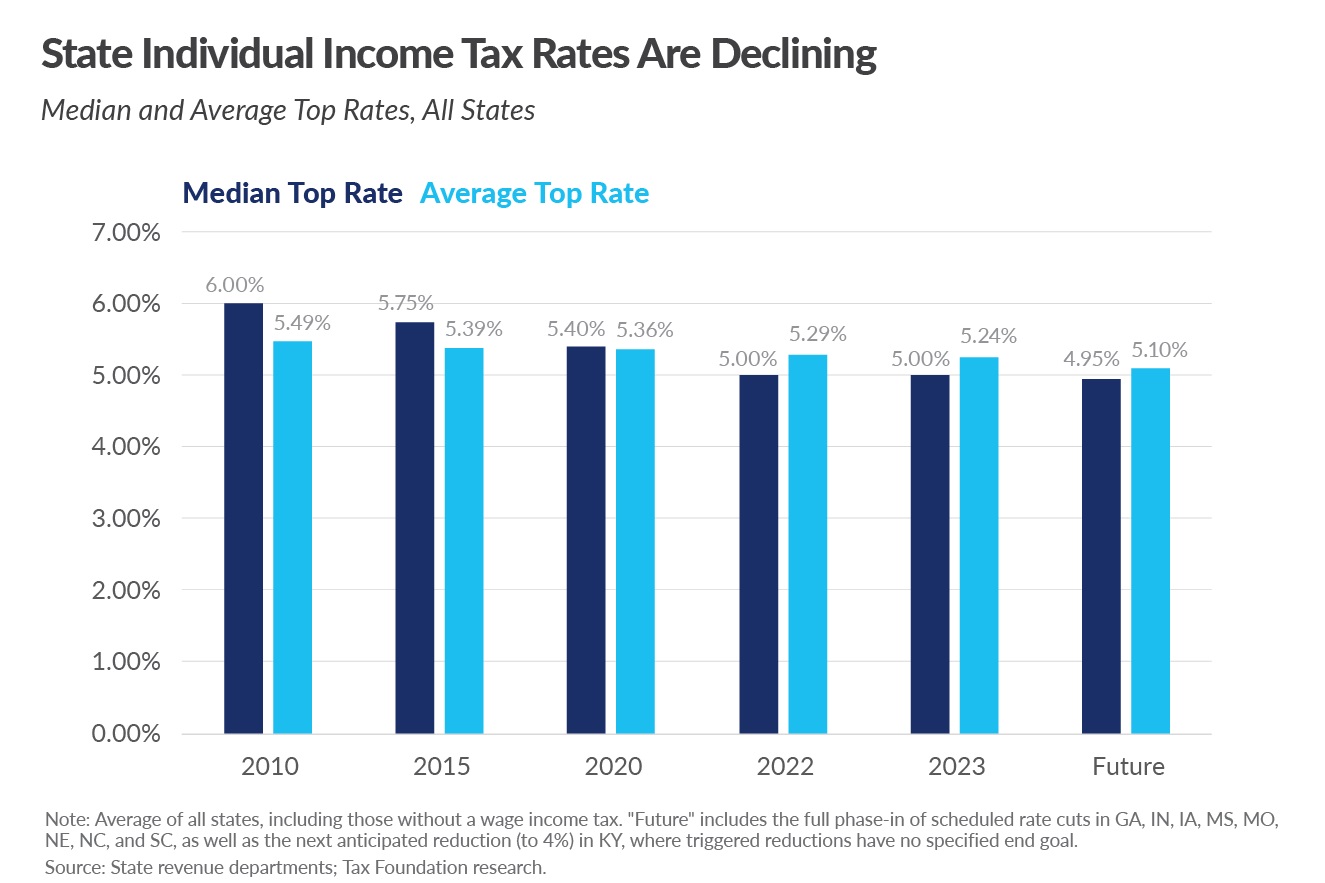

Today, let’s quantify these developments. Our friends at the Tax Foundation just published a chart showing how top tax rates at the state level have declined since 2010.*

The decline is not enormous, but it’s encouraging to see a downward trend (particularly if the alternative is an upward trend!).

Will we see further progress this year? Yes, notwithstanding last November’s terrible ballot initiative in Massachusetts, there are already some pre-approved reductions in tax rates. So the average will fall in 2023 and 2024.

After that, my fingers will be crossed.

But I am confident that we will see continued migration from high-tax states to low-tax states. And this will happen for two reasons.

- First, some people will move because they are tired to paying high tax rates, especially since they live in states that do a rotten job of providing basic services (high tax burdens generally get diverted to bureaucrat salaries and pensions).

- Second, other people might not earn enough to directly care about high tax rates, but they nonetheless will move because low-tax states create more jobs and offer greater opportunities for economic advancement.

Let’s close with some speculation about what might happen in the future.

I’m guessing that folks on the left don’t like this shift to lower tax rates at the state level, much as they didn’t like the global shift to lower tax rates after Ronald Reagan and Margaret Thatcher instigated a virtuous cycle of tax competition about 40 years ago.

In the case of global tax competition, high-tax nations have been using the OECD as a vehicle to curtail the shift to better tax policy. The OECD pressured so-called tax havens with financial protectionism and is now pressing governments to increase corporate tax burdens.

Unsurprisingly, global tax rates are now creeping upwards.

Is it possible that there will be similar efforts inside the United States?

I hope not. I can’t imagine sensible states like Texas and Florida agreeing to any sort of state tax cartel.

And I also don’t think there’s any immediate threat of Congress imposing a Washington-created cartel.

But it doesn’t hurt to be vigilant. Remember, the great thing about tax competition is that it pressures politicians to do the right thing when they generally would prefer to do the wrong thing.

*The “mean” is the average of all 50 states and the “median” is the rate in the state that is lower than half the states and higher in half the states.