Appearing on Vance Ginn’s Let People Prosper, I discussed spending caps, entitlement reform, past fiscal victories, and potential future defeats.

For today, I want to highlight what I said about monetary policy.

The above segment is less than three minutes, and I tried to make two points.

First, as I’ve previously explained, the Federal Reserve goofed by dramatically expanding its balance sheet (i.e., buying Treasury bonds and thus creating new money) in 2020 and 2021. That’s what produced the big uptick in consumer prices last year.

And it’s now why the Fed is raising interest rates. Part of the boom-bust cycle that you get with bad monetary policy.

Second, I speculate on why we got bad monetary policy.

I’ve always assumed that the Fed goofs because it wants to stimulate the economy (based on Keynesian monetary theory).

But I’m increasingly open to the idea that the Fed may be engaging in bad monetary policy in order to prop up bad fiscal policy.

To be more specific, what if the central bank is buying government bonds because of concerns that there otherwise won’t be enough buyers (which is the main reason why there’s bad monetary policy in places such as Argentina and Venezuela).

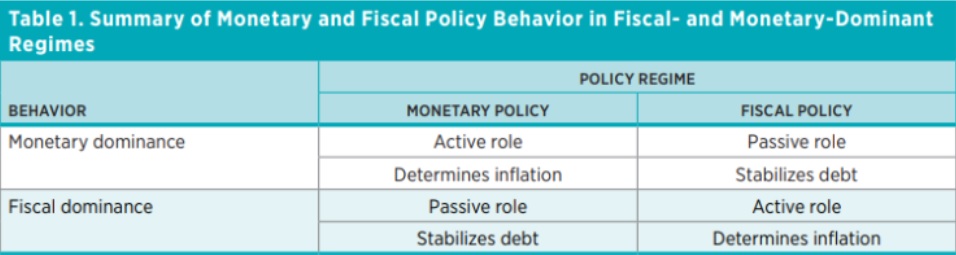

In the academic literature, this is part of the discussion about “fiscal dominance.” As shown in this visual, fiscal dominance exists when central banks decide (or are forced) to create money to finance government spending.

The visual is from a report by Eric Leeper for the Mercatus Center. Here’s some of what he wrote.

…a critical implication of fiscal dominance: it is a threat to central bank success. In each example, the central bank was free to choose not to react to the fiscal disturbance—central banks are operationally independent of fiscal policy. But that choice comes at the cost of not pursuing a central bank legislated mandate: financial stability or inflation control. Central banks are not economically independent of fiscal policy, a fact that makes fiscal dominance a recurring threat to the mission of central banks and to macroeconomic outcomes. …why does fiscal dominance strike fear in the hearts of economists and financial markets? Perhaps it does so because we can all point to extreme examples where fiscal policy runs the show and monetary policy is subjugated to fiscal needs. Outcomes are not pleasant. Germany’s hyperinflation in the early 1920s may leap to mind first. …The point of creating independent central banks tasked with controlling inflation…was to take money creation out of the hands of elected officials who may be tempted to use it for political gain instead of social wellbeing.

A working paper from the St. Louis Federal Reserve Bank, authored by Fernando Martin, also discusses fiscal dominance.

In recent decades, central banks around the world have gained independence from fiscal and political institutions. The proposition is that a disciplined monetary policy can put an effective brake on the excesses of political expediency. This is frequently achieved by endowing central banks with clear and simple goals (e.g., an inflation mandate or target), as well as sufficient control over specific policy instruments… Despite these institutional advances, the resolve of central banks is chronically put to the test. … the possibility of fiscal dominance arises only when the fiscal authority sets the debt level.

The bottom line is that budget deficits don’t necessarily lead to inflation. But if a government is untrustworthy, then it will have trouble issuing debt to private investors.

And that’s when politicians will have incentives to use the central bank as a printing press.

P.S. Pay attention to Italy. The European Central Bank has been subsidizing its debt. That bad policy supposedly is coming to an end and things could get interesting.

———

Image credit: Rdsmith4 | CC BY-SA 2.5.