Last week, I wrote about Biden’s proposed budget, focusing on the aggregate increase in the fiscal burden.

Today, let’s take a closer look at his class-warfare tax proposals. Consider this Part VI in a series (Parts I-V can be found here, here, here, here, and here), and we’ll use data from the folks at the Tax Foundation.

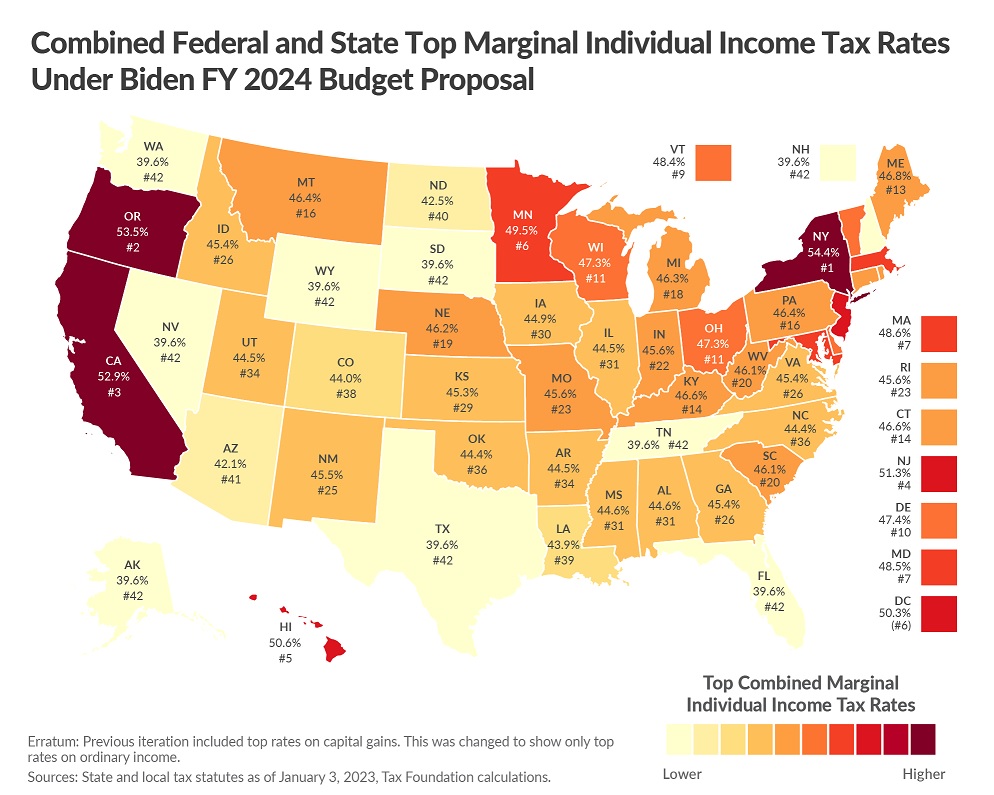

We’ll start with this map, which shows each state’s top marginal tax rate on household income if Biden’s budget is enacted.

The main takeaway is that five state would have combined top tax rates of greater than 50 percent if Biden is successful in pushing the top federal rate from 37 percent to 39.6 percent.

At the risk of understatement, that’s not a recipe for robust entrepreneurship.

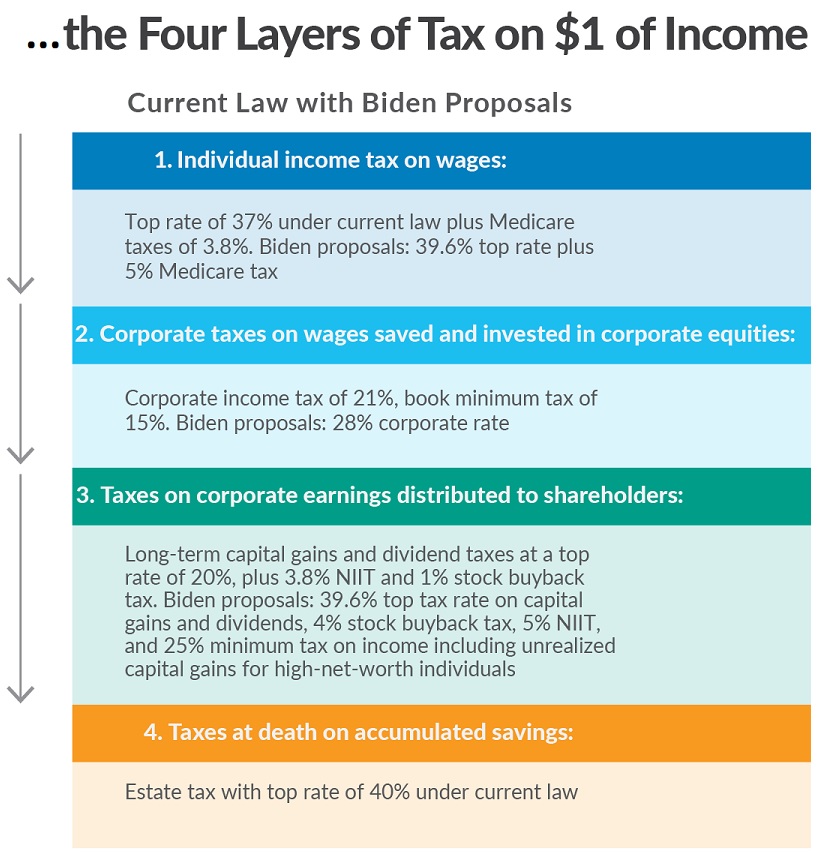

While it is a very bad idea to have high marginal tax rates, it’s also important to look at whether the government is taxing some types of income more than one time.

That’s already a pervasive problem.

Yet the Tax Foundation shows that Biden wants to make the problem worse. Much worse.

His proposed increase in the corporate tax rate is awful, but his proposal to nearly double the tax burden on capital gains is incomprehensibly foolish.

I guess we should be happy that Biden didn’t propose to also increase the 40 percent rate imposed by the death tax.

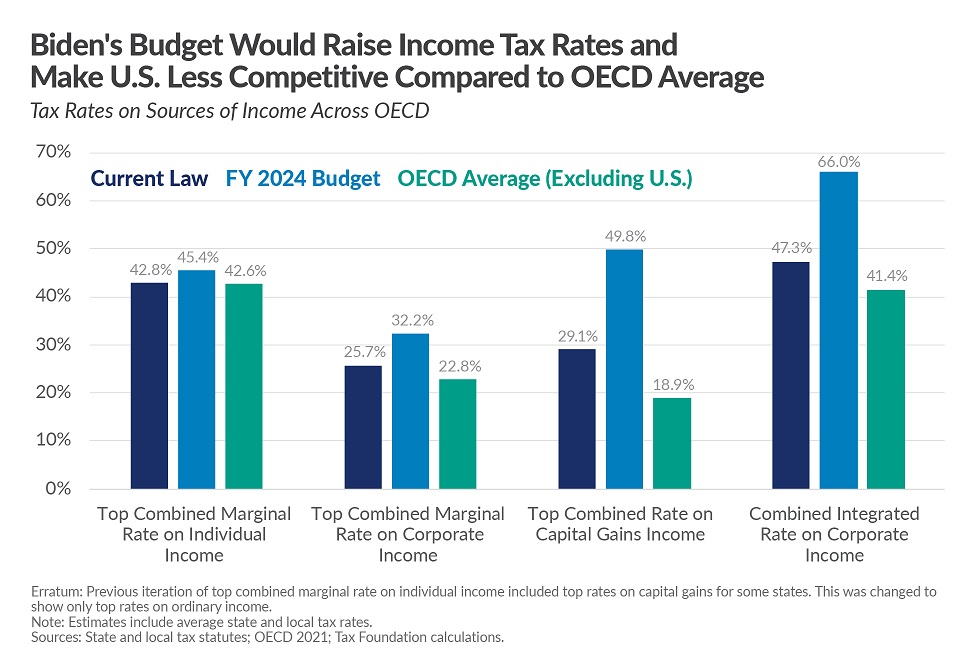

But that’s not much solace considering what Biden would do to American competitiveness. Here’s our final visual for today.

As you can see, the president wants to make the US slightly worse than average for personal income taxes, significantly worse than average for the corporate income tax, and absurdly worse than average for taxes on capital gains and dividends.

I’ll close by observing that some of my leftist friends defend these taxes since they target the “evil rich.”

I have a moral disagreement with their view that people should be punished simply because they are successful investors, entrepreneurs, or business owners.

But the bigger problem is that they don’t understand economics. Academic research shows that ordinary workers benefit when top tax rates are low, and there’s even more evidence that workers are hurt when there is punitive double taxation on saving and investment.

———

Image credit: Gage Skidmore | CC BY-SA 2.0.