In 2020 and 2021, I wrote a four-part series (here, here, here, and here) about Biden’s class-warfare tax agenda.

And I also wrote a series of columns about some of his worst ideas.

- Biden wants America to have the developed world’s highest capital gains tax rate.

- Biden wants America to have the developed world’s highest tax burden on business investment.

- Biden wants America to have the developed world’s highest personal income tax rates.

He even proposed taxes that don’t exist anywhere else in the world.

The main purpose of those columns was to explain why it would be economically harmful to impose punitive tax rates on productive behaviors such as work, saving, investment, and entrepreneurship.

Unsurprisingly, Biden still wants all these tax increases, even though Democrats lost control of the House of Representatives.

Today, let’s look at his awful proposal to tax unrealized capital gains (an idea so absurd that no other nation has enacted this destructive levy).

Eric Boehm’s article in Reason debunks Biden’s proposal (the president calls it a billionaire’s tax).

Say what you will about the Biden administration’s approach to tax-the-rich populism: It’s creative. …Taxpayers with net wealth above $100 million would have to pay a minimum effective tax rate of 20 percent on an expanded measure of income that adds unrealized capital gains to more conventional sources of income, like wages, business income, and investment income. …By raising the effective tax rate on capital gains, the proposal would reduce U.S. saving, discourage entrepreneurship, and decrease economic output. …An annual tax on paper gains would be conspicuously complex. The largest administrative problems relate to valuing non-tradable assets like privately held businesses and taxing illiquid taxpayers with large gains on paper but little cash on hand to pay a minimum tax bill. …Given these problems, it’s unsurprising the idea hasn’t caught on around the world.

And the Wall Street Journal has an editorial about this class-warfare scheme.

After the November midterm election, President Biden was asked what he would change in his last two years. “Nothing,” he said, and…he proved it by reproposing…enormous tax increases that he couldn’t get through even a Democratic Congress. Start with a reprise of his “billionaire minimum tax.” …For starters, it isn’t a billionaire tax and it isn’t an income tax. It would apply to households worth more than $100 million in accumulated assets, and its target is wealth. …if your assets rise in value during a year, you will pay taxes on that increase even if you realized no actual gains through a sale. …If your assets fell in value, you would not be able to deduct the full loss from your overall income. Heads the government wins, tails you lose.

The bottom line is that the capital gains tax is an awful levy.

But rather than abolishing the tax to boost American competitiveness, Biden has latched on to an idea to make a bad tax even worse.

And that’s in addition to his other proposals to make the capital gains tax more burdensome!

P.S. I guess we shouldn’t be surprised at bad ideas since the president is infamous for economically illiterate tax tweets.

———

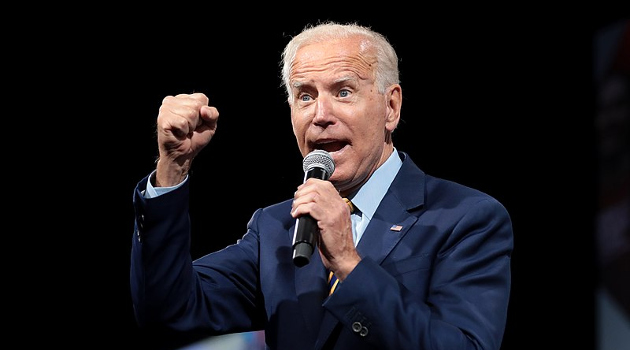

Image credit: Gage Skidmore | CC BY-SA 2.0.