It’s fun to write about big-picture issues such as tax reform (for instance, should we have a flat tax or national sales tax?).

It’s also fun to write about contentious issues such as whether there should be tax increases or whether the tax code should be based on class warfare.

Many tax topics, however, are tedious and boring. But they nonetheless involve important issues. For instance:

- Depreciation vs. expensing for new business investment.

- International tax rules and the choice of worldwide taxation vs territorial taxation.

- The debate on consumption-base taxation vs. Haig-Simons taxation.

- Choosing the right way of treating prior-years business losses.

- The fight over whether border-adjustable taxation should be part of tax reform.

Building on that list, today we’re going to wade into the boring topic of “tax expenditures.”

For those unfamiliar with the term, tax expenditures are special preferences in the tax code. In other words, tax loopholes.

But here’s the challenge: In order to figure out what’s a loophole, you first need to define a neutral tax system. And that means the debate over tax expenditures is actually a fight over consumption-base taxation vs. Haig-Simons taxation (the third item in the above list).

At the risk of over-simplifying, here’s what both sides believe:

- Proponents of consumption-base tax believe you get a neutral system by taxing all income one time, but only one time (i.e., there should be no discriminatory extra layers of taxation on income that is saved and invested).

- Proponents of Haig-Simons taxation, by contrast, believe that a neutral tax system also requires double taxation of income that is saved and invested (for all intents and purposes, taxing income and changes in net worth).

I’m motivated to write about this topic because the Committee for a Responsible Federal Budget put out a report last year entitled, “Addressing Tax Expenditures Could Raise Substantial Revenue.”

Since I don’t think our fiscal problem of excessive spending can be solved by giving politicians more revenue, I obviously disagree with the folks at CRFB about whether it would be desirable to “raise substantial revenue.”

For what it’s worth, I want to get rid of tax loopholes, but only if we use the revenues to facilitate lower tax rates. Indeed, that’s the goal of reforms such as the flat tax.

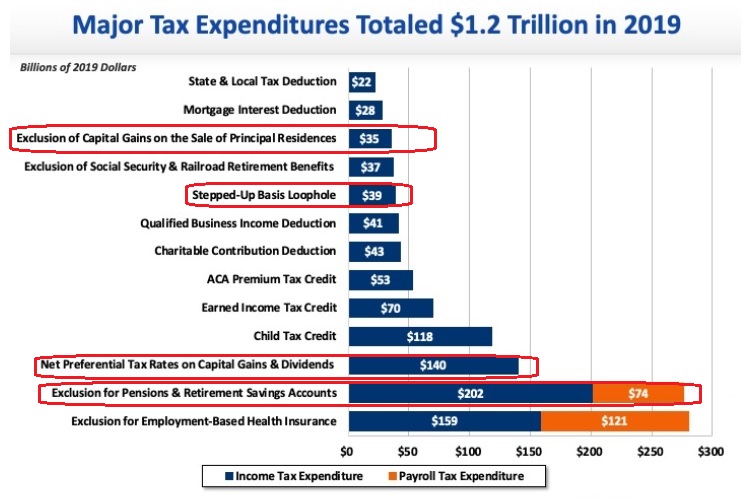

But let’s set aside that fight over tax increases and instead look at CRFB’s list of supposed tax expenditures. They rely on the Haig-Simons approach and thus include items (circled in red) that are not actually loopholes.

In a neutral tax system with no double taxation, there is no capital gains tax, no death tax, and no double taxation of dividends. In a neutral tax system, all savings is treated like IRAs and 401(k)s, which means the provisions circled above should be viewed as mitigations of penalties rather than loopholes.

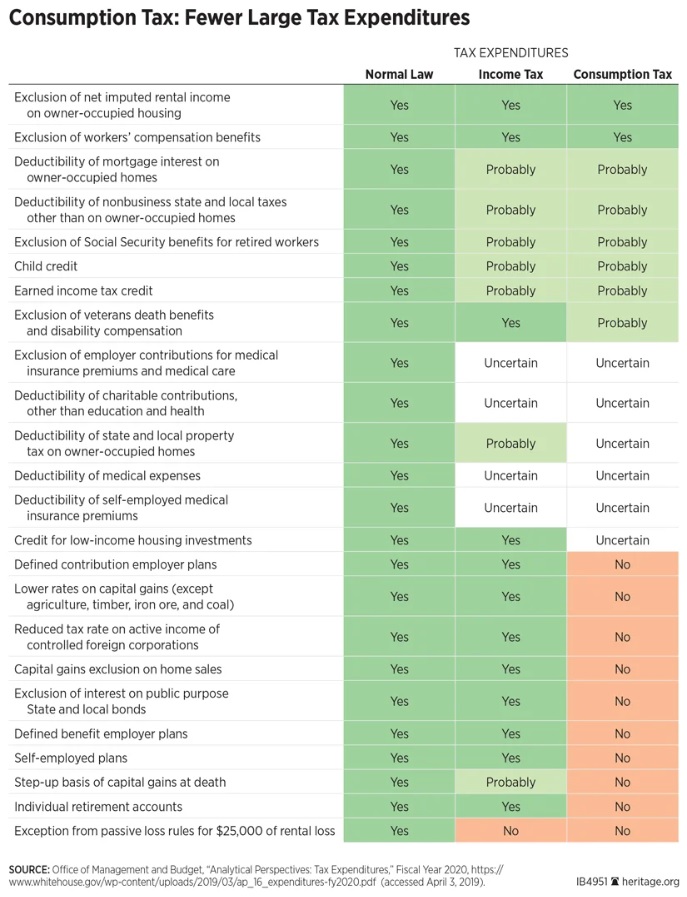

Adam Michel of the Heritage Foundation illustrated the differences between consumption-base and Haig-Smons taxation in a 2019 report.

Here’s his table looking at what’s a loophole under both systems and the bottom part of the visual is where you will see the stark difference in how both systems treat saving and investment.

I’ll close by observing that my friends on the left generally support double taxation because they view such policies as a way of getting rich people to pay more (or as a way of punishing success, regardless of whether more revenue is collected).

I try to remind them that saving and investment is what leads to higher productivity, which means it is the most effective way of boosting wages for those of us who are not rich.

Sadly, it’s not easy to get them to understand that labor and capital are complementary factors of production (apologies for the economic jargon).

P.S. While CRFB uses the wrong definition when measuring tax loopholes, they are not alone. The Joint Committee on Taxation, the Government Accountability Office, and the Congressional Budget Office make the same mistake. Heck, you even see Republicans foolishly use this flawed benchmark.

P.P.S. Here’s my award for the strangest tax loophole.

———

Image credit: 401(K) 2012 | CC BY-SA 2.0.