Folks on the left think it is terrible for nations to be “tax havens.”

Since I’ve written many columns defending low-tax jurisdictions (including the moral argument), let’s flip the script today and instead look at “tax hells.”

The 1841 Foundation has just released the 2023 version of its Tax Hell Index, which reviews nations (mostly in Europe and the Americas) and ranks them based on fiscal pressure and quality of governance.

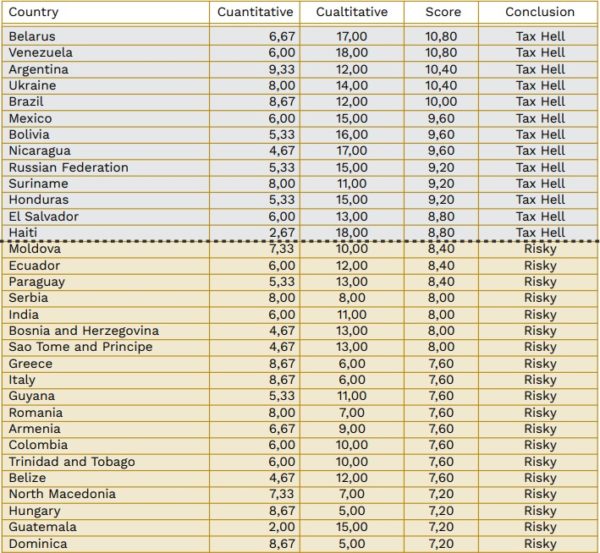

Here are the unfortunate countries that are tax hells – or are at risk of crossing the threshold and becoming tax hells.

The world’s three worst tax hells are Belarus, Venezuela, and Argentina (they also held the top three spots in last years Index).

It’s hardly a surprise to see those nations on the list, or to see countries like Brazil and Russia as well.

The 1841 Foundation explains what makes a nation eligible to be a tax hell.

Although the fiscal pressure is an important factor, we believe that a ‘tax hell’ is not only a country with high taxes, but rather one with a weak rule of law and where the rights to privacy and property are not enforced or protected as required. …Therefore, when considering the results, countries with high government quality and economic and legal stability may have high taxes (i.e., Denmark), but are very far from being considered tax hells. …In fact, there are countries with both low and high taxes in the top-13 tax hells; all of them, however, have low quality of government, high levels of corruption and use of discretionary power, poor economic management, weak institutions, and low or complete lack of legal certainty.

Even though the Index is not based solely on tax, the three best nations (i.e., with the lowest scores) are Ireland, Switzerland, and Luxembourg, all of which have been labelled as tax havens.

Which reaffirms a point I have made about so-called tax havens having higher-quality governance than high-tax nations.