As documented in Commanding Heights: The Battle of Ideas, Margaret Thatcher and Ronald Reagan saved their nations from economic malaise and decline.

Today, let’s focus on what happened in the United Kingdom.

Economic liberty greatly increased during the Thatcher years.

She deserves the lion’s share of the credit for the U.K.’s economic rebirth and renaissance, but she also had the wisdom to appoint some very principled and very capable people to her cabinet.

Such as Nigel Lawson, who served as her Chancellor of the Exchequer (akin to a combined Treasury Secretary/OMB Director in the U.S.).

Lawson died last week, leading to many tributes to his role is resuscitating the U.K. economy.

The Wall Street Journal‘s editorial summarized his achievements.

…our problems are solvable, as they were a half century ago. One of those crucial problem solvers was British politician Nigel Lawson, who died this week at age 91. …the 1970s…was even more miserable in the United Kingdom than it was in the U.S. By the time Margaret Thatcher led the Tories into office in May 1979, inflation was raging and the country had been wracked by strikes in its “winter of discontent”… Lawson entered Thatcher’s administration… He made his historic mark as Chancellor of the Exchequer starting in 1983. He’s best known for his tax reforms, which reduced the top personal income-tax rate to 40% from 60% and brought the top corporate rate to 35% from a 1970s high of 52%. He also was a steward of the Thatcher administration’s privatizations of large state-owned firms and the “Big Bang” financial reforms that would transform London into a global financial center.

In a column for CapX, Madsen Pirie examines Lawson’s work.

Nigel Lawson left a huge legacy. Under his stewardship Britain went from being the sick man of Europe into becoming an economic powerhouse and one of the world’s leading economies. He is regarded by many as the finest Chancellor of the 20th century… Lord Lawson held the firm conviction that lower taxes created space for enterprise and opportunity, and made it his policy that in every Budget he would lower the burden of taxation and abolish at least one tax. …During his tenure, Britain was transformed from being an economy in which most major businesses and services were owned and run by the state, into one in which they became private businesses, paying taxes instead of receiving taxpayer subsidies. Failing and outdated state enterprises became modern, successful private ones. …His 1988 Budget…announced that all taxes above 40% would be abolished, and that the basic rate would be cut to 25%, its lowest for 50 years… Within a very short time, more money was coming into the Treasury from the lower rates than it had been taking in from the higher ones. It was a vindication of the Laffer Curve. …The top 10% of earners had been paying 35% of the total income tax take. Under Lawson’s lower rate that went up to 48%. In rough terms this meant that the top 10% went from paying just over a third to just under a half of total income taxes.

In other words, the lower tax rates in the U.K. had the same positive impact as the lower tax rates in the U.S., both in terms of encouraging growth and confirming the Laffer Curve.

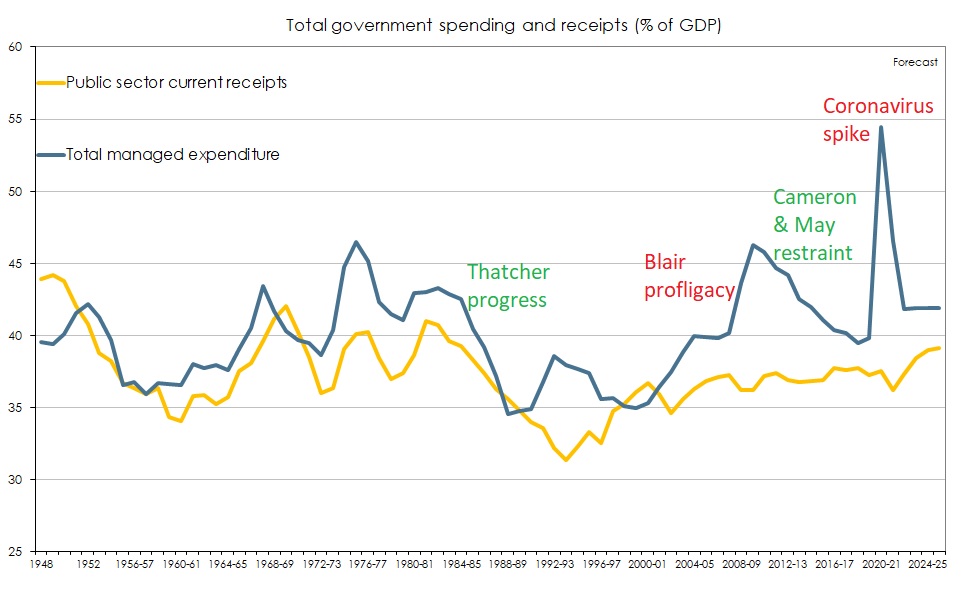

But let’s not forget that there also was spending restraint during the Thatcher years, particularly when Lawson was Chancellor of the Exchequer.

Just like we got spending restraint during the Reagan years.

The moral of the story is that it’s great to have good leaders, and it’s great when those leaders appoint good people.

P.S. If you want the U.S. equivalent of Nigel Lawson, the best historical example would be Andrew Mellon.

———

Image credit: Chatham House | CC BY 2.0.