Way back in 2009, I shared some data from Americans for Tax Reform about how taxes account for more than 40 percent of the cost of Thanksgiving.

That’s bad news, but we’re lucky compared to the Pilgrims, who had a disastrous experiment with socialism before wising up and finally having something to celebrate.

Speaking of celebration, let’s focus on some positive news for today.

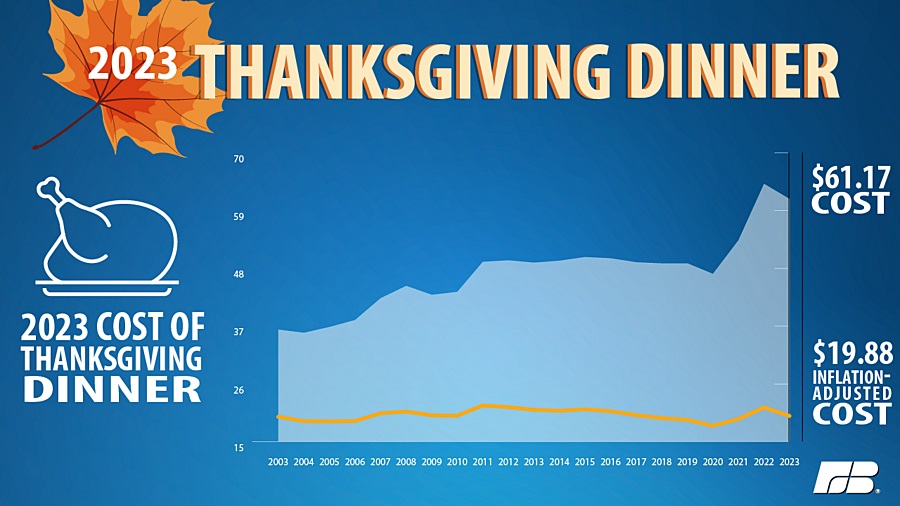

We’ll start with the Farm Bureau’s annual estimate of the cost of a Thanksgiving dinner. As you can see, families finally got a break after several years of big price increases.

But look at the inflation-adjusted cost of dinner, as shown by the orange line near the bottom of the chart. We see that the cost has been flat over the past two decades.

But there’s better news to share. While the inflation-adjusted price of Thanksgiving dinner has been flat, inflation-adjusted household incomes have been increasing.

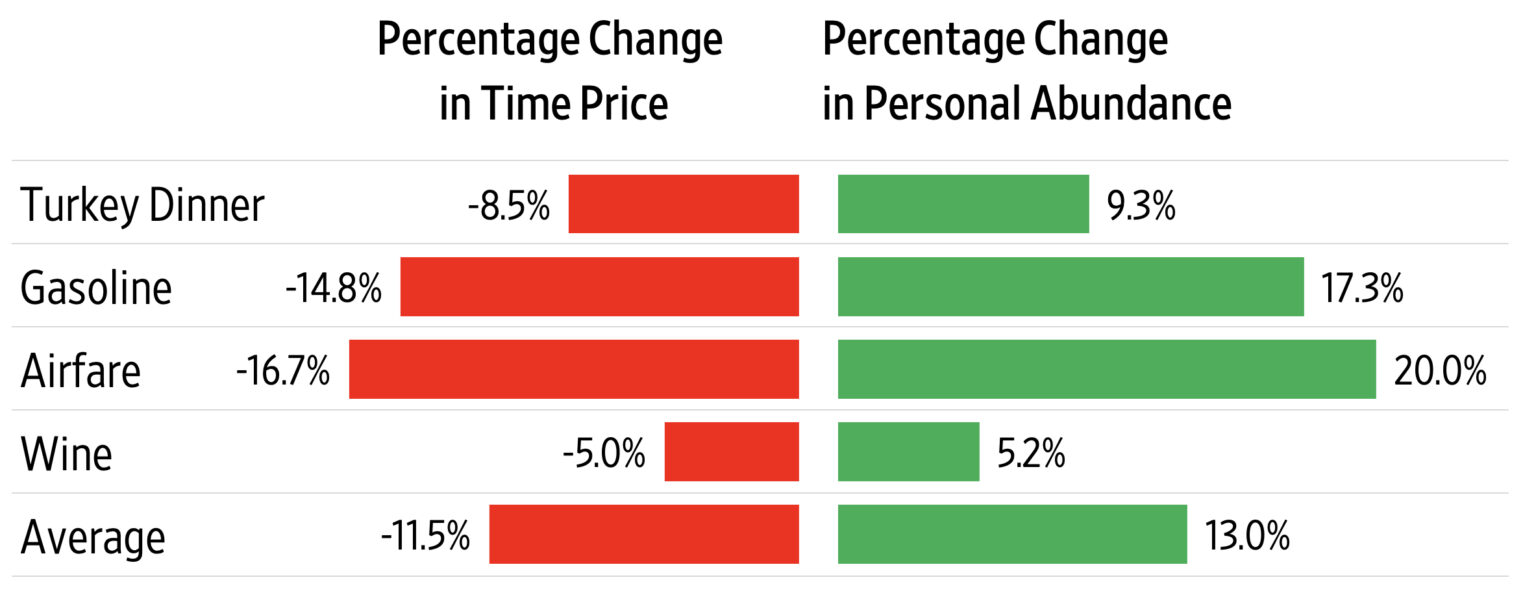

Which means it takes less time to earn the money needed to buy things like Thanksgiving dinner. Here’s Professor Jeremy Horpedahl’s calculation of the “time price” of that dinner, along with an estimate of what it means for our “personal abundance.”

Professor Gale Pooley explains for Human Progress what is meant by these terms.

Remember, it’s not how expensive things are but how affordable they are that counts. To measure affordability, we must compare prices to wages. This is what time prices do for us. A time price is simply the nominal money price divided by nominal hourly income. Since last year, the nominal money prices of our four essential items have decreased from 0.8 percent to 13 percent, while nominal hourly income has increased by 4.4 percent. That means that personal abundance has increased by between 5.2 percent and 20 percent. …Dividing the percentage change in the nominal money prices by the percentage change in nominal wages reveals the percentage change in the time price. Personal abundance is how much more you now enjoy for the same amount of time relative to last year. We get 13 percent more Thanksgiving this year for the same amount of time it took last year.

There’s a lot to digest there, but the above excerpt can be summarized in two sentences.

- Over time, we’re earning more money after adjusting for inflation.

- Over time, it takes fewer hours of work to buy just about anything.

In both sentences, I started with “over time” because there are exceptions.

Sometimes people fall behind for a short period of time because prices rise faster than wages, or because of a recession, or because of terrible economic policy.

In general, though, we enjoy more prosperity with each passing year.

That’s true even for Argentinians (though their “personal abundance” has grown at an anemic rate).

The good news is that we don’t need perfect policy to achieve higher living standards. The economy simply needs “breathing room,” which will exist so long as politicians don’t get too crazy about over-taxing, over-spending, and over-regulating.

Which leads me to unveil my 16th Theorem of Government.

I want small government and free markets so people get richer at the fastest-possible rate.

So I get angry when politicians do the wrong thing. But I’m comforted by the fact that free enterprise usually produces benefits at an even faster pace.

Remember that even small differences in annual economic growth compound into big changes in living standards over several decades.

P.S. Here are the other 15 Theorems of Government.

- The “First Theorem” explains how Washington really operates.

- The “Second Theorem” explains why it is so important to block the creation of new programs.

- The “Third Theorem” explains why centralized programs inevitably waste money.

- The “Fourth Theorem” explains that good policy can be good politics.

- The “Fifth Theorem” explains how good ideas on paper become bad ideas in reality.

- The “Sixth Theorem” explains an under-appreciated benefit of a flat tax.

- The “Seventh Theorem” explains how bigger governments are less competent.

- The “Eighth Theorem” explains the motives of those who focus on inequality.

- The “Ninth Theorem” explains how politics often trumps principles.

- The “Tenth Theorem” explains how politicians manufacture/exploit crises.

- The “Eleventh Theorem” explains why big business is often anti-free market.

- The “Twelfth Theorem” explains you can’t have European-sized government without pillaging the middle class.

- The “Thirteenth Theorem” explains that people are unwilling to pay for bloated government.

- The “Fourteenth Theorem” explains how poor people are hurt by big government.

- The “Fifteenth Theorem” explains that opponents of entitlement reform want giant tax increases.