I was sour about China’s economic prospects more than 10 years ago, and these remarks from earlier this year show that I still think China’s economy is being held back by too much government.

The people who think of China was or is an economic superpower do not pay much attention to policy, as captured by Economic Freedom of the World and the Index of Economic Freedom.

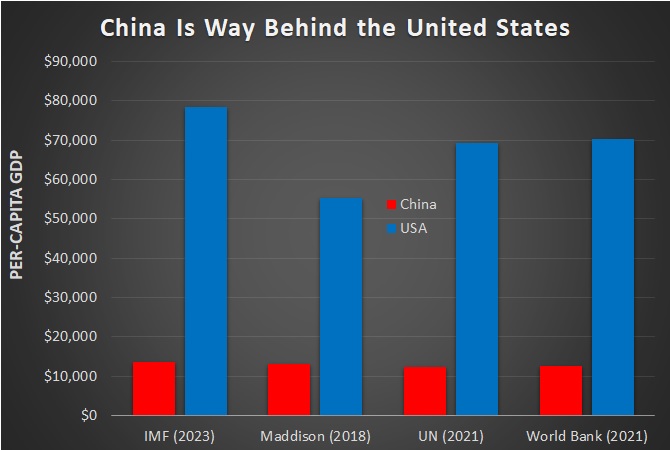

And they also don’t pay much attention to data. When you compare per-capita economic output, it quickly becomes apparent that China is way behind the United States.

And that assumes Chinese economic data is trustworthy, which almost certainly is not the case.

It seems other people are finally waking up to the fact that China is not a success story.

A story in the Wall Street Journal, authored by Stella Yifan Xie and Jason Douglas, captures some of the country’s ongoing economic challenges.

China’s era of rapid growth is over. Its recovery from zero-Covid is stalling. And now the country is facing deep, structural problems in its economy. …government overinvestment that fueled growth for more than a decade have ended. Enormous debts are crippling households and local governments. Some families, worried about the future, are hoarding cash. Chinese leader Xi Jinping’s crackdowns on private enterprise have discouraged risk-taking… Instead of expanding at 6% to 8% a year as was common in the past, China might soon be heading toward growth of 2% or 3%, some economists say. An aging population and shrinking workforce compound its difficulties. …More than a fifth of Chinese youths aged 16 to 24 were unemployed in April. …Foreign direct investment into China tumbled 48% in 2022 compared with a year earlier.

If that list of problems is not sufficiently compelling, there’s more evidence that China has serious problems.

- Rich people are moving their money out of China.

- Industrial policy is backfiring in China.

- Class warfare policies are discouraging entrepreneurship.

The bottom line is that China can prosper, but only if it returns to the path of economic liberalization. Pro-market reforms in the late 1900s produced some very positive results.

But I suspect we are more likely to see economic deterioration under the nation’s current leadership.

P.S. China will suffer even more if it follows terrible advice from the IMF and OECD.

P.P.S. Here’s a fascinating comparison of Poland and China. And we can learn even more by comparing Taiwan and China.

———

Image credit: Foreign and Commonwealth Office | CC BY 2.0.