The Baltic nation of Estonia is an improbable success.

After breaking free from the horror of Soviet communism, leaders adopted pro-market reforms.

- Including a low-rate flat tax for households.

- Including a pro-growth tax system for companies.

- Including widespread economic deregulation.

- Including periodic episodes of spending restraint.

Is Estonia a laissez-faire paradise? No. But it ranks #8 in the world for economic liberty.

And having decent policy means poverty has plummeted and it has been quickly closing the gap with European nations that did not suffer from decades of communist enslavement.

Estonia’s experience with regards to tax policy may provide some lessons for the United States. The Tax Foundation has a new report that measures the potential benefits of replacing America’s nightmarish income tax with the Estonian system.

Other countries have proven that sufficient tax revenue can be collected in a less frustrating and more efficient manner. A particularly compelling example is Estonia’s tax system, where taxes are so simple they are typically filed online in about five minutes. …Drawing on the Estonian experience and building on ideas from our initial study on reform options, we present here a plan for reforming the U.S. tax code… The reforms include: A flat tax of 20 percent on individual income combined with a generous family allowance to protect low-income households. …A distributed profits tax of 20 percent… Elimination of taxes at death and simplified treatment of capital gains.

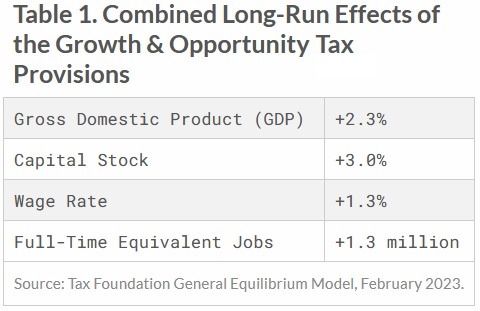

Here’s how the U.S. would benefit.

By simplifying the federal tax code, the reform would substantially reduce compliance costs, potentially saving U.S. taxpayers more than $100 billion annually. By improving work and investment incentives and eliminating the double taxation of business income, we estimate the reform would boost long-run GDP by 2.3 percent, grow wages by 1.3 percent, and add 1.3 million full-time equivalent jobs. The plan would increase average after-tax incomes by 0.3 percent in the long run on a conventional basis. When including the benefit of higher economic output, average after-tax incomes would rise by 2.1 percent in the long run.

A bigger economy, more investment, higher wages, and more jobs.

Hard to argue with these results.

Though, to be fair, you can argue with these results. The Tax Foundation’s analysis assumes that government should collect as much money with an Estonian-style flat tax as it does with the current internal revenue code.

That means poor people benefit (generous exemptions) and rich people benefit (lower tax rates) but middle-class people would wind up with less after-tax income.

That’s not a recipe for political success.

Which allows me to re-emphasize what I wrote in 2021, which is that you can’t have a good tax system without spending restraint.

That’s true for the flat tax. That’s true for the national sales tax. And it’s true for anybody and everybody who does not want massive future tax increases.

P.S. You can click here to read about Paul Krugman’s big mistake about Estonia.

P.P.S. And you can click here to read about the OECD’s campaign to undermine Estonian prosperity.

———

Image credit: NakNakNak | Pixabay License.