While speaking last year in Hawaii on the topic of good tax policy, I explained why it is misguided to impose extra layers of tax on saving and investment.

Regarding the problem of double taxation, I’ve addressed how various features of the tax code need to be fixed.

- Get rid of the capital gains tax

- Get rid of the double tax on dividends

- Get rid of the death tax

Today, we’re going to focus on the fixing the tax treatment of household savings. And the problem that needs fixing is that the federal government taxes you when you earn money and also taxes any interest you earn if you decide to save some of your after-tax income.

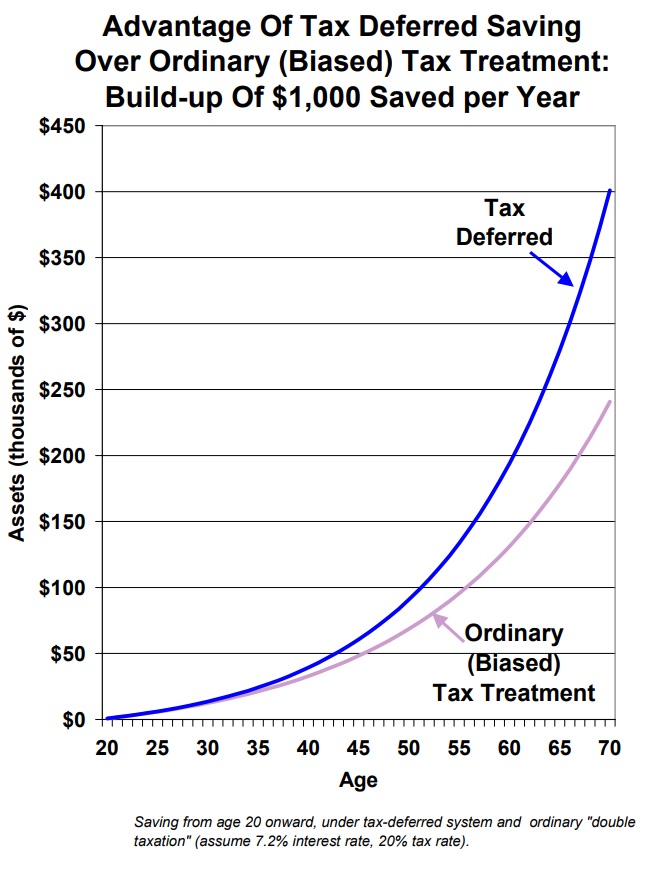

As you can see from the chart, this creates a tax wedge.

And that tax wedge distorts people’s decisions and makes them more likely to choose immediate consumption rather than savings (which can be viewed as deferred consumption).

As mentioned in the video, every economic theory recognizes that saving and investment (again, just another way of saying deferred consumption) are critical to future growth and rising living standards. So there are good reasons to fix the tax code.

The good news is that there are two ways to fix this problem.

- Tax income only one time when it is first earned.

- Tax income only one time when it is consumed.

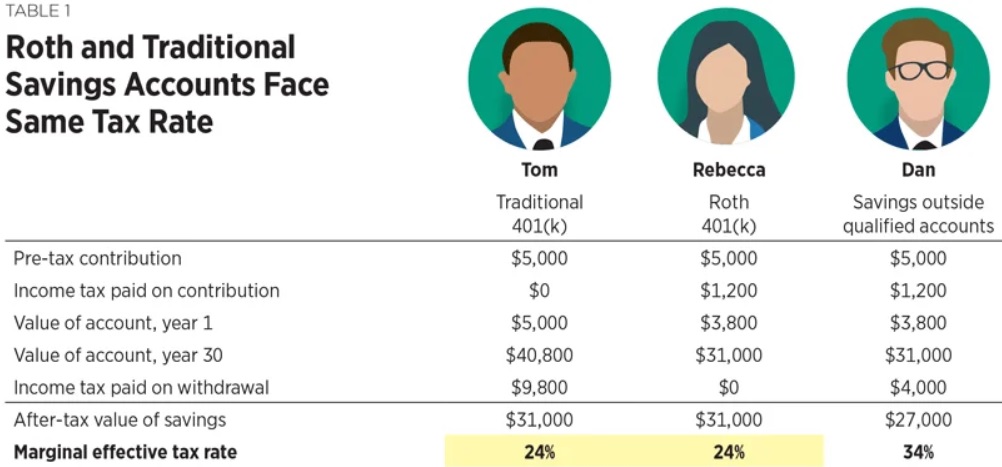

In practical terms, the first option treats all savings like a “Roth IRA,”, which means you pay tax the year you earn your income, but the IRS does not get another bit at the apple if you save some of your after-tax income and it earns interest or otherwise grows in value.

The second option treats all savings like a 401(k), which means you are not taxed on any income that you place in a savings vehicle, but you are taxed on any money (including any interest or other returns) that you withdraw from the account.

As shown by Adam Michel of the Heritage Foundation, both of these approaches lead to the same long-run result (and thus are superior to what happens when people save without being protected from double taxation).

The good news is that Americans can protect their savings from double taxation by using either individual retirement accounts (IRAs) or 401(k)s.

The bad news is that those “qualified accounts” are restricted. Only people who are saving for retirement can protect themselves from double taxation.

That needs to change.

Here’s what I wrote back in 2012 and I think it’s reasonably succinct and accurate.

…all saving and investment should be treated the way we currently treat individual retirement accounts. If you have a traditional IRA (or “front-ended” IRA), you get a deduction for any money you put in a retirement account, but then you pay tax on the money – including any earnings – when the money is withdrawn. If you have a Roth IRA (or “back-ended” IRA), you pay tax on your income in the year that it is earned, but if you put the money in a retirement account, there is no additional tax on withdrawals or the subsequent earnings. From an economic perspective, front-ended IRAs and back-ended IRAs generate the same result. Income that is saved and invested is treated the same as income that is immediately consumed. From a present-value perspective, front-ended IRAs and back-ended IRAs produce the same outcome. All that changes is the point at which the government imposes the single layer of tax.

The key takeaways are in the first and last sentences. All savings should be protected from double taxation, not just what you set aside for retirement. And that means government can tax you one time, either when you first earn the income or when you consume the income.

This means we need universal savings accounts, sort of like they have in Canada.

Here’s what Robert Bellafiore of the Tax Foundation wrote about the idea back in 2019.

USAs do not penalize withdrawals on account of their purpose or timing. In contrast, some types of existing savings accounts are not neutral, penalizing people who withdraw their money for anything but approved purposes at approved times. For example, withdrawals from 529 accounts can only be made without penalty if they are used to fund education. If a parent has a 529 account for a child but must make a withdrawal to cover emergency expenses, he or she must pay income taxes on the earnings, plus a 10 percent penalty. Withdrawals from 401(k)s before the age of 59½ incur the same penalty, though there are certain exceptions. USAs’ neutrality would likely boost saving, for two reasons. First, when savings are not hit by multiple layers of taxation, savers can expect a higher return and are therefore likely to save more. Both IRAs and 401(k)s tax savings only once, and studies have estimated that roughly half of 401(k) balances, and roughly a quarter of all IRA contributions, constitute new saving—in other words, dollars that would have been spent are saved instead.

The bottom line is that we need to copy jurisdictions such as Hong Kong and Singapore that have little or no double taxation of any kind.

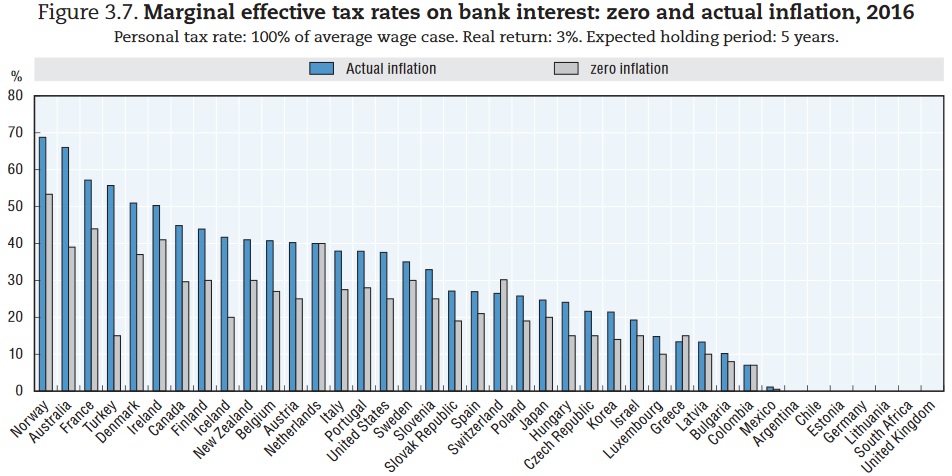

Especially since we now live in a world where inflation has become an issue, which acts as a hidden tax on saving and investment.

I’ll close with this chart from the OECD. It’s a few years old, so I’m sure some nations have changed their policies, but it gives one a good idea of how savings is treated around the world.

The bottom line is that it’s good to avoid Norway and the United States is unimpressive.

I’m very surprised to see that Argentina and Germany have good policy.

P.S. For some of our friends on the left, policies that protect from double taxation are akin to an entitlement.

———

Image credit: 401(K) 2012 | CC BY-SA 2.0.