I wrote in 2017 that class warfare in the 1950s did not work because well-to-do taxpayers could choose to earn less, evade taxes, or avoid taxes.

In this video, Brian Domitrovic elaborates on the failure of confiscatory tax rates.

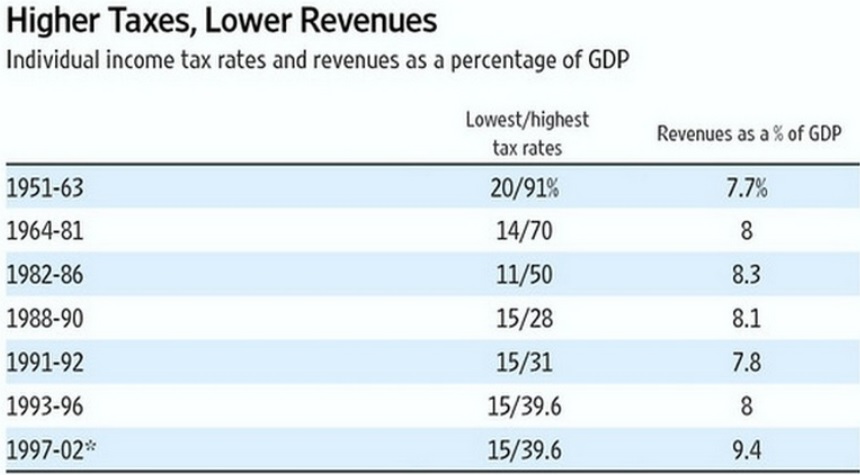

Let’s dig deeper into this topic, and we’ll start with this table from a 2012 article by James Pethokoukis.

It shows that income tax revenues during the 1950s were lower than they were in the 1960s (after the Kennedy tax cuts) and the 1980s (after the Reagan tax cuts).

Here’s some of what he wrote to accompany the table.

1950s tax rates actually generated less tax revenue than subsequent periods of lower rates. From 1950 to 1963, income tax revenue averaged 7.5 percent of GDP; that’s less than in the Reagan years when rates were being slashed. This could suggest that rates are right around the Laffer Curve equilibrium point in the current economy. …And, of course, an ultrahigh tax rate on an initially small slice of the population…would neither raise very much revenue nor do anything to create jobs. And look at what just happened in Great Britain. Their Independent Fiscal Oversight Commission—which reviews all of the budgetary assumptions—just ruled that cutting the top rate of tax from 50 to 45 was revenue neutral, implying the revenue maximizing rate is in that range. The Brits don’t have state income taxes, which implies by extension that our revenue maximizing federal rate is lower than theirs—a whole lot lower than 70, 80, or 90%. Back to the 1950s? Forget it.

In a 2023 article for the Foundation for Economic Education, Rainer Zitelmann also explains that the high tax rates didn’t produce high revenues (gee, I think there’s a way of describing this insight).

Left-wing politicians who demand higher taxes on the rich argue that the United States has, in the past, prospered when tax rates were very high, proving that high taxes do not harm the economy. …In the 1950s and early 1960s, the top federal personal income tax rate in the US was a horrendous 91 percent… Interestingly, the actual percentage paid by the top 1 percent of earners in the US was only 16.1 percent in 1962, when the top marginal rate was 91 percent. However, in 1988, when the top rate was only 28 percent, the percentage paid by the top 1 percent of earners had risen to 21.5 percent! …This seems paradoxical, but it is logical, because it is not only the tax rate that is decisive, but the amount of income that is actually taxable. …So the myth that the US experienced strong economic growth when the top marginal tax rate was high is false.

The bottom line is that the economy sputtered in the 1950s because of high tax rates and tax revenues languished for the same reason.

P.S. While the 1950s were bad, President Franklin Roosevelt actually tried to impose a 100 percent tax rate in the 1940s (and that’s not even the worst thing he advocated).