Other than doing very well in rankings of state pension debt (see here, here, and here), I’ve never had any reason to notice public policy in Nebraska.

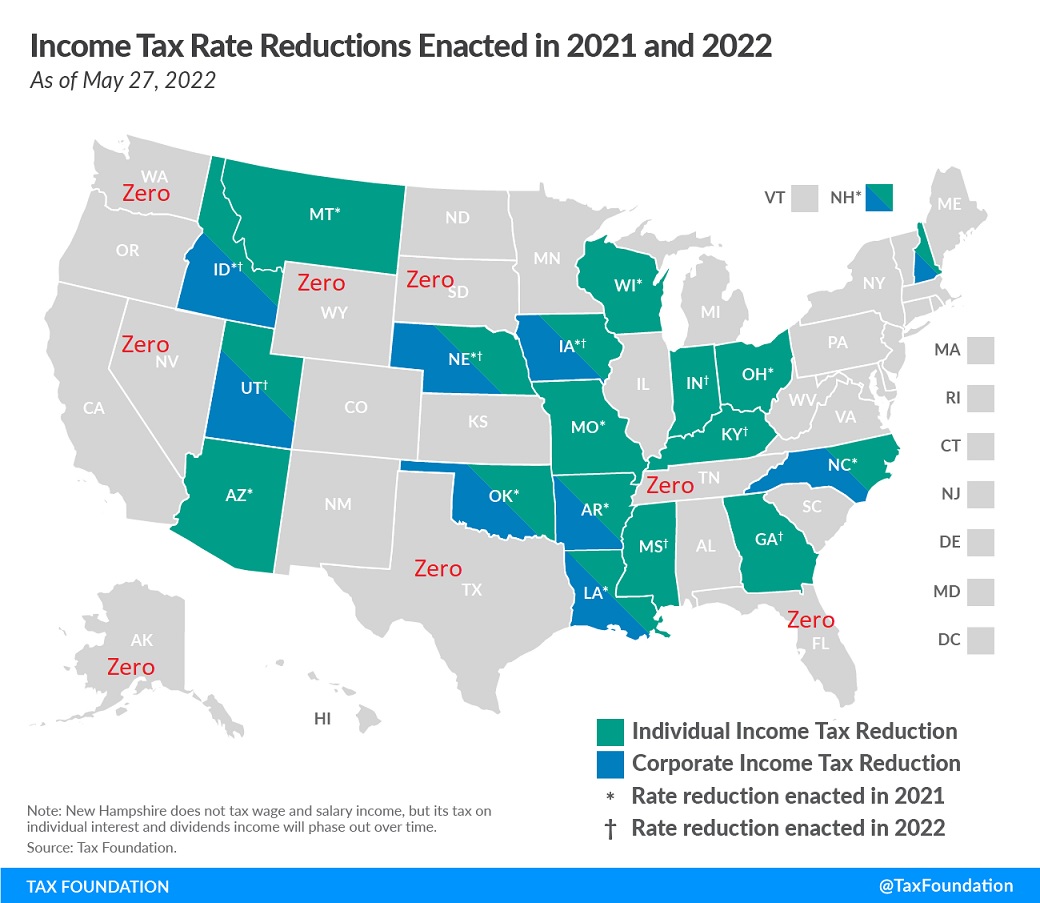

That changes today because the Cornhusker State has – like about two dozen other states – lowered income tax rates.

The widespread shift to better state tax policy is a very positive development, second only to the really great news about school choice.

Let’s take a closer look about the good news from Nebraska.

The Wall Street Journal editorialized about the state’s new tax changes, including some special attention for the improvements in business taxation.

The gulf between high- and low-tax states keeps growing, and Nebraska is the latest to use budget surpluses to cut income and property taxes—and in a big way. …An income-tax cut will bring the top rate down to 3.99% from 6.64% by 2027, and a separate cut will slash the corporate tax to the same 3.99% rate from 7.25% today. …A two-year term limit for legislators has helped produce crops of increasingly market-friendly lawmakers. Interstate competition has also kept the tax pressure on. …neighboring Missouri cut its top rate on income to 4.95%, and Iowa followed up its recent flat-tax plan with additional cuts to property taxes. …More than half of all states have reduced their income-tax rates since 2021… Fewer states have cut corporate rates. In slashing its tax on businesses, Nebraska will leapfrog its neighbors to boast the lowest rate in the region after zero-tax South Dakota and Wyoming.

Kudos to Nebraska. They’ve moving from Column 4 to Column 3 in my state tax ranking.

The next step hopefully will be a flat tax.

P.S. Some state tax cuts are hardly worthy celebrating.

P.P.S. Massachusetts and Washington are among the few states moving in the wrong direction.

———

Image credit: 401(K) 2012 | CC BY-SA 2.0.