Yesterday’s column reviewed a new academic study which found that Trump’s corporate tax reforms had a very positive impact on investment, which means more growth and higher wages for the American economy.

The study, which was written by Gabriel Chodorow-Reich from Harvard, Matthew Smith from the Treasury Department, Owen Zidar from Princeton, and Eric Zwick from the University of Chicago, echoes other findings on the benefits of better corporate tax policy.

Today, let’s investigate what the study says about the impact of Trump’s corporate tax reforms on tax revenue.

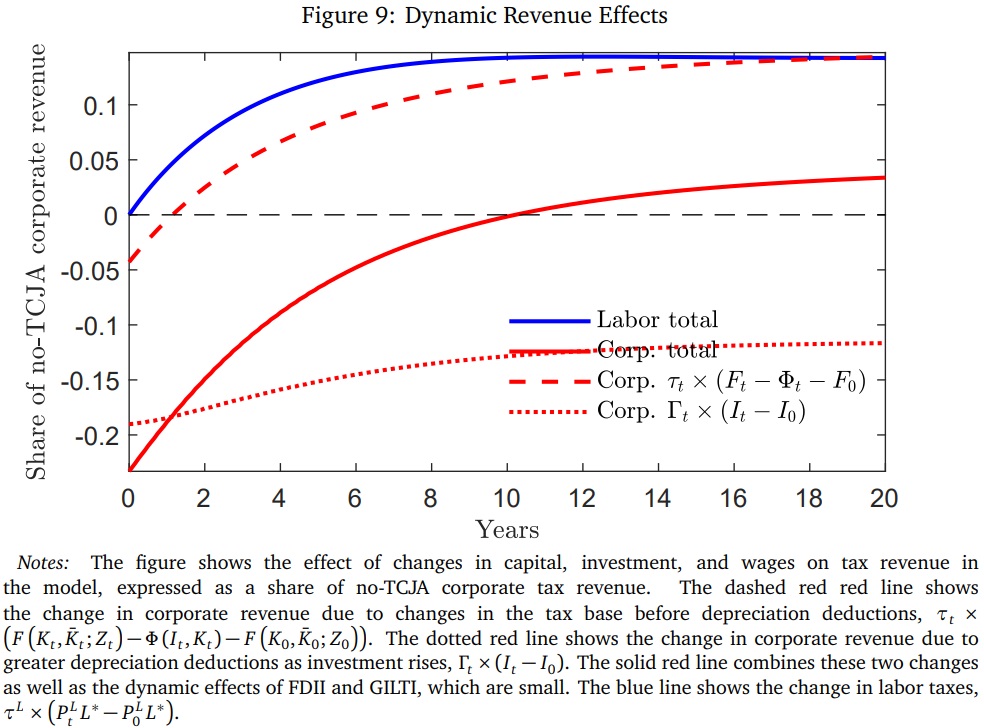

Here’s a chart from the study that looks at the revenue impact over a 20-year period.

And here’s the accompanying analysis from the study.

The total effect of the TCJA’s corporate provisions on tax revenue combines two forces: (i) the static revenue effect of the tax changes holding the capital stock fixed, and (ii) the revenue consequences of the dynamic changes in capital induced by the law. …). The solid red line in figure 9 shows the total change in corporate taxes as a result of the dynamic changes in capital, expressed as a ratio of pre-TCJA corporate tax revenue. …The dynamic response of capital reduces corporate tax revenue on impact and has a small positive long-run effect. The impact reduction occurs because capital does not jump at the time of the law change, but the immediate increase in investment incurs adjustment costs that depress taxable income and also increases depreciation deductions. Over time, rising domestic and foreign capital increase domestic corporate income. …However, because the negative revenue impact of higher depreciation deductions persists, total dynamic corporate revenue effects remain negative until year 12 and never exceed 5% of pre-TCJA revenue. …The solid blue line in figure 9 shows the effect of changes in labor taxes… Since the wage depends on the capital stock, it does not jump at the time of the law change but instead rises over time. By year 10, the increase in wages generates additional labor tax revenue of almost 15% of the pre-TCJA corporate tax revenue. Any overall long-run increase in tax revenue due to changes in capital therefore largely arises from higher labor rather than corporate tax payments

If you want a simpler explanation, here’s how the Tax Foundation summarizes the study’s findings regarding the revenue impact of Trump’s corporate tax reforms.

Regarding the TCJA’s impact on tax revenue, the study finds small dynamic effects within the 10-year budget window after accounting for increased economic activity. Tax revenues from labor increase due to the increased wage growth but are offset by a decline in corporate tax revenue particularly from bonus depreciation in the first few years after enactment. However, by year 10, dynamic corporate tax revenue gains begin to offset static corporate tax revenue losses while dynamic labor tax revenue reaches about 15 percent of baseline corporate tax revenue. This is sufficient to fully offset the static revenue losses from the corporate provisions by the end of the budget window.

Very similar to what I wrote in 2021 and 2022.

In other words, this new research is more evidence in favor of the Laffer Curve.