When Reagan campaigned for the White House, his economic plan was based on four pillars. I wrote a study about those policies for the Club for Growth Foundation and I wanted to answer two questions.

First, was Reaganomics successful? Second, should similar policies be pursued today?

Today’s column is Part IV of a five-part series.

- In Part I, we reviewed Reagan’s successful record of spending restraint and explained why the same approach is needed today, particularly to control entitlements.

- In Part II, we examined Reagan’s much-needed supply-side tax reforms and said the same insights are needed today to address the problem of double taxation.

- In Part III, we looked at Reagan’s track record on red tape, noting that he arrested the growth of regulatory restrictions and regulatory budgets and urged the same policies today.

For Part IV, let’s look at Reagan’s approach to inflation.

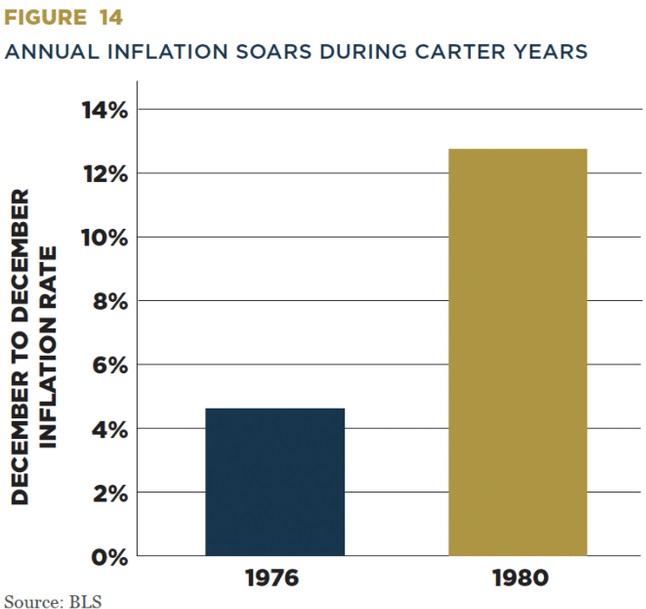

We’ll start with Figure 14 from the study, which shows how inflation dramatically increased during the 1970s.

That was the problem Reagan faced when he took office.

Here’s some of what I wrote in the study.

The United States was plagued by double-digit inflation when Reagan was elected. Rising prices were a problem throughout the 1970s, and the problem became particularly acute during the Carter Administration (see Figure 14), with prices climbing by nearly 50 percent in just four years. …The Federal Reserve deserved the blame for the surge in prices. The central bank created too much liquidity, motivated in part by a belief in Keynesian monetary policy and in part by a desire to appease politicians who like the sugar high of easy money. To make a bad situation worse, prices were increasing faster than income, which meant that the average household was falling behind. According to the Census Bureau, when Reagan took office in 1981, both median and mean household income was several hundred dollars lower than when Carter took office in 1977.

Here’s what Reagan achieved.

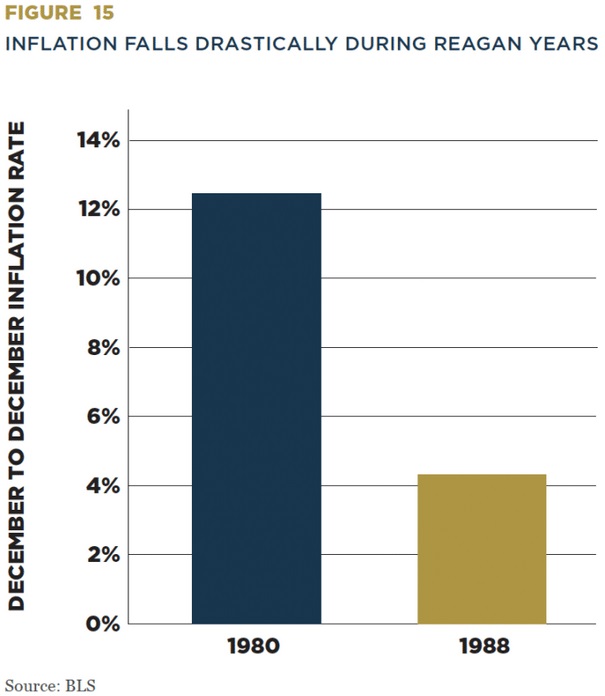

Unlike other presidents, who favored the sugar high of easy money, Reagan understood that the Federal Reserve needed a restrictive policy to bring inflation under control. He supported Chair Paul Volcker’s efforts to slow monetary growth even when it became politically unpopular. He courageously did what was best for the nation, even though it hurt his party in the 1982 mid-term elections. …Reagan’s courage paid dividends. The inflation rate came down very quickly. As shown Figure 15 below, inflation was down to about 4 percent in 1988:

Here’s the chart showing what Reagan achieved.

As I did with Part I, Part II, and Part III, let’s now consider whether Reagan’s policies are still relevant today.

In the case of monetary policy, the answer clearly is yes. The Federal Reserve (and other central banks) recklessly expanded their balance sheets during the pandemic. In effect, they repeated the mistakes of the 1970s, albeit for a different reason.

Regardless of the reason for bad policy, the solution is the same. Replicate Reagan’s courage and bring inflation under control.

The bottom line is that Reaganism was the right approach in the 1980s and it is the right approach today.