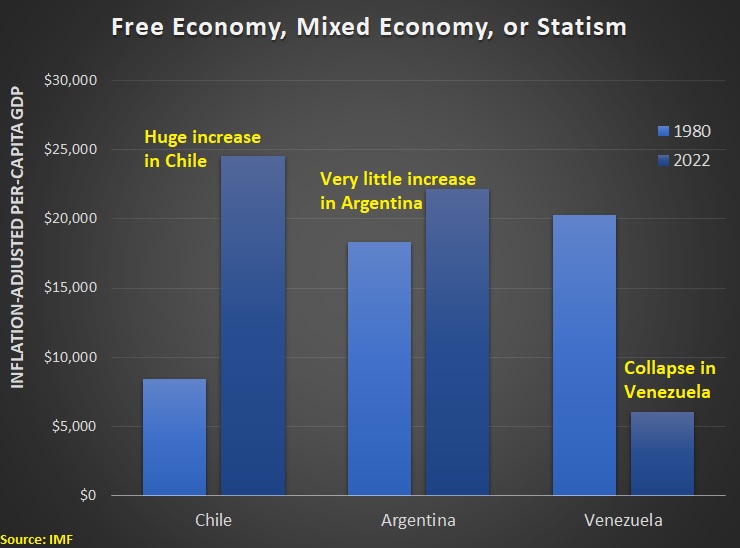

The economic policy lessons from Latin America are very clear.

There’s one unambiguous success story (at least until the past couple of years), one semi-decent success story, and then a bunch of utter failures.

What’s interesting (and tragic) is that the failures teach different lessons.

- We learn about long-run socialist suffering from Cuba.

- We learn about rapid socialist collapse from Venezuela.

- We learn about gradual socialist collapse from Argentina.

And if we pay attention to the region, we can expect more collapse.

Why? Because left-wing governments are now in charge and sensible people are moving their money where it can’t be confiscated.

In an article for Bloomberg, Ezra Fieser and Andrea Jaramillo report on people taking their money out of Latin America.

As every major country in Latin America shifts to the left…, capital is flying out of the region. Wealthy and, increasingly, middle-class investors are looking for a Plan B… People and corporations in the region’s five largest economies pulled roughly $137 billion out of their countries in 2022. That number—preliminary data from the Institute of International Finance, a group of banking institutions—is 41% higher than the 2021 figure and the most since 2010. …popular destinations include the Dominican Republic, Panama, Spain and the US. …Each time a leftist gets elected, money pours into South Florida, says Raul Henriquez, chairman of Insigneo Financial Group LLC, a wealth manager in Miami. …Often called a “pink tide,” this shift toward socialism dates to 2018, when Andrés Manuel López Obrador swept into power in Mexico. Leftists prevailed in Argentina in 2019, Chile and Peru in 2021, and Brazil and Colombia last year. “This is a historic event we’ve never before seen—the entire region has gone pink on us,” says Talbert Navia… Mauricio Cárdenas, a former Colombian finance minister, says capital flight is playing a role and could make it difficult to enact socialist policies.

If you want to know why people and/or their money are escaping, read this article from Americas Quarterly by José Antonio Ocampo, who is now Colombia’s Finance Minister.

Latin America can return, of course, to the path of growth, employment, and improvement in social conditions. But this implies a significant increase of fiscal resources… A key barrier is the generally weak level of tax revenue obtained by Latin American countries. In 2018, the average tax revenues in the region were 23.1% of GDP… One of the problems is the lack of income tax regimes with significant redistributive effects… supports the proposal for the introduction of a global minimum effective corporate tax rate of 25%. …countries should…adopt effective progressive wealth taxes on their residents.

By the way, Senor Ocampo used to be at the United Nations, where he enjoyed a tax-free salary while urging higher tax burdens on everyone else.

Also, I can’t resist pointing out that tax burdens in Latin America are already far too high. Ocampo wants a “path to growth,” but he apparently does not understand that today’s rich nations all became rich when the burden of government was very small.

Last but not least, the tax-free bureaucrats at the Organization for Economic Cooperation and Development in Paris continue to push for bad policies.

Here is some of the nonsense included in the bureaucracy’s latest Economic Outlook for the region.

…a fiscal sustainability framework focused on strengthening public revenues will be required… In the medium term, the region will have to focus on generating more progressive and greener fiscal pacts, with the aim of increasing tax collection and strengthening direct income and property revenues. …it is essential that social protection systems have funding sources that will ensure their financial sustainability. This can be achieved, in part, by increasing tax revenues… Innovative income support policies could be worth exploring to increase progressivity… A set of tax policy options are available in LAC that could help increase revenues… These include measures to…increase the progressivity of personal income taxes.

While the OECD should be condemned for pushing bad policy on poor nations, at least they deserve credit for consistency.

———

Image credit: World Economic Forum | CC BY-NC-SA 2.0.