After eight years of being head of the International Monetary Fund, where she seemingly specialized in pushing for bailouts, bigger government, and higher taxes (conveniently, her lavish salary was tax exempt), Christine Lagarde was rewarded for her mistakes by being appointed president of the European Central Bank in 2019.

Amazingly, she may be an even bigger failure as a central banker. Within just a couple of years, inflation became a major problem in the eurozone (the various nations that use the euro currency).

Yet, as noted by this tweet, Ms. Lagarde apparently is mystified by what has happened while she’s been in charge.

Imagine what would happen to any senior manager in a private business if he/she would give this explanation about missing the only item listed in his/her job description.

— Michael A. Arouet (@MichaelAArouet) July 4, 2023

pic.twitter.com/OJJdY9NNh3

For what it is worth, I think this tweet is much too kind.

It implies Lagarde deserves blame merely for being caught by surprise, for “missing” the signs that inflation was about to become a big problem.

Sort of like we might be upset with a park ranger who fell asleep in his tower and didn’t see the fire starting in the forest.

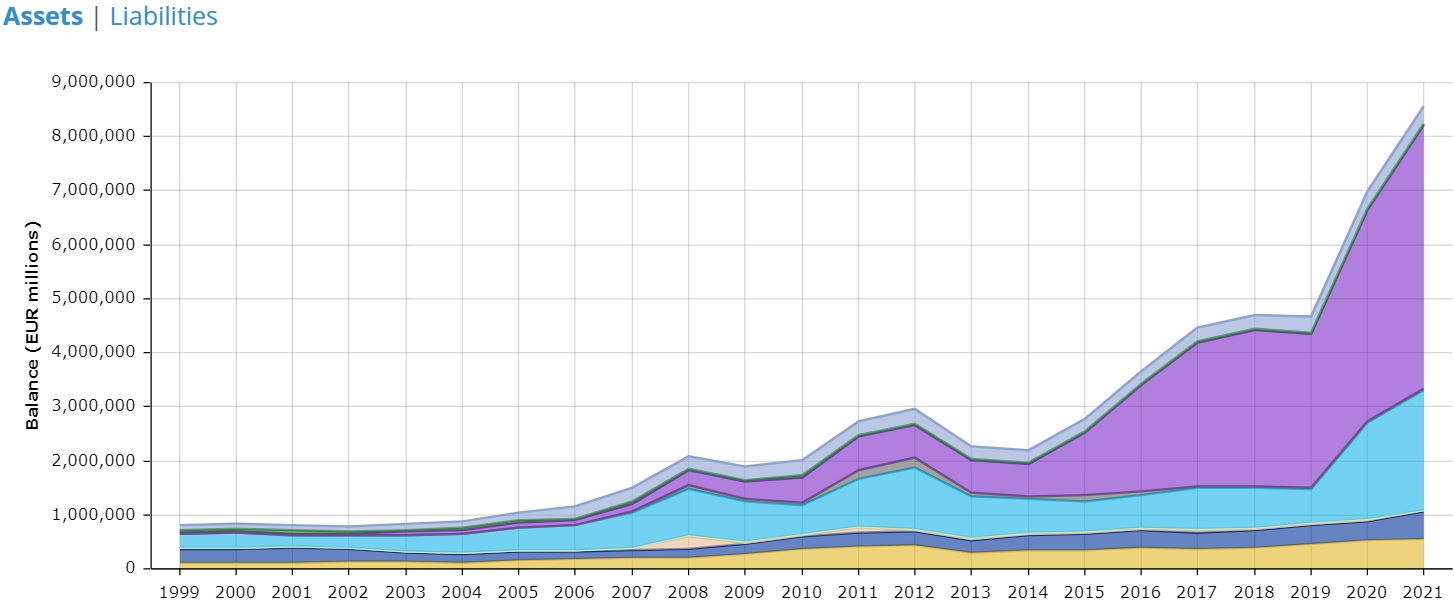

But Largarde is more akin to an arsonist. Check out this chart, which shows the European Central Bank’s balance sheet, which is a good measure for how much money is being created.

Lagarde was appointed in 2019, which is when the ECB pivoted to an easy-money policy.

Heck, she doubled the size of the ECB’s balance sheet. So she was an arsonist who first doused the forest with gasoline.

Milton Friedman must be spinning in his grave.

P.S. I was worried about the ECB’s easy-money approach about 10 years ago, but that episode was trivial compared to what’s happened during Lagarde’s reign.

P.P.S. But at least Ms. Lagarde can feel confident that the IMF is carrying on her legacy.

———

Image credit: MEDEF | CC BY-SA 2.0.