I normally write a column every year (2021, 2020, 2019, etc) when the Tax Foundation releases its International Tax Competitiveness Index, in part because I’m curious to see how the United States compares to other developed nations.

I somehow overlooked the 2022 version, but there’s a very good reason to cite the Index today. In the latest version, Estonia retains its #1 ranking, which is no surprise.

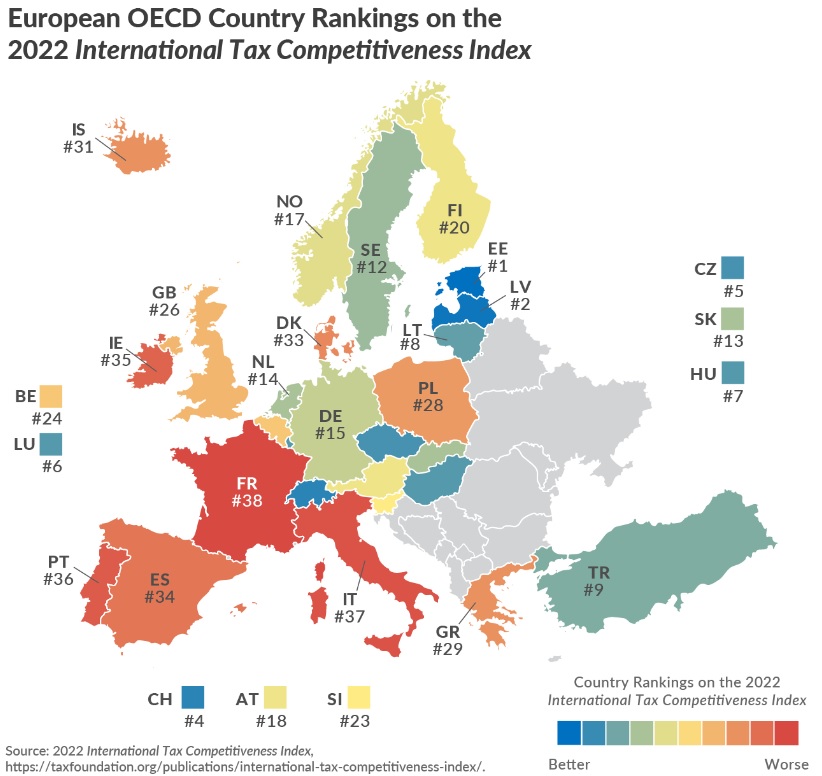

And, as you can see from the map, France is #38, giving it the worst tax system among industrialized nations.

I want to focus on France because the nation is in the midst of a massive political controversy over President Macron’s plan to increase the retirement age from 62 to 64.

That’s too little and too late from my perspective, given the country’s terrible fiscal outlook.

Some people, however, don’t understand this reality. In a column for the New York Review, Madeleine Schwartz writes that Macron’s plan “has few supporters among French economists.” Here are some excerpts.

Macron and his defenders have called the reform a necessity. …But one group of voices has been missing among the commentators advocating for the change. “You won’t find many economists defending this reform,” says the economist Mathieu Plane, who works at the French Observatory of Economic Indicators… Patrick Artus, a well-known economist who currently works as an advisor to the French bank Natixis, told me that the government has several tools at its disposal… They might increase taxes. “The government has a complete block on raising taxes,” he says. “And yet there are some tax increases that would be legitimate.” …Instead the government has forced forward a law that many economists consider both inequitable and ineffective. …“It’s a pretty brutal measure,” says Camille Landais, chairman of the French Council of Economic Advisers.

Wow, what an indictment of French economists. Are they really that clueless? Are they the ones who are bad at math?

It’s hard to answer those question.

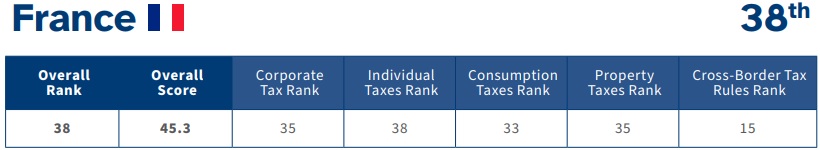

But I can say with certainty that big tax increases are not the solution when France already has the developed world’s worst tax system, with terrible grades in all but one category.

What’s especially amazing is that some of the French economists inadvertently confirm my argument that Macron did not go far enough.

A number of economists have questioned whether the reform would do much to solve the larger issue, which is that the population is aging and productivity levels do not balance the cost of demographic change. By making older workers work longer, the reform will only raise the employment rate by about one point, says Artus, even though France’s employment rate is about nine points less than, for example, Germany’s.

Yet, amazingly, their view is to do nothing other than double down on the policies that have produced low levels of employment.

I’ve joked in the past that economists are untrustworthy, and perhaps even despicable and loathsome. In France, it appears that my satire is reality.

P.S. Today’s column focused on France. For those interested in other nations, here’s the full Index.

The United States ranked #22, which is bad but not as bad as it used to be. Kudos to the Baltic nations, as well as New Zealand and Switzerland. Sympathy for the mistreated taxpayers of Italy and Portugal (as well as Ireland, where the benefits of a low corporate rate are offset by very bad scores in other areas).

———

Image credit: Yann Caradec | CC BY 2.0.