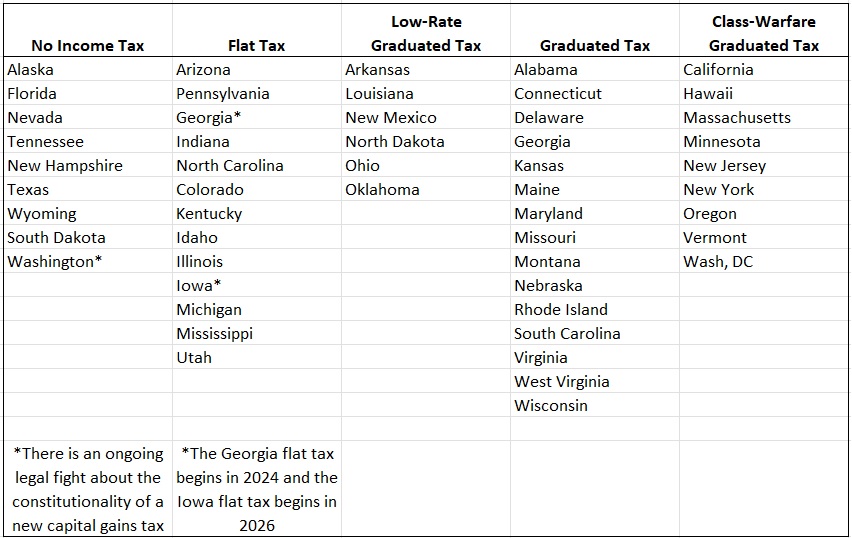

There’s been great progress in recent years with regards to state tax policy.

When I put together my first ranking back in 2018, there were 9 states with flat taxes and and 3 states with low-rate graduated tax systems.

Today, there are 11 (soon to be 13) states with flat taxes and 6 states with low-rate graduated systems.

But one thing has not changed.

The ideal state tax policy is to have no income tax and the 9 states in that category have not changed. Indeed, things may even be moving in the wrong direction since politicians in the state of Washington recently imposed a capital gains tax and they hope that the state’s top court somehow will decide it is constitutional.

But there’s now a glimmer of hope that a few states will jettison their income taxes.

We’ll start with an editorial in the Wall Street Journal about tax reform in North Dakota, where the state is about to join the flat tax club and might even phase out the income tax altogether.

The state has five brackets that range from 1.1% to 2.9%. That’s low compared with the 9.85% top rate in big-city Minnesota, but South Dakota doesn’t tax income at all. In the competition to be the best Dakota, this matters… The bill “would put us on a path toward eventually zeroing out our individual income tax,” Mr. Burgum told the House finance committee in January. “We compete for energy workers. Alaska, Texas and Wyoming are three of those eight states that already have zero income tax, and of course our neighbor right next to us in South Dakota.” …Zeroing out North Dakota’s income tax could finally be accomplished via a third bill, also passed by the state House. This plan would automatically cut income taxes by 0.5 percentage point if the state’s revenue targets are exceeded. If the rate starts at 1.5%, as the Governor hopes, the best case scenario is that the income tax could disappear entirely by 2028.

Iowa already has made great progress on tax policy, but may go even further according to this story in the Des Moines Register.

Iowa senators are advancing a bill that would eventually eliminate the state’s income tax. …Sen. Dan Dawson..said economic data since last year’s tax cuts show the state can afford to be even more aggressive. And, he said, Iowa needs to keep cutting taxes to compete with other states that are also lowering their own rates. …[Governor] Reynolds has said she’d like to eliminate the income tax by the end of her current term in office, which would be 2027. …”My goal is to get to zero individual income tax rate by the end of this second term,” she said. …Senate Study Bill 1126 would lower Iowa’s income tax rate to 3.55% in 2026, 2.95% in 2027 and 2.5% in 2028. Beginning in 2030, the bill would transform Iowa’s taxpayer relief fund into an “individual income tax elimination fund” and use the money in the fund to eventually lower the individual income tax rate further until it is eliminated entirely.

There’s also interest in Mississippi, as reported by Michael Goldberg for the Associated Press.

Gov. Tate Reeves promised to push for a full elimination of the state’s income tax during the 2023 legislative session. The move would make Mississippi the 10th state with no income tax. …Mississippi’s Republican-controlled legislature passed legislation in 2022 that will eliminate the state’s 4% income tax bracket starting in 2023. In the following three years, the 5% bracket will be reduced to 4%. …Mississippi’s population has dwindled in the past decade, even as other Sun Belt states are bustling with new residents. Tax-cut proposals are a direct effort to compete with states that don’t tax earnings, including Texas, Florida and Tennessee. “You don’t have to be a geography expert to look at a map and recognize that we have Texas to our west, Florida to our east and Tennessee to the north,” Reeves said. “All three of those states have no income tax, and therefore all three of those states have a competitive advantage when we are recruiting for both businesses and individual talent.”

Last but not least, the Democratic Governor of Colorado wants to abolish his state’s flat tax. Here are some details from a report by Ben Murrey in National Review.

…during his state of the state address last month, Governor Jared Polis suggested using TABOR refunds to decrease the state’s income-tax rate. The address marked the first time Polis had explicitly proposed using TABOR-refund dollars — which come out of state revenue surpluses — to lower the income-tax rate as part of his push to eliminate the state’s income tax altogether. …Discussing tax reform during his address, Polis said, “I was proud to have supported two successful income-tax cuts at the ballot and since I took office our income-tax rate has gone from 4.63 percent to 4.44 percent, helping produce strong economic growth and low unemployment.” …“It’s no secret that I, and most economists, despise the income tax,” Polis added. “I don’t expect that we can fully eliminate the income tax by our 150th anniversary [in 2026], but let’s continue to make progress.” …Polis’s willingness to stand by his support of TABOR refunds and light a path forward for his zero-income-tax agenda in the face of opposition from his own party is laudable.

By the way, “TABOR” refers to the Taxpayer Bill of Rights, which is a spending cap that requires automatic refunds to taxpayers when tax revenues increase faster than inflation plus population.

Leftists in Colorado fantasize about being able to spend those extra revenues, so kudos to Gov. Polis for instead wanting to use them to gradually phase out the income tax.