Since I’m a policy wonk with a keen interest in international and comparative economics, I write every year (2022, 2021, 2020, 2019, etc) about the annual release of Economic Freedom of the World, published by the Fraser Institute in Canada.

The 2023 version has been released, so let’s look at some key findings.

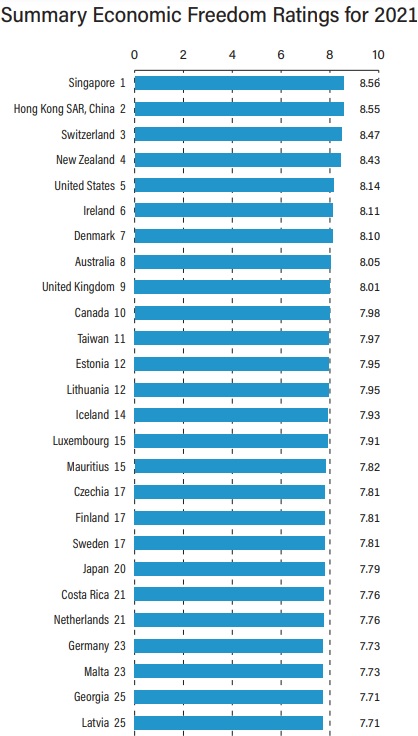

We’ll start with a look at the 25-freest jurisdictions, with Singapore claiming the top spot, followed by Hong Kong, Switzerland, New Zealand, and the United States.

Venezuela, by the way, is last. Hardly a surprise.

Here are a few of my quick-and-dirty observations.

- The United States actually improved between 2020 and 2021, albeit only a very small increase from 8.11 to 8.14.

- Notice how many Northern European nations get good scores, particularly Baltic and Nordic countries.

- Taiwan and Australia continue to perform well, but it is sad that Chile‘s score has dropped over the past few years.

- Congratulations to Nigeria, Moldova, Fiji, and Croatia for the biggest increases (though they all still have weak scores).

- Jeers to Yemen, Suriname, Lebanon, and Myanmar for the biggest falls (they all started bad and got even worse).

Here are some of the key conclusions from the EFW report.

Hong Kong and Singapore, as usual, occupy the top two positions—but for the first time in the history of the EFW index, Singapore edges out Hong Kong for the #1 ranking. The next highest scoring nations are Switzerland, New Zealand, United States, Ireland, Denmark, Australia, United Kingdom, and Canada. The rankings of some other major countries are Taiwan (11th), Japan (20th), Germany (23rd), Korea (42nd), France (47th), Italy (53rd), Mexico (68th), India (87th), Brazil (90th), Russia (104th), and China (111th). The 10 lowest-rated countries are: Republic of Congo, Algeria, Argentina, Libya, Iran, Yemen, Sudan, Syria, Zimbabwe, and Venezuela. …A number of interesting patterns emerge from an analysis of these data. High-income industrial economies generally rank quite high for Legal System and Property Rights (Area 2), Sound Money (Area 3), and Freedom to Trade Internationally (Area 4). Their ratings were lower, however, for Size of Government (Area 1) and Regulation (Area 5). This was particularly true for the high-income countries of Western Europe.

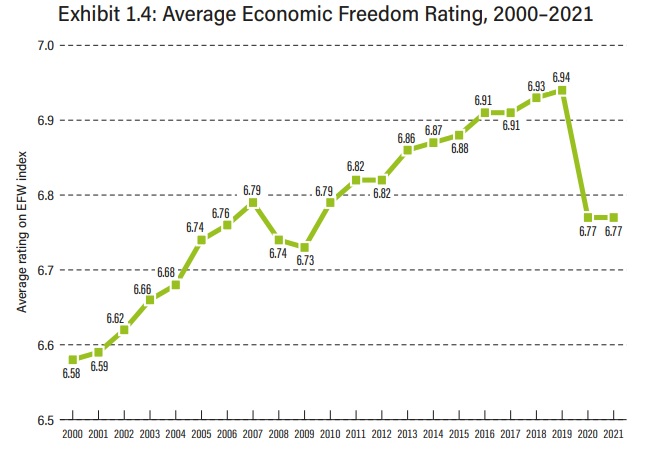

Next, let’s take a look at the global average.

As you can see, politicians took advantage of the pandemic to impose significant reductions in economic liberty.

The good news is that the decline stopped in 2021. The bad news is that there was no rebound.

Let’s close with two further observations.

Here is some of EFW‘s commentary about Hong Kong’s decline.

Hong Kong’s rating has now fallen 0.64 points since its peak rating of 9.19 in 2010. In just the last two years, Hong Kong’s rating has fallen by a whopping 0.40 points. How much of that decline is related to China’s economic and political crackdown in Hong Kong and how much is related to the coronavirus pandemic is difficult to discern, but we do note that the decline in Hong Kong’s rating in recent years has been much larger than the world’s average decline. It seems reasonable to assume that much of this decline is related to China’s new harsh policies in Hong Kong and is not entirely the fault of pandemic policies.

Very discouraging since Hong Kong used to be a role model (it still has a lot of economic freedom, of course, but most observers are not optimistic about the future).

Next, here is some discussion about how a small fiscal burden, by itself, is not enough to deliver prosperity.

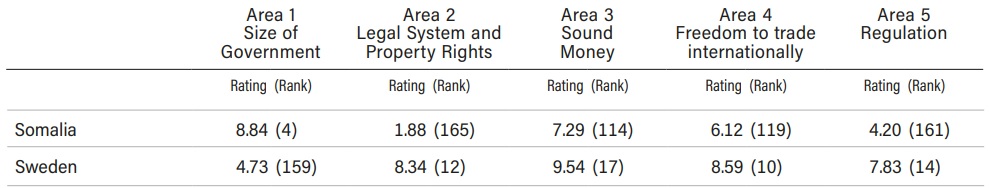

…a number of developing nations have a small fiscal size of government but rate low in other areas, and as a result, have a low overall rating. The lesson from this is clear: a small fiscal size of government is insufficient to ensure economic freedom. The institutions of economic freedom, such as the rule of law and property rights, as well as sound money, trade openness, and sensible regulation are also required.

If you want a tangible example, compare Somalia and Sweden.

Somalia has one of the best scores for size of government while Sweden has one of the worst scores (#159 out of 165 nations).

Yet Sweden has much more economic liberty because it gets relatively high scores in other areas while Somalia gets failing grades.

For what it’s worth, places like Somalia don’t actually have good fiscal policy. Instead, their governments are grossly incompetent and are unable to collect revenue. And with very little revenue, that limits their ability to spend.

If you actually want to figure out which nations have genuinely good fiscal policy, you should look for place that also get decent scores for “legal system and property rights.”

On that basis, the places with the best fiscal policy are the Bahamas, Hong Kong, Taiwan, Panama, and Switzerland.

P.S. Some readers may wonder why the United States ranks #5 in EFW while only ranking #25 in the Index of Economic Freedom. A big reason is that the latter includes a measure of long-run indebtedness and the United States gets an awful score (zero) in that category. Sadly, both Trump and Biden have openly stated that they have no desire to fix this problem.

———

Image credit: geralt | Pixabay License.