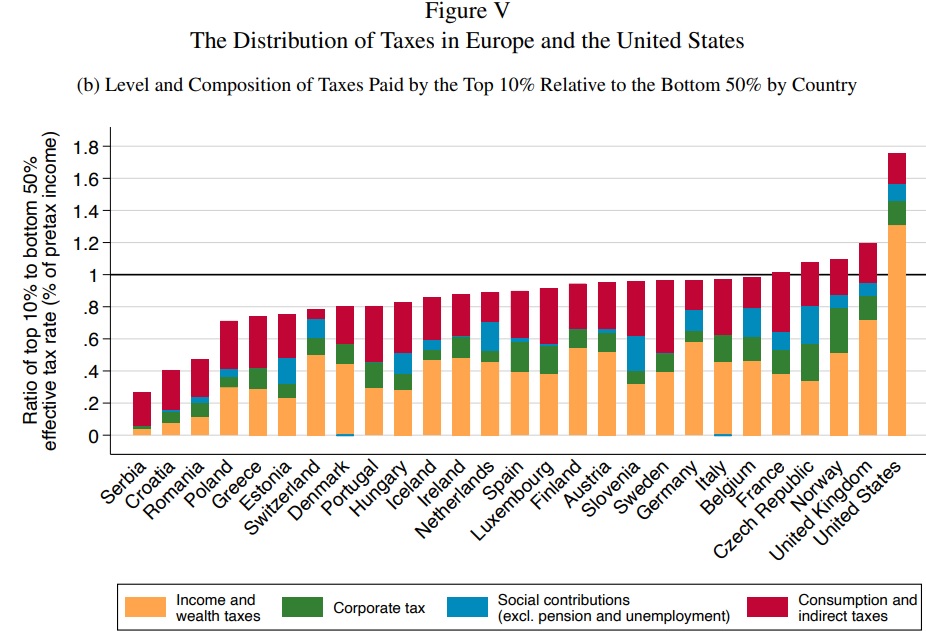

No matter how you slice the data (federal income tax, all federal taxes, state taxes, local taxes, total taxes, etc), rich people shoulder a disproportionate share of America’s fiscal burden.

Indeed, the United States has a more “progressive” tax code than any other industrialized nation.

That’s because big welfare states – like they have in Europe – require very high tax burdens on lower-income and middle-class households (simply stated, there are not enough rich people to finance big government).

But today’s column is not about class warfare and tax policy. Instead, let’s look at class warfare and spending policy.

More specifically, let’s contemplate whether spending policy should also discriminate against upper-income taxpayers.

That already happens, of course. America’s huge welfare state – by definition – funnels money and services to lower-income households.

And there are programs – ranging from museum subsidies to ethanol handouts – that perversely channel money from the poor to the rich.

But what about basic government services, what are sometimes called “public goods“?

- Should rich people be allowed to visit national parks like poor people, or should there be an extra charge?

- Should rich people be allowed to drive on roads and highways like poor people, or should there be an extra charge?

- Should rich people be allowed to send their kids to school like poor people, or should there be an extra charge?

These sound like absurd examples, but we have a real-world controversy involving state education policy.

In a column for the Washington Post, Lizette Alvarez thinks it is unfair that Florida’s school choice system will now apply equally to all households.

Gov. Ron DeSantis (R) recently signed legislation that might radically undermine the state’s education system by making Florida’s already robust school voucher program the largest…in the country. Beginning in July, the state will make it possible for every K-12 student to receive a taxpayer-funded voucher or savings account worth $8,648. And for the first time in Florida, the vouchers will be available to children from wealthy families… The new policy is…revolutionary…even the child of a private-jet-flying tycoon will be eligible for a voucher. …The conservative rationale for doing away with income caps and sweeping in private and religious school students seems rooted in a twisted sense of “justice for all.” In their view, those parents are paying what amounts to a wasted tax for public schools their children don’t use — and returning that money to them to pay for their schools of choice is only fair.

For what it’s worth, I think Ms. Alvarez does not fully understand the conservative rationale.

But I’ll focus on giving the libertarian rationale. From a moral and legal perspective, we think the law should apply equally. If the government is going to operate schools, those schools should be open to all children. If government is going to allow school choice, all children should be allowed to participate.

P.S. I can’t resist commenting on Ms. Alvarez’s assertion that school choice will undermine the education system. That is a very bizarre assertion since kids get better test scores when they attend private schools or get home-schooled. Moreover, academic evidence shows that government schools actually get better when there is school choice (competition is a good thing).

———

Image credit: wp paarz | CC BY-SA 2.0.