Most people (though not all) understand that inflation is the result of bad monetary policy.

That’s the easy part to grasp.

What’s more difficult is figuring out why politicians and their central bankers impose bad monetary policy.

- Are they creating too much money because they want to artificially goose the economy with Keynesian monetary policy, especially during election season?

- Are they creating too much money because they want to finance more government spending with modern monetary theory, like Turkey, Argentina, or Sri Lanka?

My rule of thumb has been that developed nations make Mistake #1 and developing nations make Mistake #2.

But that may be changing because of irresponsible fiscal policy in richer nations.

For instance, the European Central Bank has been propping up Italy, financing a big chunk of that nation’s deficit spending.

And I worry something similar may be happening the United States.

The incentive doesn’t even require a belief in a nutty idea like Modern Monetary Theory. Government can profit from inflation in a more subtle way, as I wrote way back in 2011.

Let’s expand on that column, thanks to a a new study from the International Monetary Fund.

Authored by Daniel Garcia-Macia, it crunches a bunch of data to develop estimates of how governments benefit from unexpected inflation.

This paper has shown that inflation surprises help to reduce deficits temporarily and debt ratios persistently. Deficit-to-GDP ratios decline as the nominal values of the economy’s output and of tax bases generally rise, generating more revenues. …an unexpected bout of inflation will erode part of the real value of government debt persistently, both owing to the initial improvement in fiscal balances and the nominal GDP denominator effect. …Unexpected inflation may offer some breathing room for debt ratios but attempts to keep surprising markets and economic agents have historically proven futile or harmful. …Another important dimension is which budget items are automatically or de facto indexed for inflation and by which mechanism.

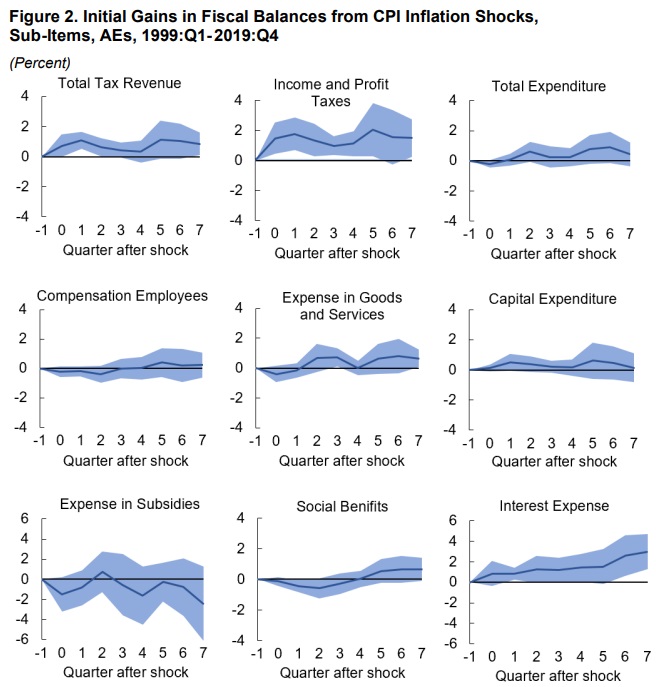

Here’s a look at different fiscal variables and how unexpected inflation during a two-year period.

What politicians presumably care about are the first two charts on the first row. You can see that inflation leads to more tax revenue, especially from taxes on income and profits.

I fear that they are less concerned (if at all) about the fact that inflation is bad for taxpayers and bad for the economy.

Sadly, there’s not much people can do to protect themselves from inflation. Unless, of course, we figure out an alternative to central banks.

———

Image credit: Federal Reserve | United States government Work.