State-to-state migration is an underappreciated issue, for both economic and political reasons. And I’ve explained that taxes play a huge role.

- In Part I of this series, we looked at how people – and taxable income – are moving from high-tax states to low-tax states.

- In Part II of this series, we reviewed how tax-motivated migration will create further fiscal nightmares for high-tax states.

- In Part III of this series, I shared excerpts from a column I wrote for Bloomberg about why state tax competition is desirable.

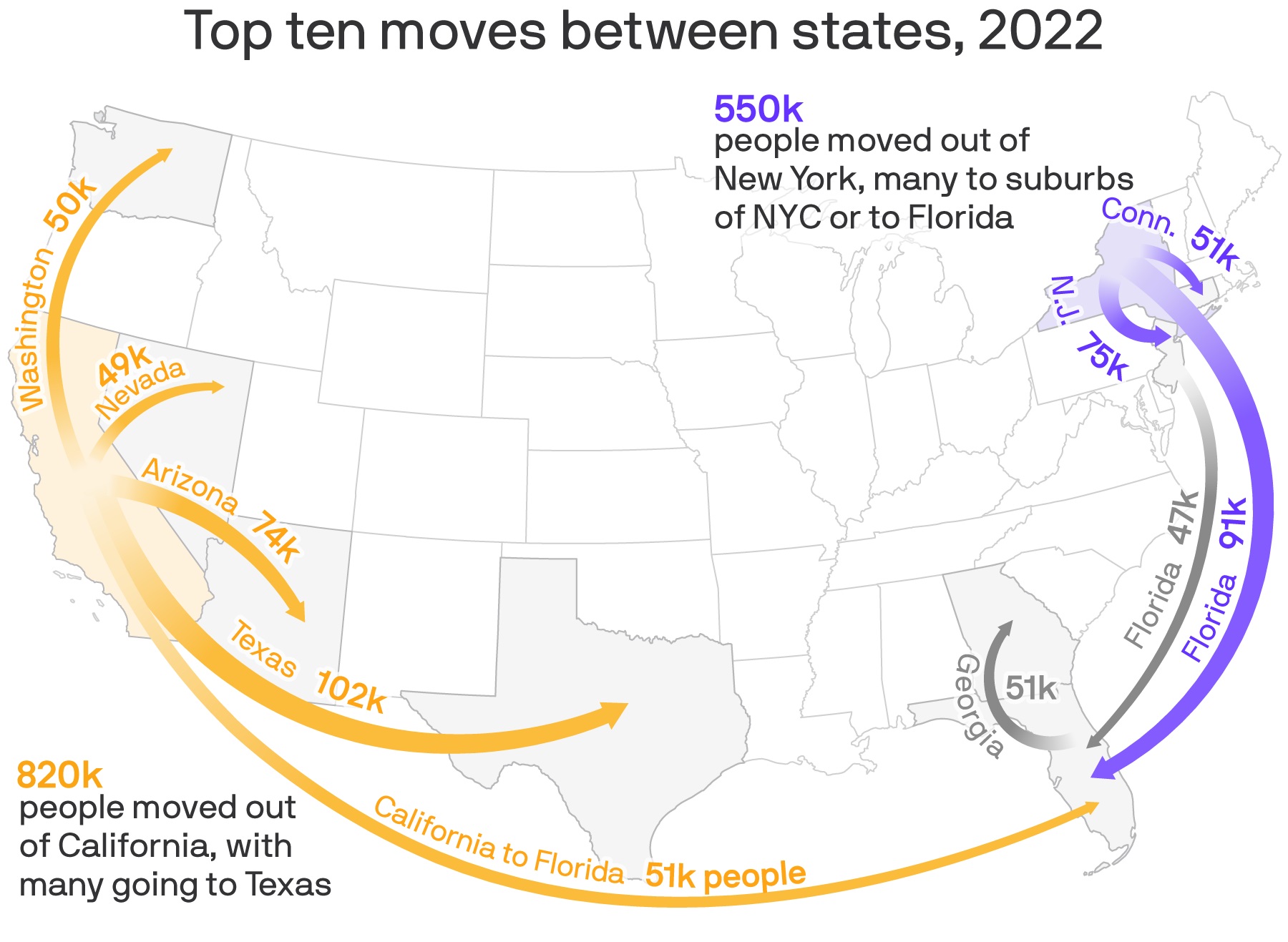

For Part IV of this series, let start with this map from Axios showing the 10 biggest state-to-state moves in 2022.

The obvious takeaway is that people are escaping the fiscal hellholes of California and New York.

The second takeaway is that tax migrants are mostly picking states with no income tax. And when they don’t move to states with no income tax, they move to states with flat taxes.

But there is a very interesting story to tell about the state of Washington. Yes, it’s getting plenty of tax refugees from California, but it’s also losing one very prominent taxpayer.

Because although Washington has no income tax, politicians are trying to impose one. And they already have saddled their taxpayers with a capital gains tax and a death tax.

Jeff Jacoby of the Boston Globe explains that those taxes won’t collect any money from Jeff Bezos.

Jeff Bezos, the founder of Amazon and the third-richest person in the world, has lived in Washington state for nearly 30 years. …he has decided to relocate to Miami. …Bezos is almost certainly going to save money — a lot of money — once he is no longer subject to Washington’s tax laws. To begin with, Washington has a new capital gains tax, which was upheld by the state’s highest court in March. …By relocating to Florida, he ensures that future stock sales will likewise remain untouched by Washington’s new capital gains levy. That’s not all. Washington had no estate tax during the years when Bezos was building Amazon into a commercial giant, but that changed after 2005. Now Washington has the steepest death tax in the nation, with a top rate of 20 percent on estates worth more than $9 million. Florida, on the other hand, has no estate tax at all. For a man with a personal fortune of more than $160 billion, the move from Washington to Florida could be worth $30 billion or more to his heirs.

What’s the logical conclusion?

Jacoby provides the answer, telling politicians that Bezos and other rich people can vote with their feet.

He has also provided fresh evidence of an economic fact of life: When taxes get too high in one state, the wealthy can move to another one. …In progressive circles, it remains an article of faith that high tax rates don’t drive people to flee, but evidence to the contrary is overwhelming. Massachusetts, Washington, California, and Illinois can keep waving goodbye as prosperous taxpayers keep relocating to Florida, Texas, Arizona, and New Hampshire. Or they can pull their heads out of the sand and acknowledge that reality isn’t optional. In the real world, when you try to soak the rich, you’re apt to lose the rich.

Amen. The geese with the golden eggs can and will fly away. One of the reasons that tax competition should be celebrated.