In Part I and Part II of this series, we looked at how taxpayers are moving from high-tax states to low-tax states.

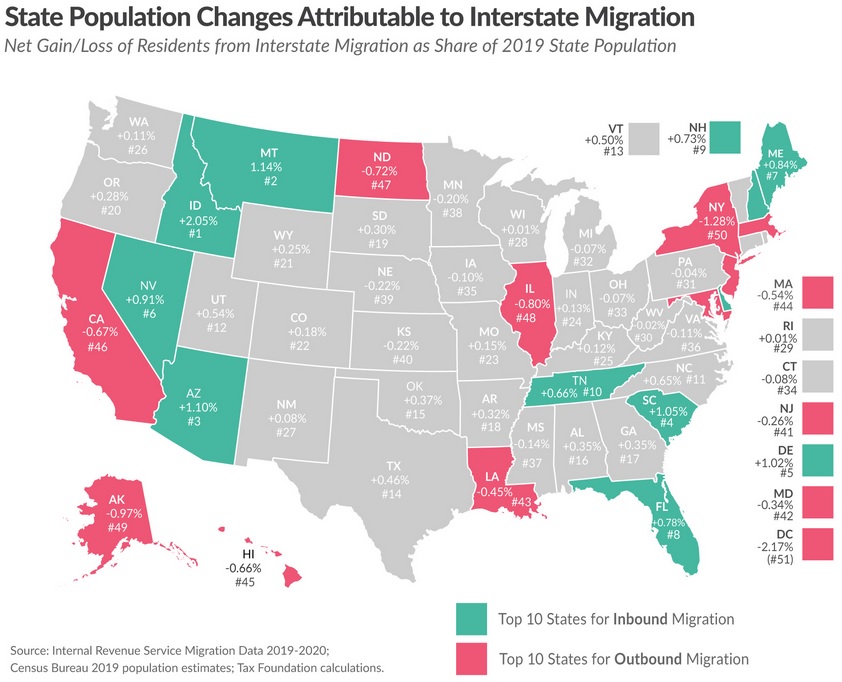

For Part III, let’s start with a map from the Tax Foundation, which shows which states are winning and losing as Americans vote with their feet.

People moving is only part of the story. We also need to look at who is moving.

That can have major implications for a state’s long-run competitiveness. Or even its fiscal viability.

Here are some excerpts from a column I wrote for Bloomberg.

States want to make sure they attract—or at least don’t lose—rich people. Upper-income taxpayers pay a disproportionate amount of taxes (just like they pay the lion’s share of federal taxes), and states that attract such residents are fiscal winners. …IRS data shows that high-tax states such as California, New York, and Illinois are losing tens of thousands of successful residents to low-tax states, with zero-income-tax Florida being a preferred destination. But what really matters from a fiscal perspective is that those tens of thousands of people leaving higher-tax states account for tens of billions of dollars of taxable income. This is a dangerous trend for the nation’s high-tax states. Simply stated, a government needs an acceptable ratio of people pulling the wagon versus those riding in the wagon. Otherwise, as former British Prime Minister Margaret Thatcher famously warned, they’ll “run out of other people’s money.” …high-tax states…face a grim future as more and more taxpayers do a cost-benefit analysis and decide whether they get enough value from government to justify punitive income tax rates (topping out at more than 10 percent in California, New York, and New Jersey). Based on current trends, expect a growing number of those taxpayers to “vote with their feet.”

The Tax Foundation study cited above, authored by Katherine Loughead, has some sobering data showing how interstate migration creates winners and losers.

The IRS data also show interstate migration broken down by AGI level. Among taxpayers with $200,000 or more in AGI, the top destinations for inbound interstate moves were Florida, Texas, Arizona, North Carolina, and South Carolina. Meanwhile, the states that saw the largest losses of taxpayers with $200,000 or more in AGI were New York, California, Illinois, Massachusetts, and Virginia. Several of the states losing higher-income taxpayers, especially New York, California, and New Jersey, have highly progressive tax codes under which tax liability rises steeply with income. States that structure their tax codes in this manner have consistently lost higher-income residents to lower-tax states, and not only the residents, but also any associated tax revenue and entrepreneurial activity that goes along with them.

Let’s close with a look at how California is a big net loser.

A TV station in Los Angeles, KTLA, reports on how the state is suffering from an exodus of people who are net tax-payers.

For the third straight year, the state of California has experienced a decline in population, according to U.S. Census Bureau data, and many of those packing up and heading east are some of the state’s wealthiest. A study of IRS Migration Data by an online real estate portal found that no state experienced a larger loss of tax income from migration than California. The study, conducted by MyEListing.com, found that California lost more than $340 million in 2021 IRS tax revenue due to residents moving. …“Despite its numerous attractions … beautiful landscapes and cultural richness, California’s high personal income tax rates seem discouraging for many high-wealth individuals. This, coupled with the state’s high cost of living, will likely fuel a wealth migration out of California,” the website wrote in its analysis. California is the entertainment capital of the world as well as home to Silicon Valley, but it appears some of the highest earners no longer need to keep their California residency to maintain their careers and businesses.

I’ll conclude by emphasizing that a state can get in fiscal (and economic) trouble if it drives away net tax-payers and attracts net tax-consumers.

As I wrote for Bloomberg, it is not a good idea to have lots of people riding in the wagon and too few people pulling the wagon. That’s bad for states, and it’s bad for nations.

P.S. While California does not have a very encouraging fiscal outlook, it is not the state viewed as most likely to go bankrupt.