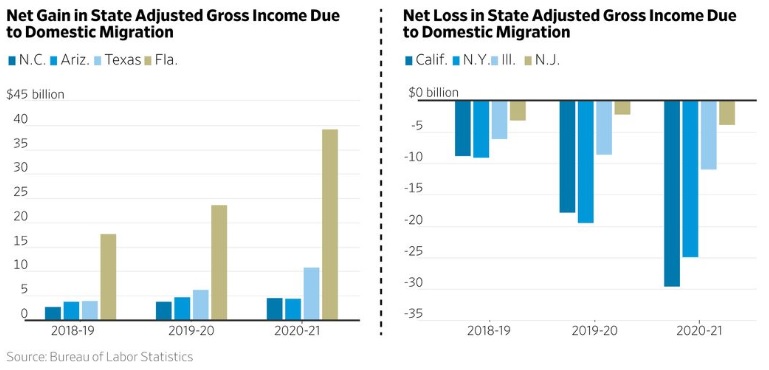

In Part I of this series, I shared some excerpts from a Wall Street Journal editorial that documented how taxpayers fleeing high-tax states such as California, New York, Illinois, and New Jersey.

Where are they going? In many cases, they are moving to zero-income-tax states such as Florida and Texas or flat-tax states such as Arizona and North Carolina.

This is not a new phenomenon. I first started writing about tax-motivated migration in early 2010.

And I suspect there will be many future columns, particularly since an impressive number of states have been improving their tax systems.

For Part II in this series, let’s look at some excerpts from an article by Patrick Villanova for Yahoo!Finance. Here are some excerpts.

When a state loses more high-earning tax filers than it gains in a given year, tax revenues may decline and the state’s fiscal situation may worsen. That’s why despite making up less than 7% of total tax returns filed across the 50 states and the District of Columbia in 2020, the migration patterns of high-earning households continue to make headlines. With this in mind, SmartAsset set out to identify the states with the most movement of high-earning households. To do this, we examined the inflow and outflow of tax filers making at least $200,000 in each state between 2019 and 2020. …There are nine states in the country that do not tax income at the state level. Four of those states – Florida, Texas, Tennessee and Nevada – are among the 10 places with the largest net inflow of high-income households. …No state is gaining more high-earning households than Florida…a net addition of 20,263 high-income filers. Like Florida, Texas – the No. 2 ranking place – does not have state income tax. …It’s no surprise that most of the states with the highest net losses of households earning over $200,000 are traditionally viewed as high-tax states. New York saw a net outflow of nearly 20,000 high-earning households in 2020, more than any state in our study. …California wasn’t far behind, losing a net figure of 19,229 high-earning filers.

This is a story about people “voting with their feet,” but there are also very important implications for state finances.

Every state has people who pay taxes (workers and businesses in the private sector) and people who consume taxes (bureaucrats, welfare recipients, interest groups, etc).

However, if a state is losing the former and retaining (or even attracting) the latter, that’s a recipe – sooner or later – for Greek-style fiscal trouble.

Which is why I have sometimes speculated that states such as California are committing slow-motion suicide.

P.S. Switching to a different topic, the article notes that, “D.C. has the largest proportion of high-earners… Households earning at least $200,000 per year make up 12.19% of all tax filers in the District of Columbia.” Unfortunately, this is not a sign that DC has good fiscal policy. Indeed, the opposite is true. What it does show is that it is very lucrative to be a bureaucrat, lobbyist, politician, or some other type of “beltway bandit.” The only solution to this problem is to shrink the size and scope of the federal government.