I realize it’s not nice to take pleasure in the misfortune of others, but that rule does not apply when bad things happen to greedy politicians.

As such, I greatly enjoy reading about when taxpayers “vote with their feet” by moving from high-tax jurisdictions to low-tax jurisdictions.

I enjoy when there is tax-motivated migration between nations.

And I enjoy when there is tax-motivated migration between states.

Regarding the latter version, there’s a must-read editorial in the Wall Street Journal about the ongoing exodus from fiscal hellholes such as Illinois, New York, and California.

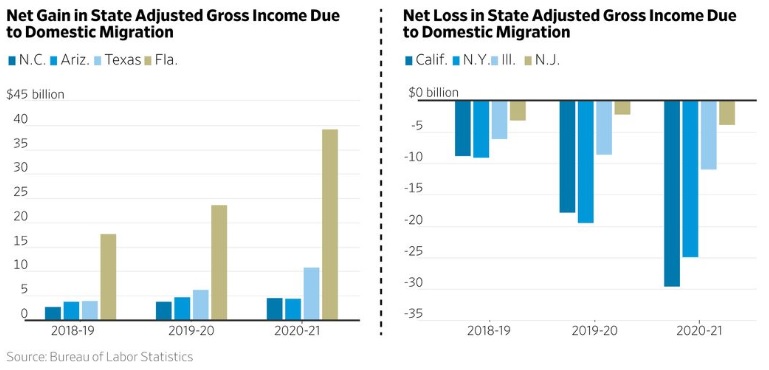

The IRS each spring publishes data on the movement of adjusted gross income (AGI) and taxpayers across state lines from year to year. …the IRS data shows blue states are losing taxpayers and income at an increasing clip. …a net 105,000 people left Illinois in 2021, taking with them some $10.9 billion in AGI. That’s up from $8.5 billion in 2020 and $6 billion in 2019. New York’s income loss increased to $24.5 billion in 2021 from $19.5 billion in 2020 and $9 billion in 2019. California lost $29.1 billion in 2021, more than triple what it did in 2019. By contrast, the lowest tax states added some $100 billion of income during the pandemic. Zero-income-tax Florida gained $39.2 billion—up from $23.7 billion in 2020 and $17.7 billion in 2019. About $9.8 billion of the total arrived from New York, $3.9 billion from Illinois, $3.7 billion from New Jersey and $3.5 billion from California. Texas was another winner, attracting a net $10.9 billion in 2021, which follows a gain of $6.3 billion in 2020 and $4 billion in 2019. Californians represented more than half of Texas’s income gain in 2021.

Congratulations to Texas and Florida. Having no income tax is definitely a smart step.

Here is a chart that accompanied the editorial.

By the way, migration is the headline event, but it is also important to pay attention to who is migrating.

The WSJ‘s editorial notes that the people leaving high-tax states tend to be economically successful.

The IRS data shows that the taxpayers leaving Illinois and New York typically made about $30,000 to $40,000 more than those arriving. Of Illinois’s total out-migration, 28% of the leavers made between $100,000 to $200,000 and 23% made $200,000 or more. By contrast, the average return of a Florida newcomer in 2021 was about $150,000—more than double that of taxpayers who left. High earners spend more, which yields higher sales tax revenue. This helped Florida post a record $22 billion budget surplus last year. California is forecasting a $29.5 billion deficit.

In other words, the geese with the golden eggs are flying away.

———

Image credit: Pixnio | Public Domain.