Two days ago, I dug into the C-Span archives to share a 15-year old clip of me explaining the theoretical virtues of a national sales tax.

Let’s now go back more than 30 years for this segment from a 1990 interview.

So why am I sharing my thoughts on Washington’s use of misleading budget rhetoric?

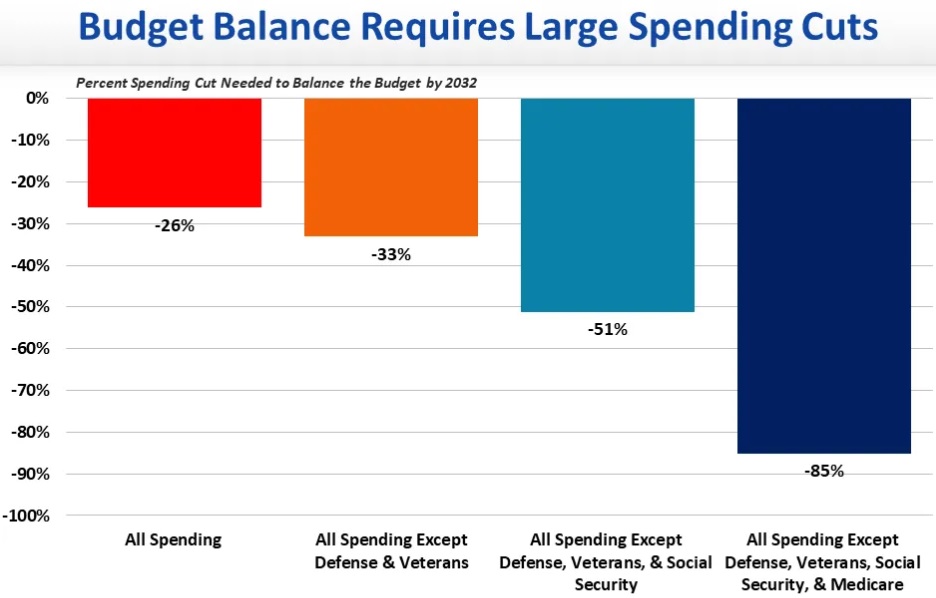

I’m motivated by this chart from the folks at the Committee for a Responsible Federal Budget. They want readers to believe that balancing the budget over the next 10 years would require drastic spending cuts.

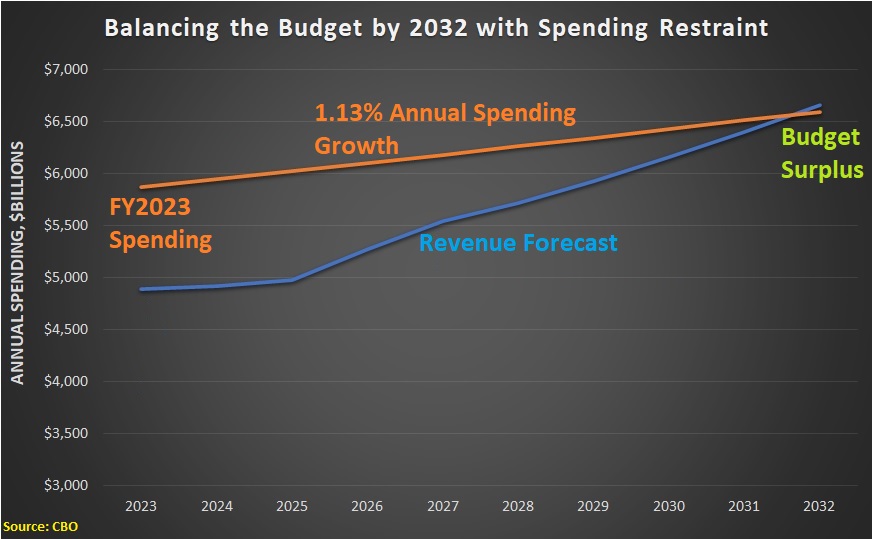

To understand what’s wrong with this CRFB chart, let’s go to the latest 10-year forecast from the Congressional Budget Office.

You’ll notice that this year’s federal budget is $5.87 trillion. And you’ll also notice that revenues in 2032 are projected to climb above $6.66 trillion.

At the risk of showing off my amazing math skills, $6.66 trillion is more than $5.87 trillion. Indeed, nearly $800 billion higher.

And what does that mean? Well, it means that we can balanced the budget by 2032 so long as spending does not increase by more than $800 billion between now and 2032. As illustrated by this chart.

To be fair to the CRFB crowd, they didn’t use make-believe numbers.

Their estimate is based on what would happen if the federal budget is left on autopilot, which means the budget grows every year because of factors such as inflation, demographic change, and previously legislated program expansions.

They then compared that artificial “baseline” to projected revenues. That’s how they came up with an estimate of a 26 percent budget cut.

In reality, though, government would be spending more than 13 percent more in 2032 when compared to 2023.

Here’s the bottom line: If CRFB or anyone else wants to argue that the budget should grow by more than 13 percent over the next nine years, they can make that argument. They can say that various programs are important and that overall spending should increase because of inflation. Or demographics.

Heck, they can even say spending should grow at a rapid pace because AOC and Bernie want bigger government.

We can then have an honest and fair debate. I’ll argue we need a TABOR-style spending cap and they can argue we should be like Greece or Italy.

———

Image credit: Bjoertvedt | CC BY-SA 3.