Mostly because of an aging population, entitlement spending in the United States is projected to become a much bigger burden.

Without reform of those programs, the U.S. within a few decades will have a European-sized level of government spending.

Joe Biden and Donald Trump have both stated that they oppose entitlement reform, so this raises the very important question of how they would finance this massive expansion in the burden of government.

Biden’s answer is “tax the rich” while Trump simply pretends the problem doesn’t exist.

Since there’s no way of dealing logically with Trump’s head-in-the-sand approach, let’s address Biden’s supposed solution of soak-the-rich taxes (and keep in mind Biden wants several trillion dollars of new spending on top of the trillions of dollars of higher spending that’s already in the pipeline for existing entitlements).

I’ve written about this issue before, but this is an opportune time for some new data since Brian Riedl of the Manhattan Institute has a new study on the topic.

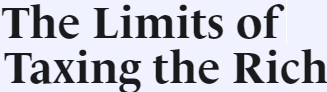

Here’s the table he put together of the revenue that might be generated by the various class-warfare tax proposals the left has offered.

As you can see, establishment sources estimate the maximum revenue from all of these soak-the-rich tax increases is 2 percent of GDP.

And the actual revenue collected would be lower because all of these tax hikes would significantly undermine incentives to engage in productive behavior by entrepreneurs, investors, small business owners, and others.

Would 1-2 percent of GDP be enough to finance existing spending promises, as well as Biden’s proposals for more spending?

Not even close. As Brian explains, it doesn’t even deal with current levels of spending.

Budget deficits have risen to nearly 6% of GDP and are projected to rise to 10% of GDP over three decades. …To close these baseline deficits and finance additional expansions, most progressives reject most spending cuts as well as middle-class tax increases. Instead, just “tax the rich” has become an easy and popular answer. However, …the plausible revenue estimates from these proposals fall far short of closing these budget gaps. …America’s federal tax code is already the most progressive in the Organisation for Economic Co-operation and Development (OECD) and has become sharply more progressive over the past 40 years. Much of this tax progressivity is the result of drastic cuts to low- and middle-income taxes while leaving upper-income-tax rates closer to international norms. …Europe’s significantly higher tax revenues are driven overwhelmingly by broad-based consumption and payroll taxes, rather than by notably higher tax rates on the wealthy.

In other words, Brian’s research confirms my Twelfth Theorem of Government.

This is true even in Nordic nations, as Brian explains.

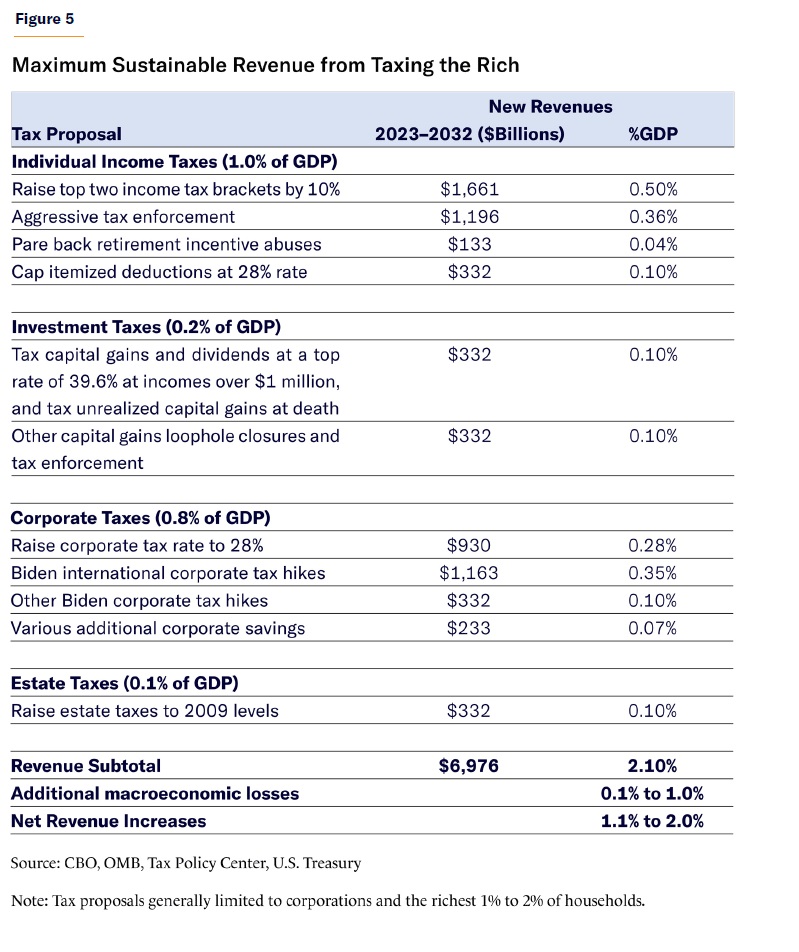

American progressives often hold up Europe—and especially the Scandinavian social democracies of Denmark, Finland, Norway, and Sweden—as successful tax-the-rich utopias that the U.S. should replicate. In reality, European tax systems do not fit the American progressive stereotype, as their higher revenues are overwhelmingly raised through steep income, payroll, and consumption taxes on the middle class.

Here’s a table from the study showing that Denmark, Finland, Norway, and Sweden have slightly higher taxes on income and capital gains, but that’s offset by lower taxes on corporations and lower death taxes.

So what’s the bottom line?

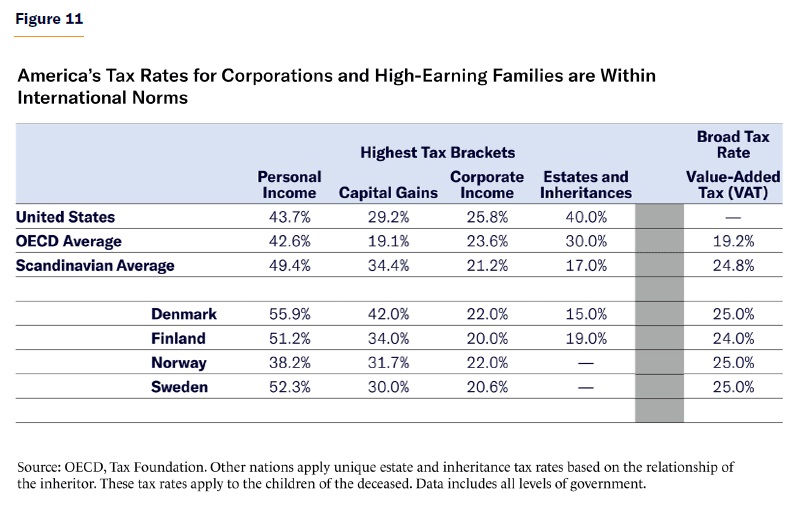

Simply stated, as explained in my Fifteenth Theorem of Government, there is no way to have European-sized government without European-level taxes on lower-income and middle-class households.

As you can see from this table, it’s the only place where there is substantial potential tax revenue.

P.S. There’s one final excerpt from the study I want to share.

I mentioned above that class-warfare taxes would be very detrimental to growth. Well, don’t forget that payroll and consumption taxes are bad for growth as well. And a bigger burden of government spending also is very harmful to prosperity.

So if we go down the wrong path of bigger government and higher taxes, we can expect European-style economic anemia. And Brian explains that also has fiscal consequences.

…a tax package that reduces annual economic growth rates by 1 percentage point would, in turn, reduce tax revenues by $3.3 trillion over the decade—likely canceling all static tax-revenue gains while also costing jobs and reducing incomes. In other words, tax-the-rich advocates cannot afford to ignore economic considerations. Raising every upper-income-tax rate to its revenue-maximizing level—the point at which the economic damage cancels out any additional revenues—is a recipe for economic stagnation, job losses, and declining incomes.

At the risk of understatement, we don’t want to copy Europe.