Writing about the economic tragedy of Argentina, I’ve explained that one major problem is inflation, thanks to that country’s version of “modern monetary theory.”

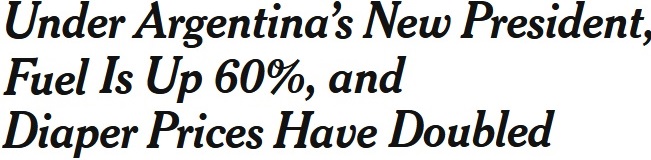

This is not a trivial problem. Here’s a chart, from a recent report by Reuters, showing how prices have been rising for nearly 10 years and skyrocketing for the past three years.

I’m sharing this chart because the New York Times published a story a few days ago about inflation in Argentina.

What’s remarkable about this report is that the authors, Daniel Politi and Lucía Cholakian Herrera, want readers to think that the country’s just-inaugurated libertarian president, Javier Milei, is responsible for rising prices.

I’m not joking. It’s in both the headline and the story. Here are a few excerpts.

In Argentina, a country synonymous with galloping inflation, people are used to paying more for just about everything. But under the country’s new president, life is quickly becoming even more painful. …since Mr. Milei took office on Dec. 10…, prices have soared at such a dizzying pace that many in this South American country of 46 million are running new calculations on how their businesses or households can survive the far deeper economic crunch the country is already enduring. …“Since Milei won, we’ve been worried all the time,” said Fernando González Galli, 36, a high school philosophy teacher in Buenos Aires.

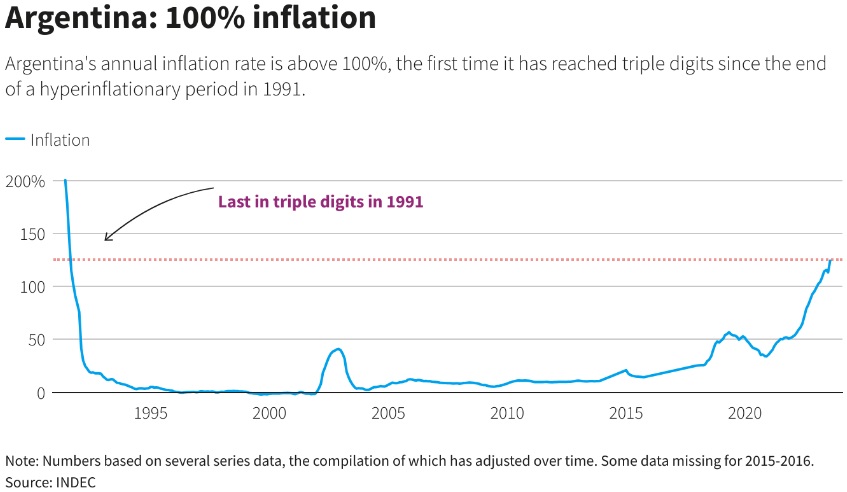

In other words, the reporters want readers to believe that President Milei, who has been in office less than three weeks, somehow is responsible for high inflation, which has been bad – and getting worse – for a decade.

To understand the absurdity of that argument, here’s another look at the Reuters chart, with a notation on when Milei took office.

Blaming Milei for today’s inflation in Argentina would be like blaming Reagan for the double-digit inflation in the United States in January and February of 1981, right after Reagan was inaugurated.

In the real world, it takes a while for bad monetary policy to create inflation. For instance, the Federal Reserve’s irresponsible monetary expansion that began with the pandemic in 2020 didn’t trigger big price increases until the middle of 2021.

Similarly, it takes a while for good monetary policy to tame inflation.

Will Milei be as successful as Reagan, both with regards to inflation and overall economic rejuvenation? I hope so, though Milei has an even bigger challenge.

I’ll close by noting that the article did have a bit of sensible and honest analysis. Here are a few sentences that accurately describe how Milei is trying to undo the damage caused by the prior government.

The previous leftist government had used complicated currency controls, consumer subsidies and other measures to inflate the peso’s official value and keep several key prices artificially low, including gas, transportation and electricity. Mr. Milei vowed to undo all that, and he has wasted little time. Two days after taking office, Mr. Milei began cutting government spending, including consumer subsidies. He also devalued the peso by 54 percent, putting the government’s exchange rate much closer to the market’s valuation of the peso.

Milei needs to engage in what has been called “daredevil economics,” though it’s really just the common-sense policies that used to be called the “Washington consensus.”

Not that folks in the media understand what’s happening. Or if they do understand, they don’t discuss the issue honestly and accurately.

The bottom line is that the New York Times report is a grotesque example of media bias and media sloppiness. Perhaps even worse than this example or this example.

So the next time someone asks whether there is media bias, you know the answer. Though dealing with this problem should be left to the market.

P.S. Click here to understand the left’s analysis of Argentina.

P.P.S. And click here if you want to understand that “dollarization” is the best long-run answer for Argentinian monetary policy.