In Part I of this series, we learned from a report in the Wall Street Journal that the combined economies of the European Union have grown by only 6 percent over the past 15 years compared to 82 percent growth in the United States.

That is stunning evidence that big welfare states lead to economic stagnation.

For Part II, let’s look at a remarkable new study by the Brussels-based European Centre for International Political Economy.

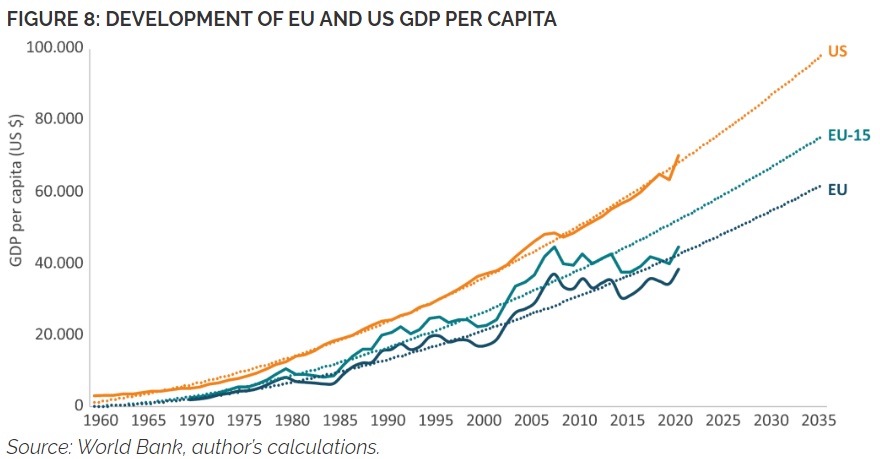

We’ll start with this chart, which shows that the U.S. is much richer. But what’s especially noteworthy is that the gap between the U.S. and E.U. keeps widening even though convergence theory says poorer nations should grow faster than richer nations.

Given the E.U.’s dismal performance over the past 15 years, it seems like the “anti-convergence” is becoming even more pronounced.

Here is some of the analysis from the report, authored by Fredrik Erixon, Oscar Guinea, and Oscar du Roy. They start by emphasizing the importance of long-run growth.

…it is the long-term trend that matters. An economy that grows at 3 percent per year will double in 24 years but an economy that grows at 1 percent per year will double only in 48 years. …If European countries were states in the United States, many of them would belong to the group of poorest… The result of this economic divergence between EU member states and US states is a growing wedge of GDP per capita between the EU and the US, which in 2021 was as large as 82 percent. If the trend continues, the prosperity gap between the average European and American in 2035 will be as big as between the average European and Indian today. …Economic growth in the Euro Area, a region that is comparable with the US, has been deeply disappointing: the region has been falling behind the US since the 1980s… At the current growth rates, it will take 20 years for output per person to double in the US, while in the EU it would take 43 years! …only two EU member states, Luxembourg and Ireland, have a GDP per capita higher than the US average.

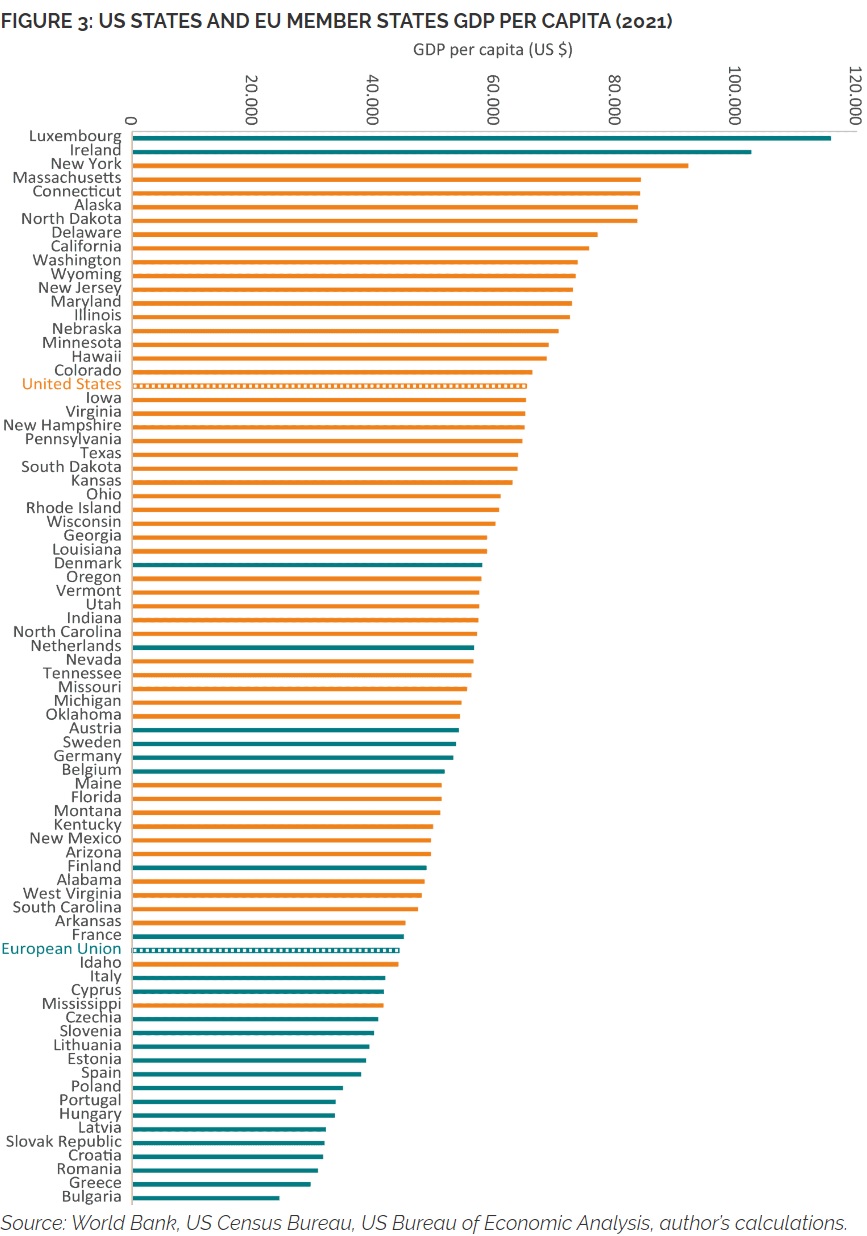

One of the most interesting things about the report is the comparison of E.U. nations to American states.

As you can see, almost all American states rank about almost all European nations.

By the way, the above ranking is based on GDP per capita and the report notes that this approach overstates the prosperity of Luxembourg and Ireland.

…their GDP per capita overestimates their level of prosperity. In Ireland, GDP is boosted by large foreign pharmaceutical and IT multinationals based in the country which, while producing goods and services in Ireland, record a significant proportion of their global profits within Ireland. The Central Bank of Ireland estimated that Ireland should instead rank between the 8th and 12th position in the EU if the relevant parts of per capita income are considered. For Luxembourg the story is slightly different. High GDP per capita is mainly due to the cross-border flows of workers in total employment, as they contribute to overall GDP but are not residents of the country.

If you want a less-distorted view, I recommend the OECD’s data on per-capita “Actual Individual Consumption.” And the U.S. lead based on AIC data also has expanded over time.

———

Image credit: Sébastien Bertrand | CC BY 2.0.