When I write about fiscal policy, there are two ever-present themes.

- Bad tax policy reduces growth and competitiveness, driving away jobs, people, and investment.

- Bad spending policy occurs when budgets grow faster than the economy’s productive sector.

And both of these themes can be found in a comprehensive new report issued by the Maine Policy Institute.

The report provides lawmakers with a detailed analysis of the state’s fiscal status and it shows specific spending reforms that would save money and create “fiscal space” for pro-growth tax reforms.

I realize that readers from most places won’t care very much about some of the Maine-specific data, but the report contains some charts that teach a very important lesson that can be applied in other states, as well as in Washington and other national capitals.

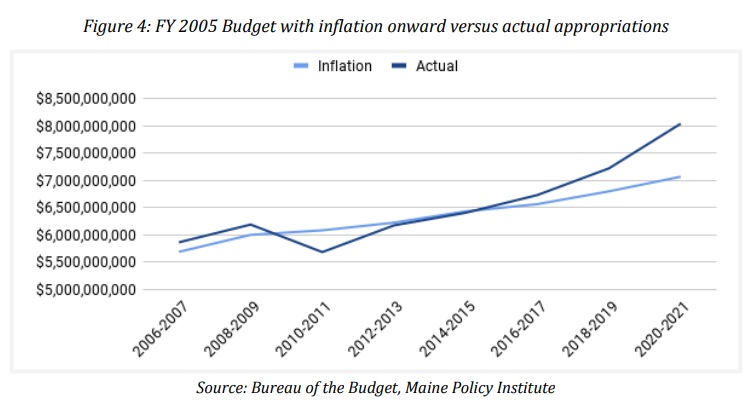

Consider, for instance, this chart showing that Maine is getting in trouble because spending in recent years is growing significantly faster than inflation.

The same is true in Washington, except the problem is far worse.

And in other states. And various cities. And other nations.

In other words, governments at all levels and in almost all places have a hard time complying with fiscal policy’s Golden Rule.

That being said, spending caps are a universal solution to this universal problem. Let’s look at Figure 10 from the report, which shows how a TABOR-style spending cap would have produced very good results for Maine.

Once again, we can take this information and apply it very broadly.

A spending cap is the smart and effective way of dealing with irresponsible fiscal policy at all levels of government.

For instance, Switzerland is well know for its spending cap, known as the debt brake. This approach has yielded very good results for the nation’s finances, but less well know is the fact that many subnational governments in Switzerland’s federalist system have their own versions of a spending cap.

The bottom line is that good fiscal policy is universally applicable. And spending restraint is a necessary precondition for that to happen.

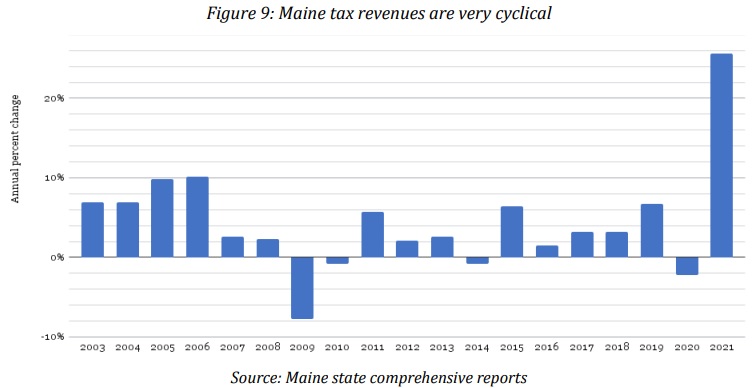

P.S. Some people ask whether a balanced budget amendment would be better than a spending cap. This question gives me an excuse to share one more chart from the study. As you can see from Figure 9, annual tax revenues are very unstable. Sometimes they grow rapidly, sometimes they grow slowly, and sometimes they actually shrink (and the same thing is true in Washington).

This means that a balanced budget requirement is very difficult to enforce and often does not produce good results. During boom years, when revenue is rapidly increasing, politicians have too much leeway to increase spending. And during downturns, when revenue if stagnant or falling, politicians claim that spending restraint would be too difficult and they raise taxes instead.

The advantage of a spending cap is that it targets the real problem of spending (rather than the symptom of red ink). Moreover, politicians are subject to a rule that is much easier to enforce (increasing spending by, say, 2 percent every year is very straightforward compared to the wild swings in spending that occur with a balanced budget rule).

———

Image credit: Paul VanDerWerf | CC BY 2.0.