President Biden has released his 2024 budget, which mostly recycles the tax-and-spend proposals that he failed to achieve as part of his original “Build Back Better” plan.

It is not easy figuring out his worst policy.

- Is it one of the proposed tax increases, such as the higher corporate tax rate or the increased burden of the death tax?

- Is it one of the expansions of the welfare state, such as the per-child handouts that would gut Bill Clinton’s welfare reform?

I could probably write dozens of columns (as I did the past two years) about the many bad policies that Biden is pushing.

For today, though, let’s focus on the aggregate numbers.

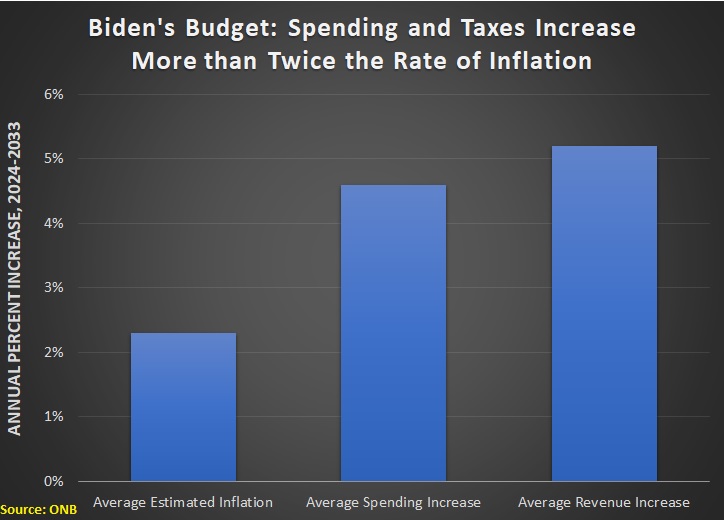

We’ll start with the fact that Biden’s budget violates the Golden Rule of fiscal policy. He wants the burden of government spending over the next 10 years to increase at twice the rate of inflation (based on Table S-1 and S-9 of his budget)

If you want raw numbers, Biden wants the spending burden to rise from about $6.4 trillion this year to $10 trillion-plus in 2033.

On the revenue side, he wants the tax burden to jump from $4.8 trillion this year to nearly $8 trillion in 2033.

To be fair, spending and taxes automatically increase every year, thanks to inflation, demographic change, and previously enacted legislation.

You can see those “baseline” numbers in Table S-3 of Biden’s budget.

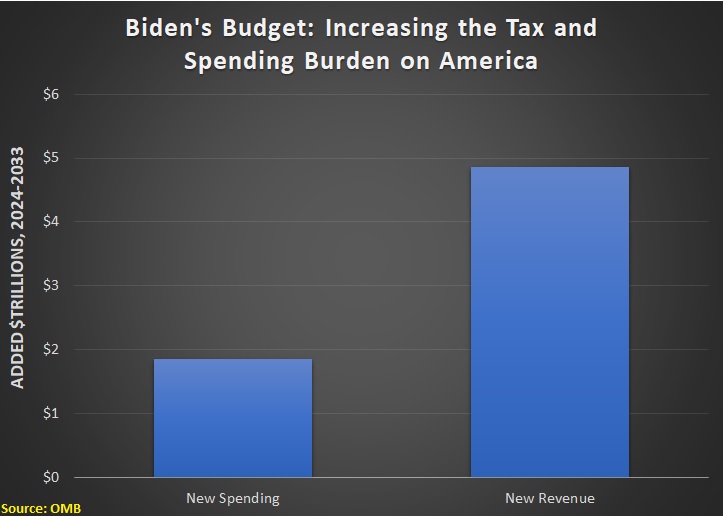

So if we want to see the net effect of what Biden is proposing, we should compared the “baseline” data to his budget numbers.

And when we do that, we find that he wants an additional $1.85 trillion of spending over the next 10 years. Even more shocking, he wants an additional $4.85 trillion of tax revenue.

I’ll close with a couple of observations.

First, Biden has a giant gimmick in his budget. If you look at the details for his proposed per-child handout (Table S-6 of his budget, bottom of page 142), you’ll notice that he’s only proposing the policy for one year.

Why? Because it is enormously expensive, with an annual cost of more than $250 billion.

Yet we know the White House and congressional Democrats want this policy to be permanent. So if we extended the cost of the per-child handout for the full 10 years, the amount of new spending in Biden’s budget would be much closer to the level of new taxes in his budget.

Second, Biden’s budget shows why supporters of good fiscal policy should not focus on deficits. A myopic fixation on red ink allows a big spender like Biden to claim the moral high ground because his proposed tax increase is even bigger than his proposed spending increase.

The variable that matters is the overall burden of government spending. And the goal should be reducing that burden, regardless of whether it is financed with taxes, borrowing, or printing money.

P.S. At the risk of stating the obvious, Biden’s tax-and-spend agenda would cause considerable economic damage.

———

Image credit: Gage Skidmore | CC BY-SA 2.0.