Every year, I highlight the most important ballot initiative or referendum.

- In 2022, Massachusetts voters tragically voted to replace the state’s flat tax with a system based on class warfare.

- In 2021, voters in the state of Washington overwhelming expressed their opposition to a capital gains tax.

- In 2020, Illinois voters wisely rejected the pro-spending lobbies and voted to retain that state’s flat tax.

- In 2019, voters in Colorado voted down an initiative that would have weakened the Taxpayer Bill of Rights.

For 2023, Colorado will once again have the spotlight.

That’s because the pro-spending lobbies and their allied politicians have not given up on their campaign to gut TABOR.

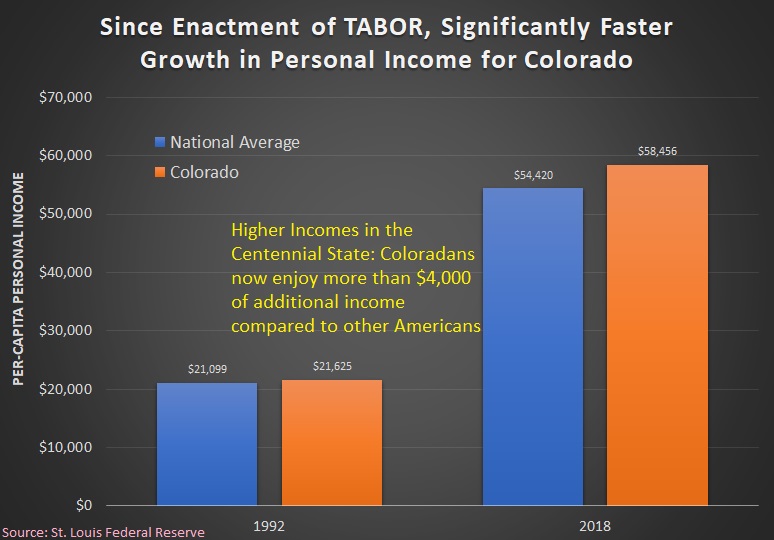

As far as they are concerned, the $8 billion-plus that has been refunded to taxpayers is money that should have been used to finance bigger government.

They hate that there is an annual spending cap that limits the growth of government. So the fact that they lost in 2019 (and in 2013 as well) isn’t stopping them from putting another proposition on the ballot.

The newest anti-TABOR initiative is called Proposition HH and the Wall Street Journal editorialized last month about this bait-and-switch scheme.

Coloradans enjoy relatively low taxes for a blue state, but their luck may not last. Democrats in Denver are backing a measure that would blow through the state’s spending cap… The coming tax hazard is known as Proposition HH… It proposes two policy changes that work in opposite directions. The first would curb property-tax growth modestly by lowering the assessment rate. That would save about $4,600 for an average homeowner through 2032… The kicker is the second part. The same ballot measure would raise the amount the state can spend by about 25% a year… That change would cost each household about $5,100 over nine years, swallowing the savings from the property-tax cut. The changes could cost taxpayers an estimated net $21 billion through 2040. …Colorado Democrats have spent years trying to lift the spending cap, and the property-tax mirage is their latest gambit. …public unions, which want the no-limits spending of other Democratic-controlled states.

In a column for Forbes, Patrick Gleason expands on these concerns.

…the most consequential measure appearing on the November 2023 ballot…is found in Colorado, where voters will be asked whether they want to weaken the nation’s strongest tax and expenditure limit… Proposition HH…would weaken the state’s Taxpayer’s Bill of Rights (TABOR) by permitting the state to keep surplus revenue that would otherwise have to be returned to taxpayers. …Rather than sell HH as an initiative to end TABOR refunds moving forward so that government, not taxpayers, has more money to spend, Proposition HH backers have instead branded it as a property tax relief measure. …Opponents of HH have been pointing out that the measure would translate into forfeiture of TABOR refunds and ultimately lead to a much higher overall tax state burden in the future. …Proposition HH would raise the TABOR spending limit by a cumulative $12.5 billion over the first decade, around $65 billion over two decades.

Will Colorado voters be tricked by Proposition HH? Will they be distracted by the shiny bauble of lower property taxes while politicians grab a greater amount of income tax revenue?

We’ll find out next month.

Since TABOR is the gold standard of fiscal rules in America, I’ll be very interested to see what happens.

P.S. If I was including ballot initiatives from other nations, Chile’s rejection of a statist constitution would have been 2022’s most important result. And Switzerland’s rejection of “universal basic income” would have been the most important result of 2016.