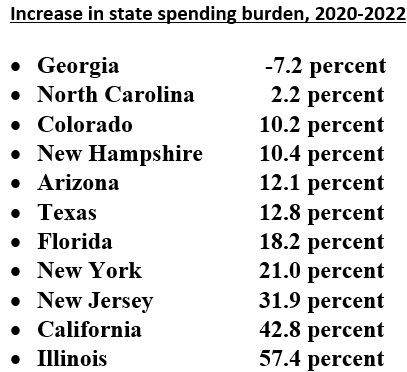

Late last year, I praised lawmakers in Georgia and North Carolina for being fiscally responsible.

The burden of government spending in those states was constrained between 2020 and 2022, even though that was a period when handouts from Washington were leading other states to squander money recklessly.

In that column, however, I did not mention Iowa.

And that was probably an oversight because “the Florida of the north” deserves more attention.

To be more specific, the Hawkeye state is pursuing good tax policy and good spending policy, and that superior combination recently led the Wall Street Journal to opine on Iowa’s success.

Kim Reynolds…has made her state a model of good tax policy… Iowa wrapped up its fiscal year with a surplus of $1.83 billion. …the third surplus in a row in the Governor’s tenure. These results have followed significant tax cuts that have helped the state’s economy. …The top rate has dropped to 6% from 8.53% since 2022, and it is scheduled to drop to a flat 3.9% rate by 2026. Iowa’s top corporate tax rate next year will drop to 7.1% from 9.8% in 2022, and it is scheduled to fall to 5.5% if the state keeps hitting its revenue targets. …Crucially, state spending has grown modestly since 2021… Now the Governor wants to raise her bet on this winning formula. “My goal is to get to zero individual income-tax rate by the end of this second term” in 2027, she said. …The Iowa tax experience belies the claims of the left that cutting taxes produces deficits. In Iowa the tax cuts have helped to produce record surpluses that then can be used to cut income-tax rates further.

The most important part of the above excerpt is “state spending has grown modestly since 2021.”

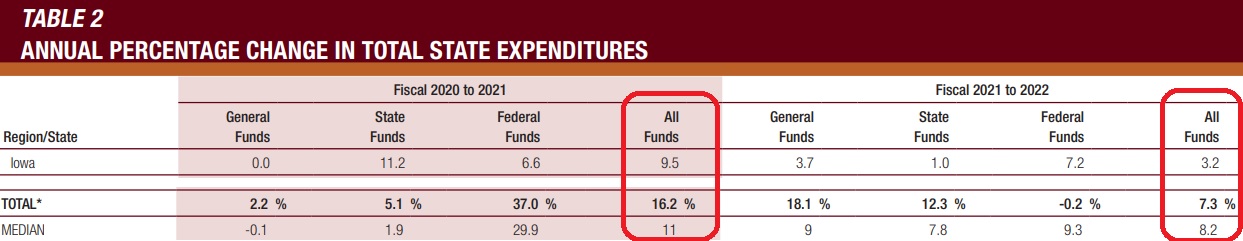

Was Iowa as prudent as Georgia and North Carolina between 2020 and 2022? Not quite, but data from the National Association of State Budget Officers shows that Iowa easily beat the national average.

And it appears that Iowa will do even better when there is final data for 2023 and 2024.

John Hendrickson of the Iowans for Tax Relief Foundation recently wrote that, “During this past legislative session, the legislature enacted an $8.5 billion budget for fiscal year 2024… This was only a slight increase from the $8.2 billion fiscal year 2023 budget.” And six months ago he and Vance Ginn noted that, “The $8.2 billion budget for fiscal year 2023 represented a mere 1 percent increase from the prior year.”

The moral of the story is Governor Reynolds has the right formula. Because she has been restraining spending, it has been feasible to enact pro-growth tax reform. And because of continuing spending restraint, her goal of having no state income tax is very achievable.

Too bad Republicans in DC are not copying that formula.

P.S. Speaking of copying, other states should learn from Iowa’s enactment of universal school choice.

P.P.S. I’ve previously cited North Carolina as an example of a state that has restrained spending and lowered tax burdens.