Yesterday’s column reviewed a new report from the International Monetary Fund and criticized that bureaucracy for celebrating how the world’s most-powerful governments are going to take more money from the private sector thanks to a corporate tax cartel.

But that’s not the worst part of the IMF document.

The report also asserts that low-income countries (LICs) can grow faster if they increase their fiscal burdens.

This is not April Fool’s Day. I’m not joking. The bureaucrats at the IMF apparently want readers to believe that higher taxes and more spending are a route to prosperity.

Let’s look at some excerpts from the report, which was authored by Ruud de Mooij, Alexander Klemm, and Christophe Waerzeggers.

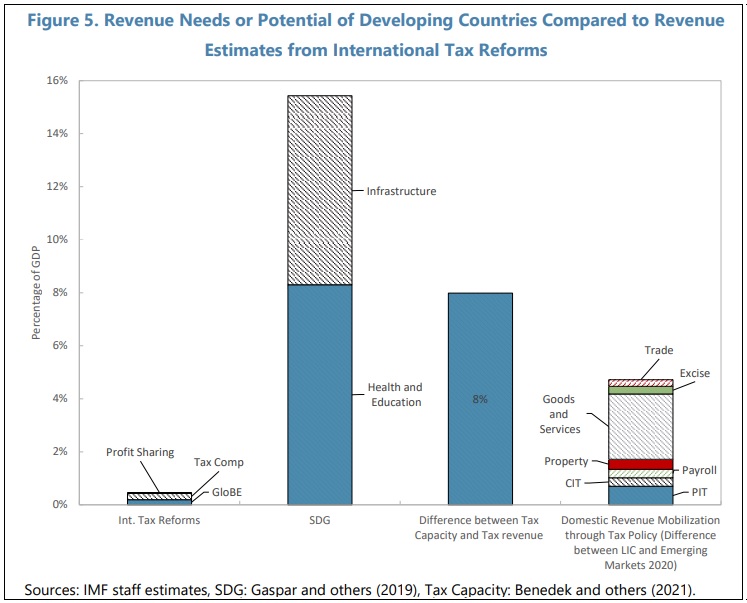

Global revenue from the 2-pillar reform…might rise to around 0.4 percent of GDP in the longer term. If a proportional share of this revenue flows to LICs, this would provide a welcome contribution to their revenue objective. However, the impact is dwarfed by the…expenditure needs in LICs of nearly 16 percent of GDP (and a significant share of this will need to come from taxation)… Estimates…suggest a potential revenue increase in LICs of 8 percent of GDP. …compared with that in emerging market economies as an aspirational level…suggests a revenue potential of around 5 percent of GDP. …Several options present themselves to raise revenues in LICs, both in tax policy and revenue administration. …Some promising avenues in tax policy include: Value-Added Tax (VAT)…specific excises…on select products such as alcohol, tobacco, unhealthy foods, passenger vehicles, fuel, and carbon emissions. …Strengthening the progressive personal income tax… Making greater use of recurrent real property taxes.

Here’s a chart from the study which shows how much bigger the IMF thinks government should be in poor nations (the second column) compared to various potential sources of revenue (columns 1, 3, and 4).

For those not familiar with the jargon, “SDG” is the abbreviation for “sustainable development goals,” as defined by the United Nations.

And the UN now robotically asserts that more taxes are needed to government can boost growth with more spending (other international bureaucracies sing from the same songsheet).

I actually went to the United Nations a few years ago and explained why this “magic beans” theory of government-led economic development is wrong.

Simply stated, there are two parts of the world that have become rich and in both cases prosperity arose when government was far smaller than what the IMF and UN want us to believe is necessary.

- First, empirical data shows that some western nations became rich in the 1800s when fiscal burdens were trivially small.

- Second, some East Asian nations became rich after World War II when their fiscal burdens were very modest.

I’ll close by challenging folks from the IMF or UN (as well as other people who agree with their agenda) to answer this very simple question.