What’s the main fiscal and/or economic problem in the European Union?

- Is it that the burden of taxes and spending is very onerous today?

- Or is it that the burden of taxes and spending will become more onerous in the future?

The easy and correct answer is that both are major problems.

But some people think the problem is that EU nations don’t tax and spend enough.

To make matters worse, this kind of thinking infects the bureaucrats at the European Commission, which has released a new report that reads like a Bernie Sanders campaign screed.

It starts by pretending that Okun’s tradeoff doesn’t exist.

…taxation can contribute to both social justice and sustainable growth, as well as financing the benefits which underpin the social citizenship contract… Contrary to the rhetoric about the inevitability of a trade-off between social justice and economic growth and a fiscal crisis of the State, the problems of financing the welfare state are far from being inevitable. …everyone should be willing to pay their share of the costs involved, whether individuals or companies.

It then explicitly endorses “pay as you go” as a model for fiscal policy, even though that approach is utterly impractical for a region with aging populations and falling birthrates.

The first specific suggestion is that a PAYG approach is the best way to link the rights and duties of generations over time, in line with the social citizenship contract at the heart of the welfare state.

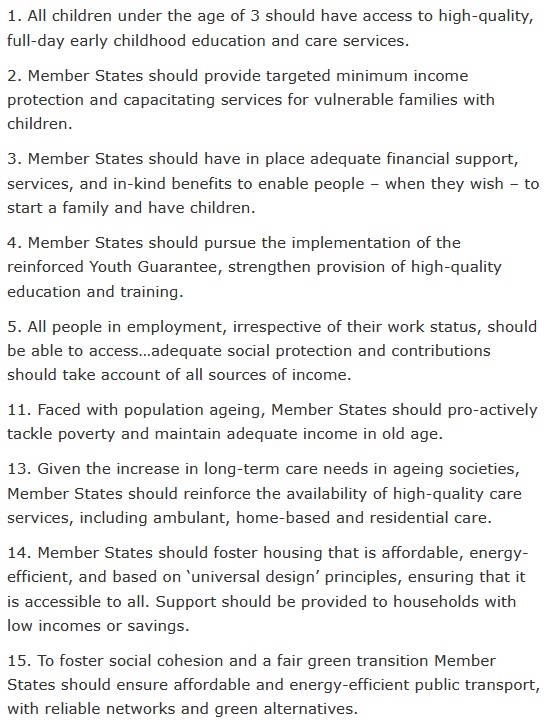

The report has 21 recommendations. Here are the ones that endorse and embrace new and expanded entitlements.

As you might expect, all that new spending is accompanied by a seemingly endless list of new and expanded taxes.

There are two main options for reforming the taxation of personal income. The first is to expand the tax base by limiting or reducing the many tax breaks that are currently present, from tax credits and tax allowances to tax exemptions and preferential treatment of different sources of income, such as income from capital… The second option for reform is to make the taxation of income more progressive. …Increasing corporate taxation. …As with preferential personal income tax regimes, the EU has an important role to play in levelling the playing field, so eliminating the negative externalities of tax competition and ending the ‘race to the bottom’, as well as making multinationals pay their fair share of tax. …there are a number of arguments for higher taxes on wealth. …Increasing taxes on wealth could help to achieve greater fairness, both in the tax system and in the distribution of resources… A tax on net wealth could complement taxes on income from capital… Indirect taxes…can make it easier to achieve social objectives, as in the case of ‘sin’ taxes… Measures such as the EU carbon tax border adjustment mechanism…can prevent unfair competition… Another option is to tax excess profits… A ‘web tax’ aimed at the excess profits of digital service companies, based on their turnover, could be a transitional step… A levy on financial transactions can also be justified, on grounds of fairness… A further option for Member States is to introduce a new tax, …a surcharge levied at source on all incomes… In summary, there are many options for achieving an adequate, fair, and sustainable means of financing of social protection at both EU and Member State levels.

That’s a frightening list.

And if it looks like it might get implemented, one can only imagine how productive people in Europe would start making plans to escape.

But the bureaucrats recommend Soviet-style exit taxes so they can continue grabbing more money.

Another option would be to tax expatriates for a given number of years after they leave the EU.

Let’s close by looking at one final excerpt.

Nations in the European Union supposedly are bound by the “Maastricht Criteria” from something called the Stability and Growth Pact.

These fiscal rules focus on limiting deficits and debt and thus are not nearly as good as the spending cap in Switzerland’s “debt brake.”

But even these weak rules apparently are too stringent according to the report.

…there is widespread agreement on the value of social investment for sustaining the inclusive welfare state in the EU… But…the long-term benefits of social investment constantly come up against short-term pressure for fiscal consolidation. …A new system is needed for monitoring public finances in the EU that would allow policy-makers to identify productive social investment…a golden rule should be applied, allowing borrowing for social investment… A starting point should be to exempt social investment from the new Stability and Growth Pact rules.

The bottom line is that Europe already suffers from excessive fiscal burdens.

Yet the European Commission wants to drive even faster in the wrong direction.

I feel sorry for European taxpayers. Their tax dollars were used to prepare a report that outlines various ways of confiscating an even greater share of their money. That’s adding insult to injury.

P.S. The report discussed today is terrible, but probably not as bad as the European Commission’s lies about poverty or attempted brainwashing of children.

P.P.S. That being said, the EC will never be the worst international bureaucracy. The OECD and IMF compete for that honor.

———

Image credit: Sébastien Bertrand | CC BY 2.0.