When making the case for spending caps, the best domestic example is Colorado and the best international example is Switzerland.

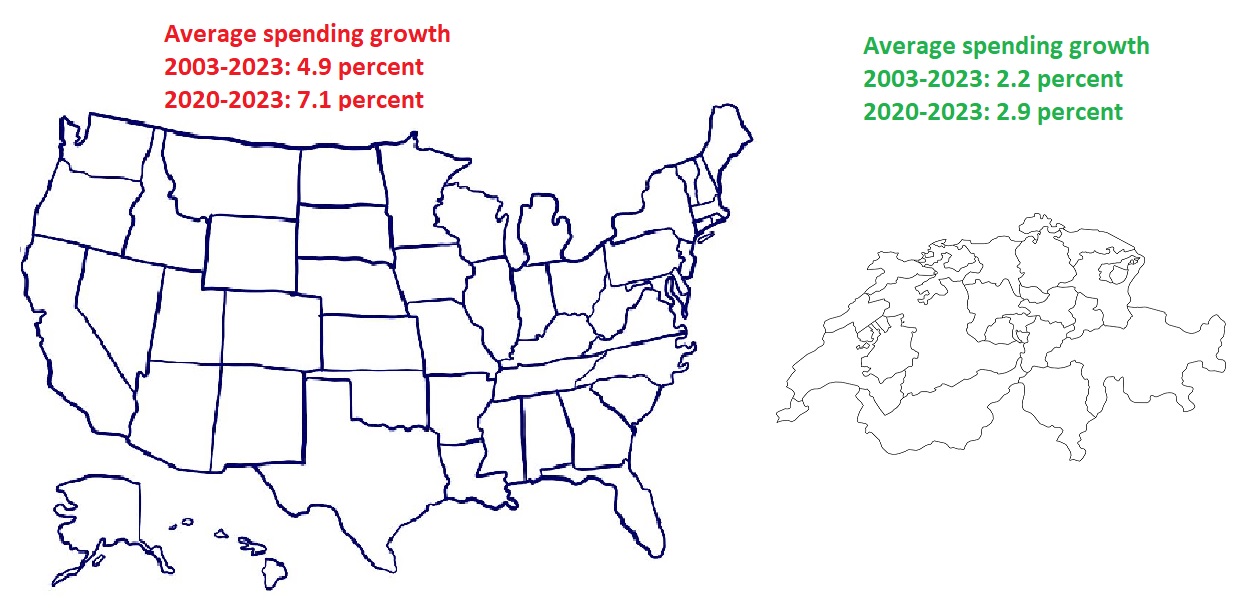

What makes the Swiss example especially persuasive is a comparison over the past 20 years between spending growth in Switzerland and the United States.

To use an education analogy, Switzerland is a star student (2.2 percent annual spending growth) and the United States is flunking (4.9 percent annual spending growth).

What’s particularly disappointing, as I wrote a couple of years ago, is that America’s current fiscal mess wouldn’t exist if politicians had been constrained by a spending cap.

In a column for the Wall Street Journal back in October, Grover Norquist and Vance Ginn discussed how national (and state) politicians have dug deep fiscal holes.

Left-wing politicians assert that Americans are undertaxed, but the data show that the government spends too much. …Between 2013 and 2022, aggregate annual spending by the 50 state governments, excluding federal funds, increased 51.7%. Total annual federal spending rose 69.4% during the decade, more than three times as fast as the 21.6% increase in the rate of population growth plus inflation. …Had the federal government limited the growth in spending to a maximum of the population growth rate plus inflation during that decade, in 2022 the federal government would have spent $1.6 trillion less than it did, resulting in at least a $200 billion surplus. If the federal government had done this over the past two decades, the national debt would have increased by less than $500 billion instead of $19 trillion. If state governments had limited spending growth to the rate of population growth plus inflation during the last decade, they would have spent $1.39 trillion in 2022, $344 billion less than the $1.74 trillion they actually spent.

Amen. Spending caps are the gold standard of fiscal policy.

There are many reasons the United States should copy Switzerland (decentralization, private pension system, trade liberalization, quality governance, etc), and the Swiss spending cap is at the top of the list.