Scandinavian countries have very unusual economic policy. They are very free market-oriented with regards to most types of economic policy.

The glaring exception is fiscal policy, where these nations get very low scores. The burden of government spending is very high, and that unsurprisingly also means very onerous tax policies.

The rich pay high taxes, of course, but the overall burden on upper-income taxpayers in Scandinavian nations is very similar to the tax burden on rich Americans.

The big difference between the U.S. and Scandinavia is the treatment of middle-class taxpayers.

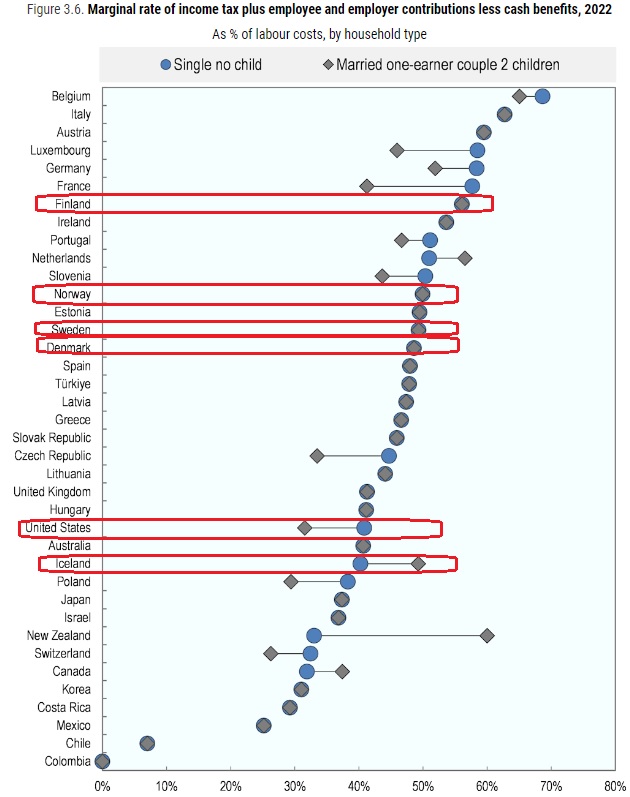

Here’s some data from the OECD showing the marginal tax rate on two types of ordinary households. I’ve highlighted the U.S. and Scandinavian countries and you can see that every Scandinavian nation other than Iceland grabs a much bigger chunk of people’s income.

I decided to share this chart because I just came across a must-read article by Brian Riedl and John Gustavsson in the Manhattan Institute’s City Journal.

Here’s some of what they wrote about Scandinavian taxation.

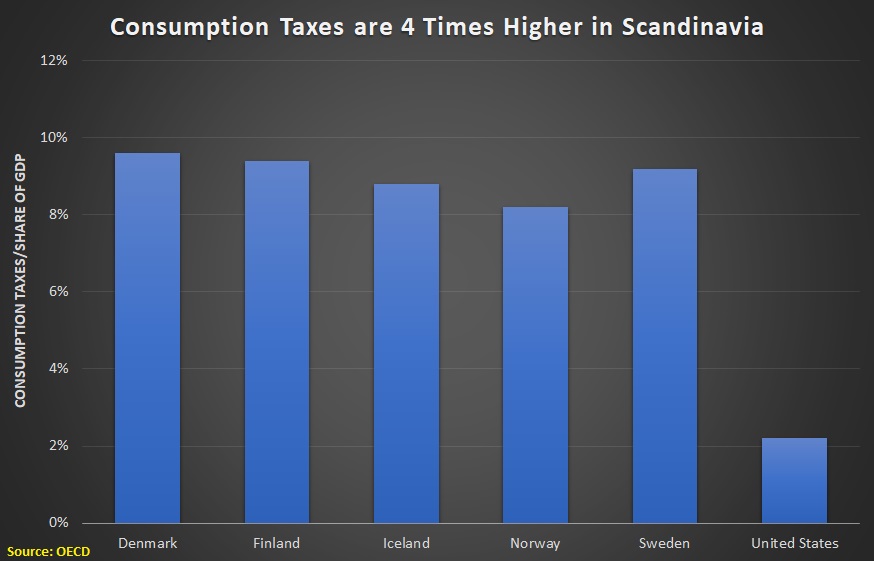

The Nordic reality doesn’t reflect the progressive caricature. Finland, Norway, and Sweden collect an average of 42.6 percent of GDP in taxes, versus the 26.6 percent collected by America’s federal, state, and local governments. However, 14 percentage points of this 16-percentage point overage come from higher payroll and value-added tax (VAT) revenues that broadly hit the middle class. …Scandinavia’s additional tax revenues come mainly from slamming their middle classes with steep social security, consumption, and income taxes. How steep? Total social security taxes (including those employers pay) are twice as high in Sweden (31.42 percent) and nearly one-third higher in Norway than in the United States. Nordic VAT rates of approximately 25 percent raise roughly 9 percent of GDP in revenues, while America has no national VAT.

And when you compare the aggregate burden of Scandinavian consumption taxes with state sales taxes in the United States, you can understand how the middle class in America is comparatively lucky.

Here’s a chart based on OECD data.

The Riedl/Gustavsson article explains why Nordic-style taxation would be undesirable in the United States, all of which is true.

Heck, Nordic-style taxation is also undesirable in Nordic nations!

That being said, there are some policies in Scandinavian nations that I would like to copy. Like private social security in Denmark and Sweden. Like school choice in Sweden. Like spending restraint in Denmark. And privatized fisheries in Iceland.

———

Image credit: Flöschen | CC BY-SA 3.0.