In our series on red states vs blue states, we’ve examined different economic variables.

- Part I: Economic growth

- Part II: Unemployment rates

- Part III: Employment growth

Today, let’s add another comparison.

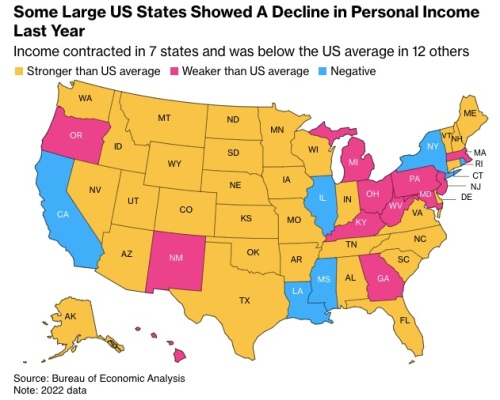

Here’s a map looking at 2022 income growth by state. The three states most known for bad policy – New York, Illinois, and California – were among the handful of states that suffered a decline in personal income.

It’s also worth noting that most of the “weaker than average” states also are known for leaning left.

The Wall Street Journal has an editorial on the performance gap between red states and blue states. Here are some excerpts.

Personal income in California, Illinois and New York declined in 2022 for the first time since 2009… Personal income last year nationwide increased 2% in current dollars, which amounts to a real decline after inflation. …The opposite was true in the fastest-growing states, including Florida (4.7%), Arizona (4.9%), Texas (5%), Utah (5.5%), Colorado (5.8%), South Dakota (5.8%), Montana (6.1%), Idaho (6.5%), North Dakota (7%), and Delaware (8.8%). …The personal income declines in California, New York, Illinois and some other states would have been larger if not for the continued growth in Medicaid spending owing to the pandemic national emergency, which didn’t end until this spring. A federal food-stamp fillip also continued until March. …California, New York and Illinois used their allotments largely to cover pre-existing budget shortfalls, boost government worker pay, and bake into their budget new spending obligations. Those will become shortfalls once the pandemic money boom ends. Taxpayers, look out.

The last few sentences above are key.

When they get new money, either from tax increases or federal transfers, irresponsible politicians create long-run spending obligations.

And that creates the conditions for future tax increases, just as the WSJ warns.

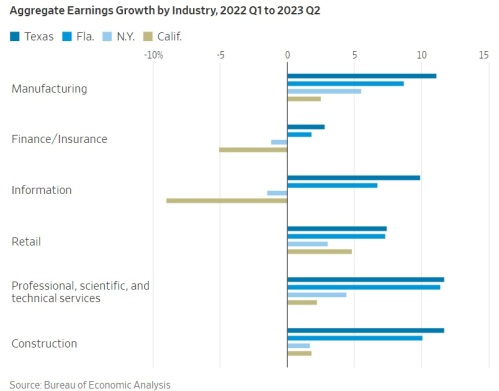

Here’s one final item for today’s column. Back in July, the Wall Street Journal compared industry performance in red states and blue states.

Here’s a table comparing Texas and Florida vs. New York and California.

Game, set, and match.

The moral of the story is that big government doesn’t work well on the national level, it doesn’t work well on the state level, and it doesn’t work well on the local level.