I’ve been warning for many years (including less than two weeks ago) that it would be a big mistake to have a “grand bargain” budget deal that includes tax increases.

This is not because of math. It is possible, of course, to have an acceptable budget agreement that includes tax increases.

But only in theory. In reality, we have gobs of evidence (even from the New York Times, albeit inadvertently) that budget deals with higher taxes don’t work.

The reason is that politicians can’t resist the temptation to increase spending whenever they think more tax revenue might be available.

In other words, Milton Friedman was right when he warned that “History shows that over a long period of time government will spend whatever the tax system raises plus as much more as it can get away with.”

Unfortunately, some people don’t understand history. Or they don’t care.

For instance, Fareed Zakaria argues in the Washington Post that politicians should impose a value-added tax. Here are some excerpts.

Total debt is now more than $33 trillion, the deficit is over 7 percent of gross domestic product, and this year’s net interest payment on the debt will probably be over $650 billion… For almost a generation, policymakers have been able to avoid seriously confronting deficits… Fortunately, there is a simple solution staring us in the face… Adopt a national sales tax, like every other advanced economy in the world. …According to the Congressional Budget Office, a broad 5 percent tax of this kind could raise $3 trillion over the next decade… On average, European Union countries get roughly 20 percent of their tax revenue from a VAT; the United States is getting zero. …It is time for the United States to join more than 160 other countries with a value-added tax and ask all Americans to chip in to set the country on a firmer fiscal path for decades.

Zakaria’s numbers are accurate. A VAT would raise a lot of money, as predicted by the CBO. And European nations generate a lot of VAT revenue.

But what about his analysis? Is Zakaria correct that a VAT would put America on “a firmer fiscal path”?

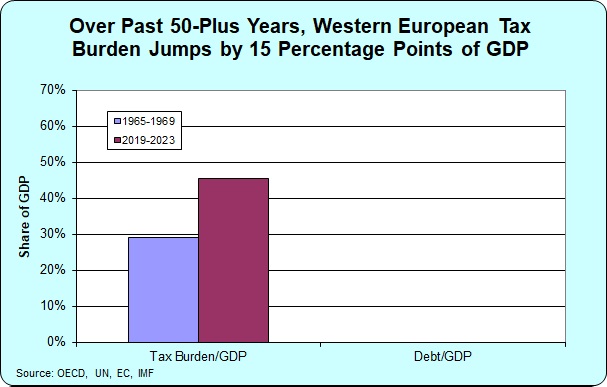

Since he cites Europe, let’s look at the evidence. I did this back in 2012, looking at the nations in Western Europe that are most similar to the United States, and comparing tax and debt levels both before and after value-added taxes.

And I did the same thing in 2016. In both cases, I used five-year averages to ensure that the numbers were not misleading because of the business cycle or anything else that might produce quirky data for a year or two.

In both cases, I found that politicians imposed massive tax increases, with VATs playing a big role. But I also discovered that politicians spent even more money (just as Friedman predicted), so the net result was more red ink.

Let’s now update that research.

We’ll start with this chart, which shows yet again that there has been a massive increase in tax revenue in Western European nations over the past five-plus decades.

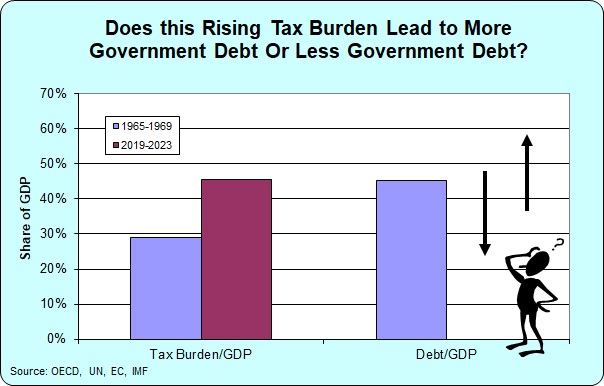

If Zakaria and other pro-tax increase people are right, all that new revenue should have produced “a firmer fiscal path” of less debt.

Our second chart shows that government debt in the late 1960s averaged about 45 percent of GDP in Western Europe.

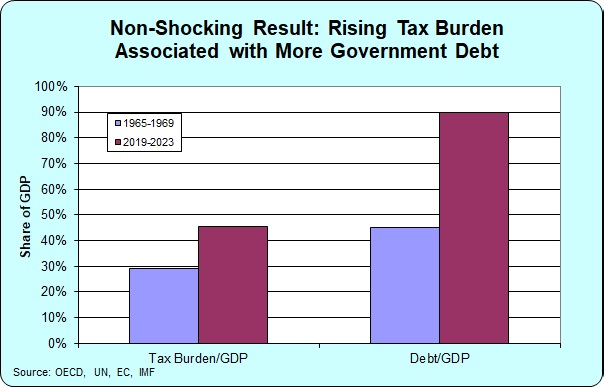

So what actually happened?

Did debt get paid off? Did debt get reduced? Was Western Europe put on “a firmer fiscal path”?

Of course not

As shown in our final chart, debt levels in the past five-plus decades have doubled to nearly 90 percent of GDP.

By the way, I’m mixing and matching data from several sources, so I’m sure that the numbers from the late 1960s are not a perfect match for the IMF numbers I used for 1919-2023.

That being said, there’s no arguing with the core finding. Massive revenue increases resulted in much higher levels of red ink because politicians increased the burden of government spending even faster.

Needless to say, analysis from “public choice” tells us that the same thing would happen in the United States.