Back in 2012, I wrote a column for the Wall Street Journal to highlight the success of Switzerland’s spending cap (also known as the “debt brake”).

Swiss voters voted for this spending cap in 2001 and ever since it took effect in 2003, government spending has increased by an average of 2.2 percent annually, only about half as fast as it was growing in the decades before the cap was imposed.

To show the ongoing success of the debt brake, here’s a map comparing changes in the burden of spending in Switzerland and its four major neighbors (France, Germany, Italy, and Austria). As you can see, IMF data reveals that Switzerland has been more responsible.

I even calculated changes in national spending burdens since the start of the pandemic.

You can see that all governments used the virus as an excuse for more spending, but the fiscal damage was most contained in Switzerland.

Seems like Switzerland is a role model, right?

Professors Steve Hanke and Barry Poulson presumably agree. They have a column in National Review arguing in favor of a similar spending cap for the United States.

President Biden’s budget proposal for 2024 makes it clear that the U.S. needs a budget straitjacket sooner rather than later. …Switzerland has been arguably the most successful country in reining in budget deficits and its debt burden. …The Swiss debt brake requires that expenditures be brought into balance with revenues. A cap is imposed on spending based on expected revenue, and revenue is projected based on long-term trends in the real growth of national income. Expenditures may exceed the cap in response to extraordinary events such as war, but if that’s the case, eventually, revenues from budget surpluses must be generated and set aside to offset this excess expenditure. We propose a debt brake for the U.S. that would initially be more stringent than the Swiss debt brake…a spending limit (read: cap) be calculated each year, and that the cap be reduced by 1 percent.

Interestingly, they want a spending cap that is stricter than the Swiss version.

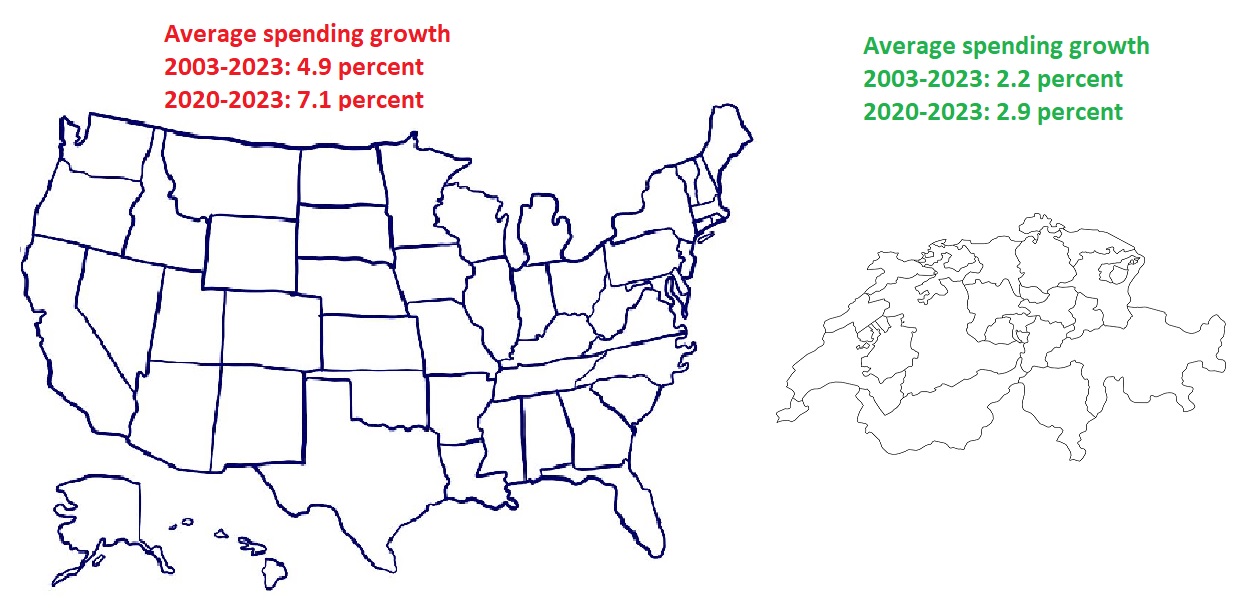

That would be ideal (the tighter the cap, the greater the progress), but I’d settle for the Swiss approach. Why? Because here’s the data comparing US profligacy and Swiss prudence.

When I contemplate these numbers, my disdain for Bush, Obama, Trump, and Biden becomes even more intense.

They all put political ambition about what’s best for America.

But I’m digressing. Let’s put the focus back on the success of the Swiss spending cap.

It’s worth noting, for instance, that Switzerland also is out-performing the United States when comparing changes in government debt.

And the Swiss also have been enjoying better economic performance since they imposed a spending cap on their politicians.

I’ll close by observing that a spending cap would have prevented massive debt accumulation in the United States. And the same is true for other nations as well.

P.S. Colorado has a very successful spending cap known as TABOR.

P.P.S. There’s plenty of academic evidence for Switzerland’s debt brake. But what’s more surprising are that pro-spending cap studies from the International Monetary Fund (here and here), the Organization for Economic Cooperation and Development (here and here) and the European Central Bank (here and here).